Viking Therapeutics's Options: A Look at What the Big Money Is Thinking

Viking Therapeutics's Options: A Look at What the Big Money Is Thinking

Whales with a lot of money to spend have taken a noticeably bullish stance on Viking Therapeutics.

擁有大量資金的鯨魚在維京療法方面採取了明顯的看好態度。

Looking at options history for Viking Therapeutics (NASDAQ:VKTX) we detected 39 trades.

查看Viking Therapeutics (納斯達克:VKTX) 期權歷史記錄,我們檢測到39筆交易。

If we consider the specifics of each trade, it is accurate to state that 46% of the investors opened trades with bullish expectations and 30% with bearish.

如果我們考慮每筆交易的具體情況,準確地說46%的投資者對看漲產生了預期,而30%則是看淡。

From the overall spotted trades, 3 are puts, for a total amount of $81,740 and 36, calls, for a total amount of $1,562,212.

從總交易中看,有3筆買入期權,總金額爲81,740美元,而有36筆賣出期權,總金額爲1,562,212美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $20.0 to $100.0 for Viking Therapeutics over the recent three months.

根據交易活動,看起來重要的投資者正在瞄準維京療法在過去三個月內的價格區間爲20.0美元到100.0美元。

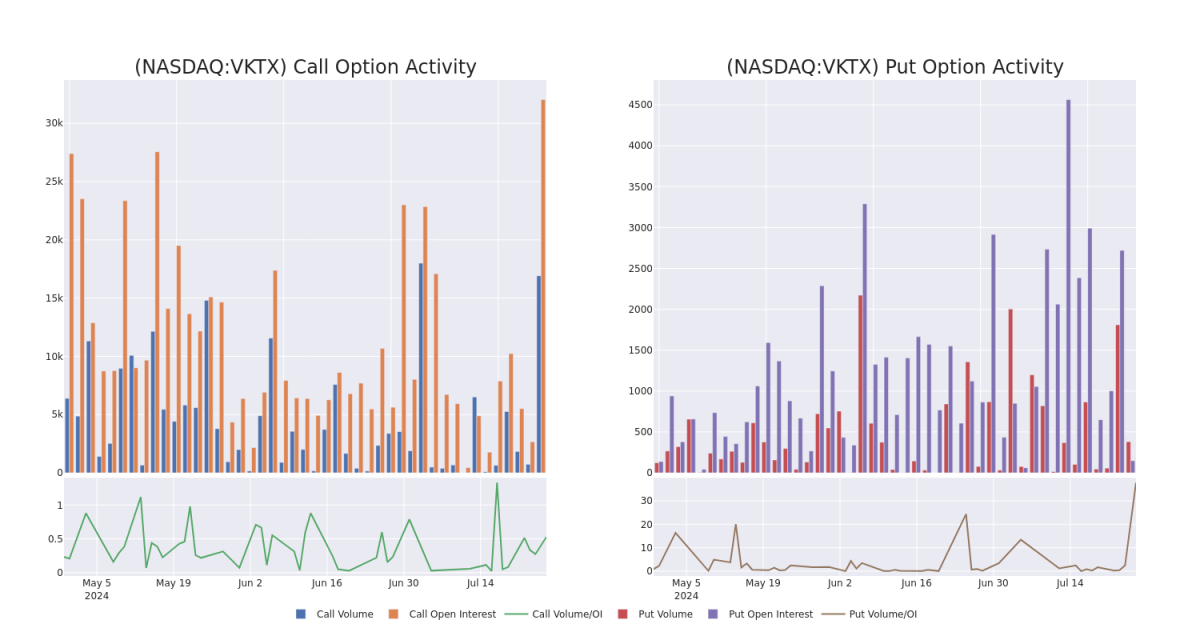

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Viking Therapeutics's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Viking Therapeutics's significant trades, within a strike price range of $20.0 to $100.0, over the past month.

