Smart Money Is Betting Big In SMCI Options

Smart Money Is Betting Big In SMCI Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Super Micro Computer.

有很多資金可以花費的鯨魚已經採取了明顯的看淡態度,針對超微電腦。

Looking at options history for Super Micro Computer (NASDAQ:SMCI) we detected 74 trades.

查看超微電腦(納斯達克:SMCI)期權交易歷史,我們發現有74次交易。

If we consider the specifics of each trade, it is accurate to state that 32% of the investors opened trades with bullish expectations and 37% with bearish.

如果我們考慮每次交易的具體情況,可以準確地說,32%的投資者持看好期權交易,37%持看淡期權交易。

From the overall spotted trades, 41 are puts, for a total amount of $2,935,647 and 33, calls, for a total amount of $1,698,244.

從整體交易中,有41次看跌期權交易,金額總計$2,935,647,還有33次看漲期權交易,金額總計$1,698,244。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $570.0 and $1200.0 for Super Micro Computer, spanning the last three months.

在評估交易量和未平倉合約後,可以明顯看出,主要市場行動者正在專注於超微電腦的股價區間,該區間跨越了過去三個月的$570.0至$1200.0。

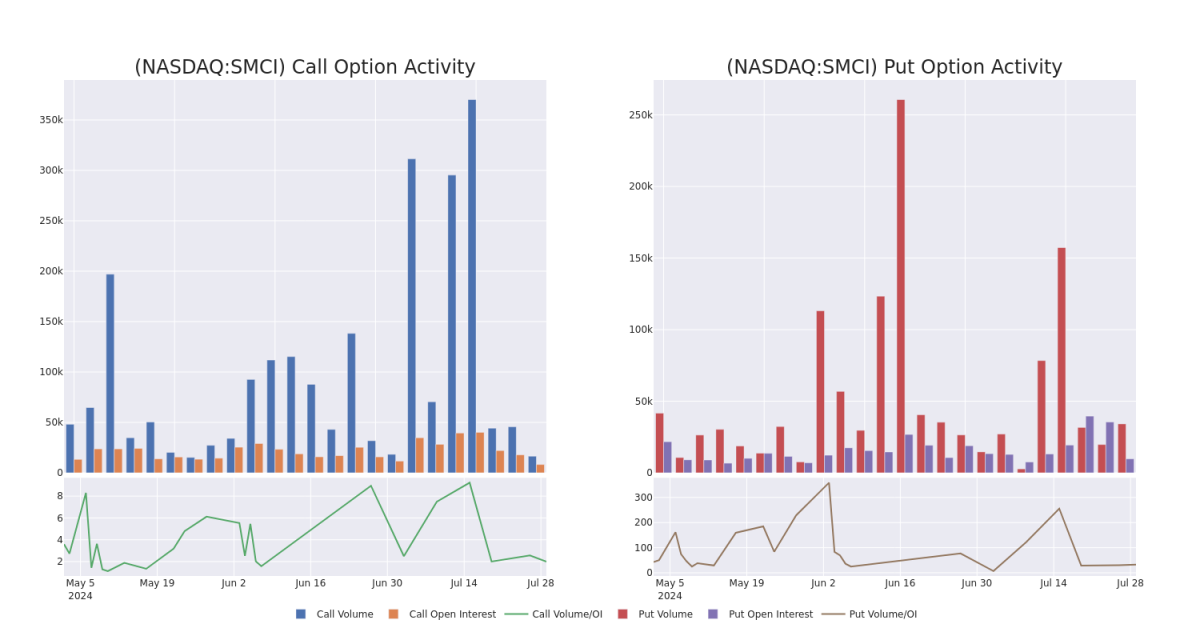

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Super Micro Computer's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Super Micro Computer's significant trades, within a strike price range of $570.0 to $1200.0, over the past month.

