Wall Street's Most Accurate Analysts Say Hold These 3 Health Care Stocks With Over 3% Dividend Yields

Wall Street's Most Accurate Analysts Say Hold These 3 Health Care Stocks With Over 3% Dividend Yields

During times of turbulence and uncertainty in the markets, even when markets are at all-time highs, many investors turn to dividend-yielding stocks.

在市場動盪和不確定時期,即使市場處於歷史最高水平,許多投資者也會轉向具備股息收益的股票。

During times of turbulence and uncertainty in the markets, many investors turn to dividend-yielding stocks. These are often companies that have high free cash flows and reward shareholders with a high dividend payout.

在市場動盪和不確定的時期,許多投資者會轉向股息收益股,這些通常是具有較高的自由現金流並以高紅利派息獎勵股東的公司。

Benzinga readers can review the latest analyst takes on their favorite stocks by visiting our Analyst Stock Ratings page. Traders can sort through Benzinga's extensive database of analyst ratings, including by analyst accuracy.

Benzinga的讀者可以查看我們的分析師股票評級頁面,查看最新的分析師對他們最喜愛的股票的看法。交易員可以瀏覽Benzinga的廣泛分析師評級數據庫,包括按分析師準確性排序。

Below are the ratings of the most accurate analysts for three high-yielding stocks in the health care sector.

以下是醫療保健板塊三隻高收益股票最準確的分析師評級。

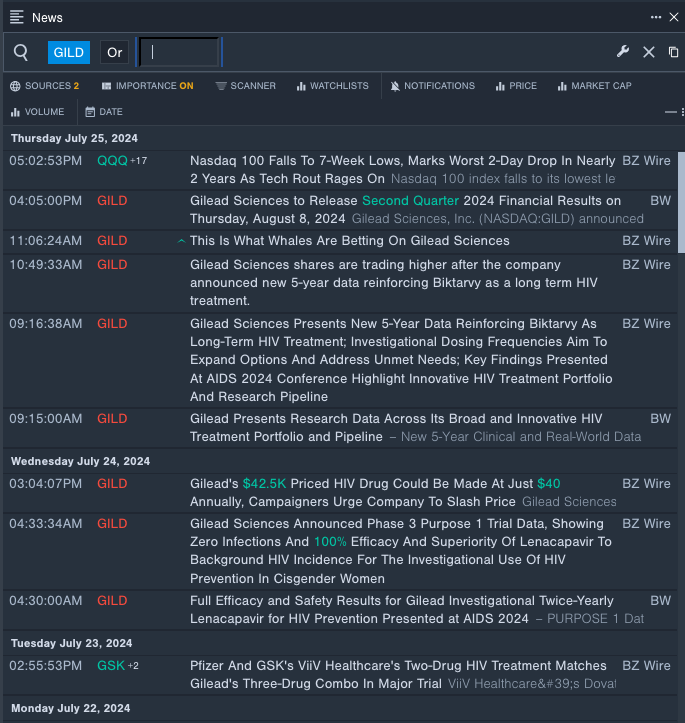

Gilead Sciences, Inc. (NASDAQ:GILD)

吉利德科學股份有限公司(納斯達克股票代碼:GILD)

- Dividend Yield: 4.00%

- Cantor Fitzgerald analyst Olivia Brayer maintained a Neutral rating and cut the price target from $75 to $70 on July 22. This analyst has an accuracy rate of 65%.

- RBC Capital analyst Brian Abrahams reiterated a Sector Perform rating with a price target of $74 on July 1. This analyst has an accuracy rate of 69%.

- Recent News: On July 25, Gilead Sciences announced new 5-year data reinforcing Biktarvy as a long term HIV treatment.

- Benzinga Pro's real-time newsfeed alerted to latest GILD news

- 股息率:4.00%

- Cantor Fitzgerald的分析師奧利維亞·佈雷耶(Olivia Brayer)維持了中立評級,並在7月22日將目標價從75美元下調至70美元。該分析師的準確率爲65%。

- RBC Capital的分析師布萊恩·阿伯拉罕斯(Brian Abrahams)在7月1日重申了板塊表現評級,並給出了74美元的目標價。該分析師的準確率爲69%。