檢視成交量和持倉量爲股票研究提供關鍵性見解。這些信息是了解在某些行使價的情況下,Viking Therapeutics期權的流動性和關注度水平非常重要。下面,我們提供維京療法重要交易中看漲和看跌的持倉量和成交量趨勢的快照,範圍爲20.0美元到100.0美元,並跨越過去的一個月。

Viking Therapeutics Call and Put Volume: 30-Day Overview

維京治療公司看漲和看跌期權的成交量:30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | CALL | TRADE | BEARISH | 09/20/24 | $3.0 | $2.5 | $2.5 | $100.00 | $124.5K | 2.4K | 36 |

| VKTX | CALL | SWEEP | BULLISH | 09/20/24 | $5.5 | $4.4 | $5.5 | $80.00 | $82.2K | 1.7K | 252 |

| VKTX | CALL | TRADE | BULLISH | 07/26/24 | $27.0 | $24.5 | $27.0 | $40.00 | $81.0K | 34 | 30 |

| VKTX | CALL | TRADE | BEARISH | 01/17/25 | $7.1 | $7.0 | $7.0 | $100.00 | $70.0K | 2.6K | 375 |

| VKTX | CALL | SWEEP | BULLISH | 08/16/24 | $6.3 | $6.0 | $6.3 | $65.00 | $63.0K | 1.5K | 287 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VKTX | 看漲 | 交易 | 看淡 | 09/20/24 | $3.0 | $2.5 | $2.5 | $100.00。 | $12.45萬美元 | 2.4K | 36 |

| VKTX | 看漲 | SWEEP | 看好 | 09/20/24 | $5.5 | $4.4 | $5.5 | $80.00 | $82.2K | 1.7K | 252 |

| VKTX | 看漲 | 交易 | 看好 | 07/26/24 | $27.0 | $24.5 | $27.0 | $40.00 | $81.0K | 34 | 30 |

| VKTX | 看漲 | 交易 | 看淡 | 01/17/25 | $7.1 | $7.0 | $7.0 | $100.00。 | $70.0K | 2.6K | 375 |

| VKTX | 看漲 | SWEEP | 看好 | 08/16/24 | $6.3 | $6.0 | $6.3 | $65.00 | $63.0K | 1.5K | 287 |

About Viking Therapeutics

關於Viking Therapeutics

Viking Therapeutics Inc is a healthcare service provider. The company specializes in the area of biopharmaceutical development focused on metabolic and endocrine disorders. The company's clinical program pipeline consists of VK2809, VK5211, VK0214 products. VK2809 and VK0214 are orally available, tissue and receptor-subtype selective agonists of the thyroid hormone receptor beta. VK5211 is an orally available, non-steroidal selective androgen receptor modulator.

Viking Therapeutics Inc是一家衛生服務提供商,專門從事代謝和內分泌障礙領域的生物製藥開發。該公司的臨床項目流水線包括VK2809、VK5211、VK0214產品。VK2809和VK0214是口服、組織和受體亞型選擇性的甲狀腺激素受體β激動劑。VK5211是一種口服、非類固醇選擇性雄激素受體調節劑。

Present Market Standing of Viking Therapeutics

維京療法現行市狀況

- With a volume of 8,312,421, the price of VKTX is up 2.5% at $66.3.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 89 days.

- VKTX的成交量爲8,312,421,價格上漲2.5%,爲66.3美元。

- RSI指標暗示該股票可能要超買了。

- 下一次業績預計在89天后發佈。

What Analysts Are Saying About Viking Therapeutics

關於維京療法,分析師的評論

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $104.33333333333333.

在過去一個月中,有3位行業分析師分享了他們對該股票的見解,提出了一個平均目標價爲104.33333333333333美元。

- In a cautious move, an analyst from HC Wainwright & Co. downgraded its rating to Buy, setting a price target of $90.

- Maintaining their stance, an analyst from Raymond James continues to hold a Strong Buy rating for Viking Therapeutics, targeting a price of $118.

- Reflecting concerns, an analyst from Morgan Stanley lowers its rating to Overweight with a new price target of $105.

- 謹慎地,來自HC Wainwright & Co.的分析師下調了其買入評級,並設定一個90美元的價格目標。

- 保持他們的態度,來自Raymond James的分析師繼續擁有強烈的買入評級,目標價格爲118美元。

- 反映擔憂,大摩資源lof的分析師將其評級下調爲超配,並設定了新的價格目標爲105美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。