Hong Kong Viable Stocks – Sinotruk (Hong Kong), AviChina Industry & Technology

Hong Kong Viable Stocks – Sinotruk (Hong Kong), AviChina Industry & Technology

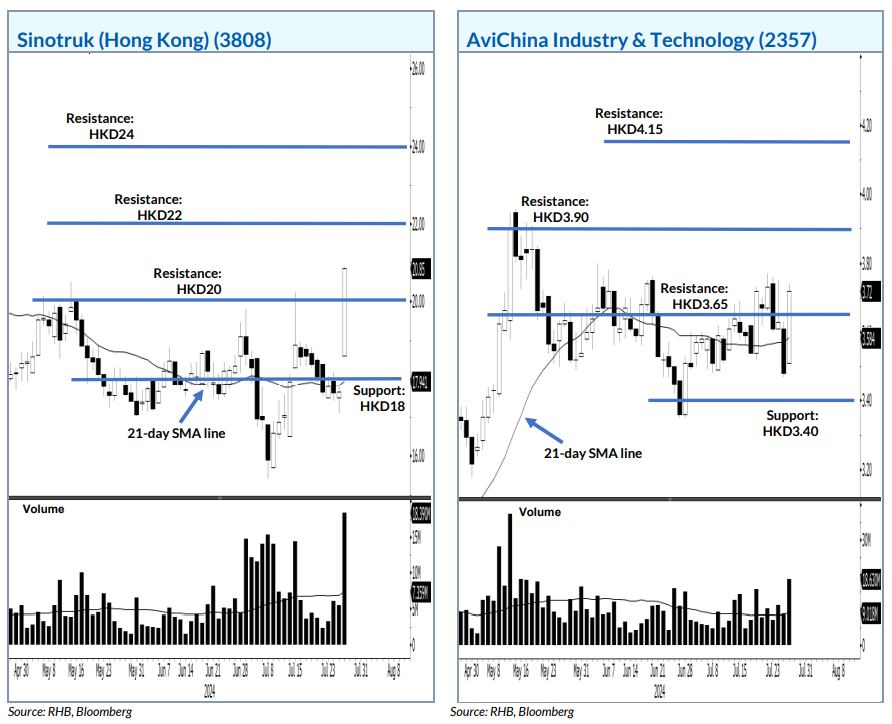

Sinotruk (Hong Kong)'s uptrend may be extended after it breached the resistance on high volume.

中國重汽(香港)的上漲趨勢可能在成交量大幅度突破支撐位後延續。

RHB Retail Research (RHB) in a note today (July 29) said the stock has surged above the 21-day SMA line and pushed past the HKD20 resistance – thereby affirming the bullish setup.

RHB 零售研究(RHB)在今天(7月29日)的一份報告中表示,該股票已經上漲並突破了21天SMA線和20元的支撐位,驗證了看好的形態。

Riding on the renewed momentum, it may head for the next resistance of HKD22, followed by HKD24.

在這股回暖勢頭的推動下,它可能會朝着22港元的阻力位前進,隨後是24港元。

On the flip side, breaching the HKD18 support would lead to the resumption of a bearish phase.

另一方面,突破18港元的支撐位將導致熊市階段的恢復。

AviChina Industry & Technology's bullish trajectory may return after the stock breached a resistance point on strong volume.

中航科工(AviChina Industry & Technology)的看好趨勢可能在成交量強勁攀升突破阻力位後回歸。

The counter has printed a bullish candlestick and closed above the HKD3.65 resistance.

該股票已經打印出一個看好的K線並且在3.65港元的阻力位上結束。

The 21-day SMA line is rounding upwards, ie short-term trend is bullish.

21日SMA線正在上升,即短期趨勢看好。

Expect a positive price action to follow through, and the stock may test the next resistance of HKD3.90, followed by HKD4.15.

預計股價將繼續上漲,測試3.90港元的阻力位,隨後是4.15港元。

Towards the downside, falling below the HKD3.40 support would nullify the bullish setup.

向下跌破3.40港元的支撐位將取消這種看好的態勢。