Loss-making Shenzhen Kexin Communication TechnologiesLtd (SZSE:300565) Sheds a Further CN¥454m, Taking Total Shareholder Losses to 45% Over 1 Year

Loss-making Shenzhen Kexin Communication TechnologiesLtd (SZSE:300565) Sheds a Further CN¥454m, Taking Total Shareholder Losses to 45% Over 1 Year

Investors can approximate the average market return by buying an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Shenzhen Kexin Communication Technologies Co.,Ltd (SZSE:300565) shareholders over the last year, as the share price declined 45%. That's disappointing when you consider the market declined 19%. To make matters worse, the returns over three years have also been really disappointing (the share price is 38% lower than three years ago). And the share price decline continued over the last week, dropping some 16%.

投資者可以通過購買指數基金來近似獲得市場平均回報。積極的投資者旨在購買大幅跑贏市場的股票,但在此過程中,他們冒着低於市場表現的風險。在過去一年中,深圳市科信技術股份有限公司(SZSE:300565)的股東已經看到了這種下行風險,因爲股價下跌了45%。考慮到市場下跌了19%,這令人失望。更糟糕的是,過去三年的回報也非常令人失望(股價比三年前低38%)。股價下跌還在繼續,在過去一週中下跌了16%。

Since Shenzhen Kexin Communication TechnologiesLtd has shed CN¥454m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

由於深圳市科信技術股份有限公司在過去7天內損失了45400萬元人民幣(約合676萬美元),讓我們看看長期的下跌是否是由業務經濟所驅動的。

Shenzhen Kexin Communication TechnologiesLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

深圳市科信技術股份有限公司目前沒有盈利,因此大多數分析師會看營業收入增長情況以了解基礎業務增長的速度。一般來說,沒有盈利的公司每年都有望增長營業收入,而且速度較快。這是因爲,如果營業收入增長微不足道,從來沒有盈利,很難有信心認爲一家公司將是可持續的。一年之內,深圳市科信技術股份有限公司的營業收入下降了38%。乍一看,這看起來非常糟糕。在這段時間內,股東已經看到股價下跌了45%。考慮到缺乏盈利和營業收入增長,這似乎是相當合理的。我們認爲,大多數持有者必須相信營業收入增長將會改善,或者成本將會下降。

In just one year Shenzhen Kexin Communication TechnologiesLtd saw its revenue fall by 38%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 45% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

在短短一年內,深圳市科信技術股份有限公司的營業收入下降了38%。乍一看,這看起來非常糟糕。在這段時間內,股東已經看到股價下跌了45%。考慮到缺乏盈利和營業收入增長,這似乎是相當合理的。我們認爲,大多數持有者必須相信營業收入增長將會改善,或者成本將會下降。

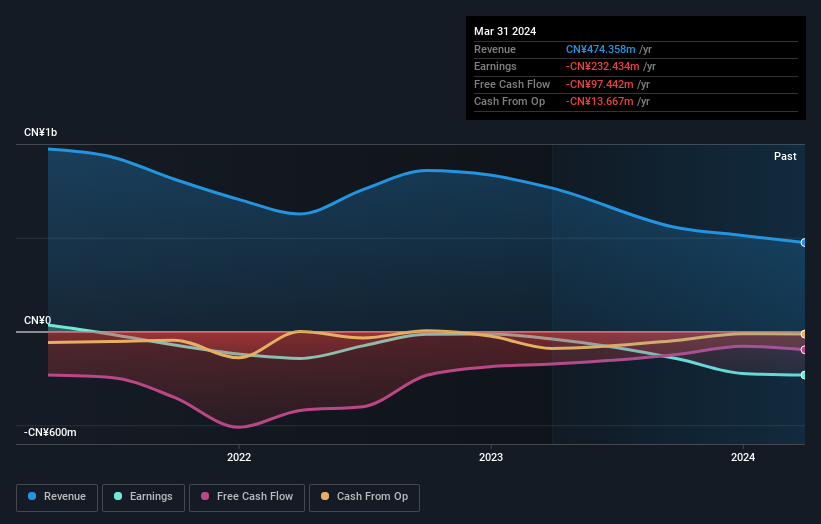

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

你可以在下面的圖片中看到收入和營業收入隨時間的變化情況(單擊圖表可查看精確值)。

Take a more thorough look at Shenzhen Kexin Communication TechnologiesLtd's financial health with this free report on its balance sheet.

通過這份有關其資產負債表的免費報告,更全面地了解深圳市科信技術股份有限公司的財務狀況。

A Different Perspective

不同的觀點

While the broader market lost about 19% in the twelve months, Shenzhen Kexin Communication TechnologiesLtd shareholders did even worse, losing 45%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 3 warning signs for Shenzhen Kexin Communication TechnologiesLtd (1 makes us a bit uncomfortable) that you should be aware of.

儘管整個市場在過去12個月中損失了約19%,但深圳市科信技術股份有限公司的股東表現得更糟糕,虧損了45%。話雖如此,在下跌的市場中不可避免地會有一些股票被超賣。關鍵是將目光放在基本面的發展上。令人遺憾的是,去年的表現是長期萎靡不振的背景之一,股東在五年時間裏面臨着總損失爲7%。我們意識到,羅斯柴爾德男爵曾說過,投資者應該“在街上有鮮血時買入”,但我們提醒投資者首先確定他們正在購買高質量的業務。我覺得長期以來的股價作爲業務表現的代理非常有趣。但是,爲了真正獲得洞察力,我們還需要考慮其他信息。例如,我們已經確定了深圳市科信技術股份有限公司的3個警示信號(有1個讓我們有點不舒服),您應該注意這些。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果您願意查看另一家公司(具有潛在的更好財務狀況),請不要錯過這個免費的公司列表,證明它們可以增長收益。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

In just one year Shenzhen Kexin Communication TechnologiesLtd saw its revenue fall by 38%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 45% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.

In just one year Shenzhen Kexin Communication TechnologiesLtd saw its revenue fall by 38%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 45% in that time. That seems pretty reasonable given the lack of both profits and revenue growth. We think most holders must believe revenue growth will improve, or else costs will decline.