Decoding Freeport-McMoRan's Options Activity: What's the Big Picture?

Decoding Freeport-McMoRan's Options Activity: What's the Big Picture?

Whales with a lot of money to spend have taken a noticeably bearish stance on Freeport-McMoRan.

Looking at options history for Freeport-McMoRan (NYSE:FCX) we detected 22 trades.

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 59% with bearish.

From the overall spotted trades, 13 are puts, for a total amount of $1,037,123 and 9, calls, for a total amount of $434,778.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $50.0 for Freeport-McMoRan, spanning the last three months.

Analyzing Volume & Open Interest

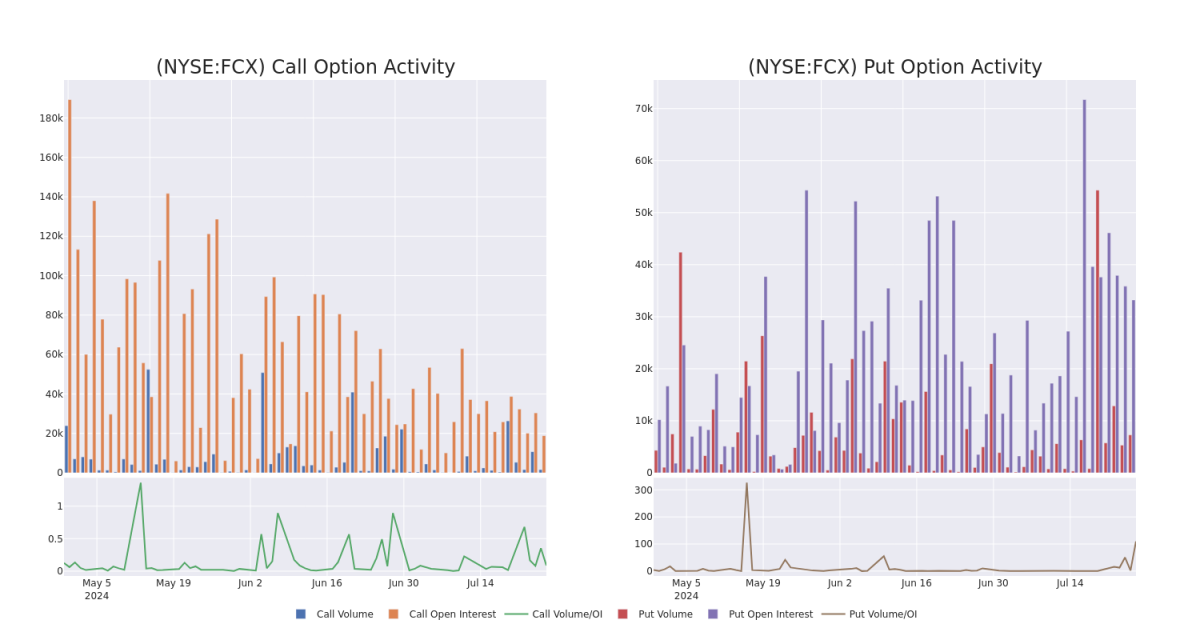

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Freeport-McMoRan's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Freeport-McMoRan's substantial trades, within a strike price spectrum from $30.0 to $50.0 over the preceding 30 days.

Freeport-McMoRan Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FCX | PUT | TRADE | BEARISH | 06/20/25 | $3.4 | $3.25 | $3.39 | $40.00 | $508.5K | 9.7K | 1.5K |

| FCX | CALL | TRADE | BEARISH | 01/17/25 | $15.4 | $14.15 | $14.3 | $32.00 | $97.2K | 5.6K | 69 |

| FCX | PUT | SWEEP | NEUTRAL | 03/21/25 | $4.9 | $4.85 | $4.85 | $45.00 | $82.3K | 2.6K | 170 |

| FCX | PUT | SWEEP | BULLISH | 01/16/26 | $5.55 | $5.45 | $5.45 | $42.00 | $81.7K | 1.9K | 250 |

| FCX | CALL | SWEEP | BULLISH | 11/15/24 | $6.8 | $6.7 | $6.8 | $40.00 | $81.6K | 649 | 255 |

About Freeport-McMoRan

Freeport-McMoRan Inc is an international mining company. It has organized its mining operations into four primary divisions: North America copper mines, South America mining, Indonesia mining and Molybdenum mines. Its reportable segments include the Morenci, Cerro Verde and Grasberg (Indonesia mining) copper mines, the Rod & Refining operations and Atlantic Copper Smelting and Refining. It derives key revenue from the sale of Copper.

Following our analysis of the options activities associated with Freeport-McMoRan, we pivot to a closer look at the company's own performance.

Current Position of Freeport-McMoRan

- With a volume of 6,291,596, the price of FCX is up 0.79% at $44.88.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 83 days.

Expert Opinions on Freeport-McMoRan

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $57.0.

- Consistent in their evaluation, an analyst from Raymond James keeps a Outperform rating on Freeport-McMoRan with a target price of $53.

- An analyst from Scotiabank persists with their Sector Outperform rating on Freeport-McMoRan, maintaining a target price of $58.

- In a cautious move, an analyst from RBC Capital downgraded its rating to Sector Perform, setting a price target of $60.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.