- 最新消息:吉利德科學公司在7月25日宣佈了新的5年數據,進一步證實Biktarvy作爲一種長期治療HIV的療法。

- Benzinga Pro的實時新聞提醒了最新的吉利德科學公司的消息。

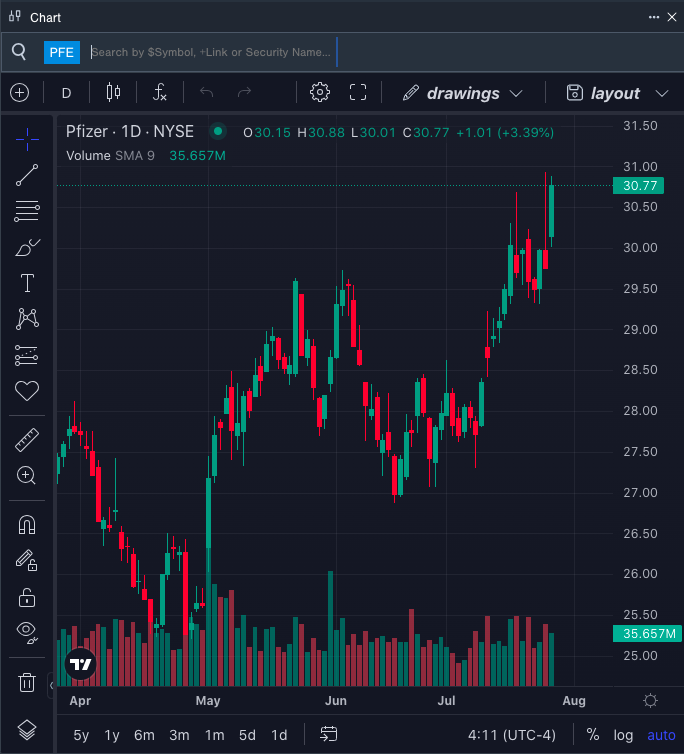

Pfizer Inc. (NYSE:PFE)

輝瑞公司(NYSE:PFE)

- Dividend Yield: 5.46%

- Barclays analyst Carter Gould maintained an Equal-Weight rating and raised the price target from $28 to $30 on July 10. This analyst has an accuracy rate of 64%.

- Argus Research analyst David Toung downgraded the stock from Buy to Hold on March 22. This analyst has an accuracy rate of 68%.

- Recent News: Pfizer announced last week that the European Commission approved a conditional marketing authorization for DURVEQTIX, a gene therapy for severe and moderately severe hemophilia B in adults whom meet certain criteria.

- Benzinga Pro's charting tool helped identify the trend in PFE's stock.

- 股息收益率:5.46%。

- 巴克萊銀行的分析師卡特·古爾德(Carter Gould)維持了股票均衡評級,並在7月10日將目標價從28美元上調至30美元。該分析師的準確率爲64%。

- 雅運股份的分析師大衛·湯(David Toung)於3月22日將股票評級從買入下調至持有。該分析師的準確率爲68%。

- 最新消息:輝瑞上週宣佈,歐洲委員會已爲DURVEQTI,一種用於符合某些標準的成年重度和中度血友病患者的基因療法,批准了有條件的營銷授權。

- Benzinga Pro的繪圖工具幫助識別了輝瑞股票的趨勢。

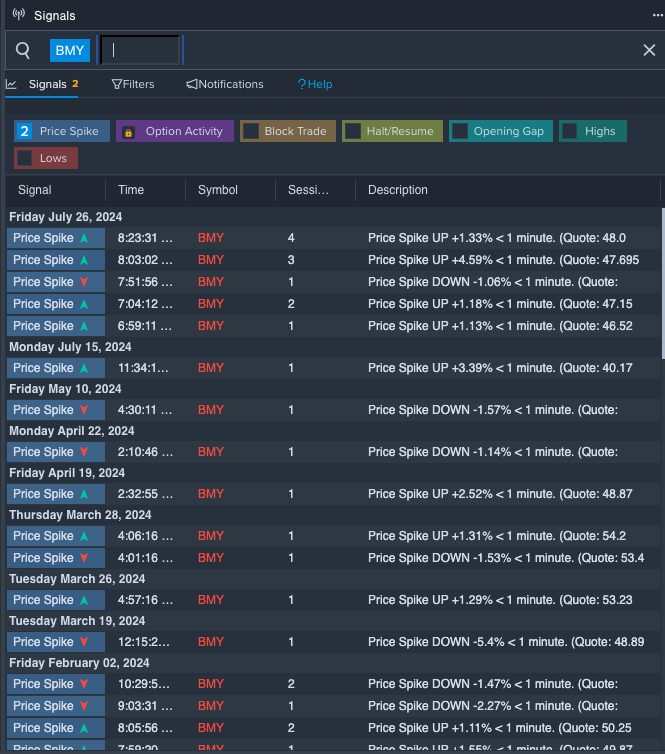

Bristol-Myers Squibb Company (NYSE:BMY)

施貴寶公司(紐交所股票代號:BMY)

- Dividend Yield: 4.76%

- Deutsche Bank analyst James Shin maintained a Hold rating and cut the price target from $53 to $45 on July 23. This analyst has an accuracy rate of 73%.

- Wells Fargo analyst Mohit Bansal maintained an Equal-Weight rating and raised the price target from $51 to $52 on April 18. This analyst has an accuracy rate of 77%.

- Recent News: On July 26, Bristol-Myers Squibb posted better-than-expected quarterly earnings.

- Benzinga Pro's signals feature notified of a potential breakout in BMY shares.

- 股息收益率:4.76%

- 德意志銀行的分析師詹姆斯·辛(James Shin)維持了持有評級,並在7月23日將目標價從53美元下調至45美元。該分析師的準確率爲73%。

- 富國銀行的分析師莫希特·班薩爾(Mohit Bansal)維持了股票均衡評級,並將目標價從51美元上調至52美元。該分析師的準確率爲77%。

- 最新消息:施貴寶公司在7月26日公佈了超預期的季度業績。

- Benzinga Pro的信號功能提示了施貴寶公司股票的潛在突破。

Read More:

閱讀更多:

- Jim Cramer Is 'Mystified' By Five Below, Predicts CrowdStrike 'Is Going To Bottom Here'

- 吉姆·克萊默對five below感到困惑,預測crowdstrike將在此處觸底。