檢查成交量和未平倉合約會爲股票研究提供關鍵見解。這些信息對於衡量超微電腦特定行權價期權的流動性和興趣水平非常關鍵。下面是過去一個月內,在$570.0至$1200.0行權價區間內,超微電腦的看跌期權和看漲期權的成交量和未平倉合約趨勢快照。

Super Micro Computer 30-Day Option Volume & Interest Snapshot

超微電腦30天期權成交量和持倉量快照

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SMCI | PUT | TRADE | BEARISH | 10/18/24 | $38.8 | $37.3 | $38.2 | $600.00 | $955.0K | 481251 | |

| SMCI | CALL | SWEEP | BEARISH | 08/02/24 | $146.1 | $144.3 | $144.3 | $570.00 | $216.4K | 1816 | |

| SMCI | CALL | TRADE | BEARISH | 10/18/24 | $91.5 | $90.9 | $90.9 | $720.00 | $145.4K | 9521 | |

| SMCI | PUT | TRADE | BULLISH | 08/02/24 | $28.3 | $27.5 | $27.82 | $715.00 | $83.4K | 9281.1K | |

| SMCI | PUT | SWEEP | NEUTRAL | 08/02/24 | $28.1 | $27.3 | $27.63 | $715.00 | $82.9K | 9281.1K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 超微 | 看跌 | 交易 | 看淡 | 10/18/24 | $38.8 | $37.3 | 38.2美元 | $600.00 | $955.0千 | 481251 | |

| 超微 | 看漲 | SWEEP | 看淡 | 08/02/24 | $146.1 | $144.3 | $144.3 | $570.00 | $216.4千 | 1816 | |

| 超微 | 看漲 | 交易 | 看淡 | 10/18/24 | $91.5 | $90.9 | $90.9 | 720.00美元 | $145.4千 | 9521 | |

| 超微 | 看跌 | 交易 | 看好 | 08/02/24 | $28.3 | $27.5 | $27.82 | 715.00美元 | $83.4千 | 9281.1千 | |

| 超微 | 看跌 | SWEEP | 中立 | 08/02/24 | $28.1 | $27.3 | $27.63 | 715.00美元 | $82.9K | 9281.1千 |

About Super Micro Computer

關於超微電腦

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

超微電腦公司提供高效的服務器技術服務,面向雲計算、數據中心、大數據、高性能計算和 "物聯網" 嵌入式市場。其解決方案包括服務器、存儲、葉片服務器、工作站、整個機架、網絡設備和服務器管理軟件。該公司採用一種模塊化的架構方法,提供靈活性以提供定製化的解決方案。該公司在一個運營部門中運營,該部門基於一種創新、模塊化和開放標準體系結構開發和提供高性能服務器解決方案。該公司的營收超過一半來自美國,其餘來自歐洲、亞洲和其他地區。

In light of the recent options history for Super Micro Computer, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到超微電腦的期權歷史記錄,現在適合關注公司的本身表現。我們旨在探討其當前表現。

Where Is Super Micro Computer Standing Right Now?

超微電腦現狀如何?

- Trading volume stands at 1,350,437, with SMCI's price down by -0.59%, positioned at $707.97.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 8 days.

- SMCI的交易量爲1,350,437,股價下跌了-0.59%,目前爲$707.97。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計8天內公佈收益報告。

Expert Opinions on Super Micro Computer

關於超微電腦的專家意見

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $627.5.

在過去的30天裏,一共有2位專業分析師對這隻股票發表了看法,設置了一個平均目標價爲627.5美元。

- Reflecting concerns, an analyst from Nomura lowers its rating to Neutral with a new price target of $930.

- An analyst from Susquehanna persists with their Negative rating on Super Micro Computer, maintaining a target price of $325.

- 出於擔憂,野村證券的分析師將評級下調到中立,目標價爲$930。

- 來自Susquehanna的分析師堅持對超微電腦給出負面評級,維持325美元的目標價。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Super Micro Computer with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子、並保持對市場動態的感知來減輕這些風險。使用Benzinga Pro進行實時提醒,了解超微電腦的最新期權交易情況。