Behind the Scenes of CrowdStrike Holdings's Latest Options Trends

Behind the Scenes of CrowdStrike Holdings's Latest Options Trends

Financial giants have made a conspicuous bearish move on CrowdStrike Holdings. Our analysis of options history for CrowdStrike Holdings (NASDAQ:CRWD) revealed 48 unusual trades.

金融巨頭在crowdstrike控股上採取了明顯的看淡動作。我們對crowdstrike控股(納斯達克CRWD)期權歷史的分析顯示,出現了48筆異常交易。

Delving into the details, we found 41% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $528,254, and 40 were calls, valued at $2,265,247.

具體分析發現,41%的交易員看漲,而50%呈看跌態勢。在我們發現的所有交易中,有8種看跌期權,價值528,254美元,有40種看漲期權,價值2,265,247美元。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $170.0 to $360.0 for CrowdStrike Holdings during the past quarter.

分析這些合約的成交量和未平倉量,似乎在過去的一個季度裏,大型交易者一直在關注crowdstrike控股170.0至360.0美元的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

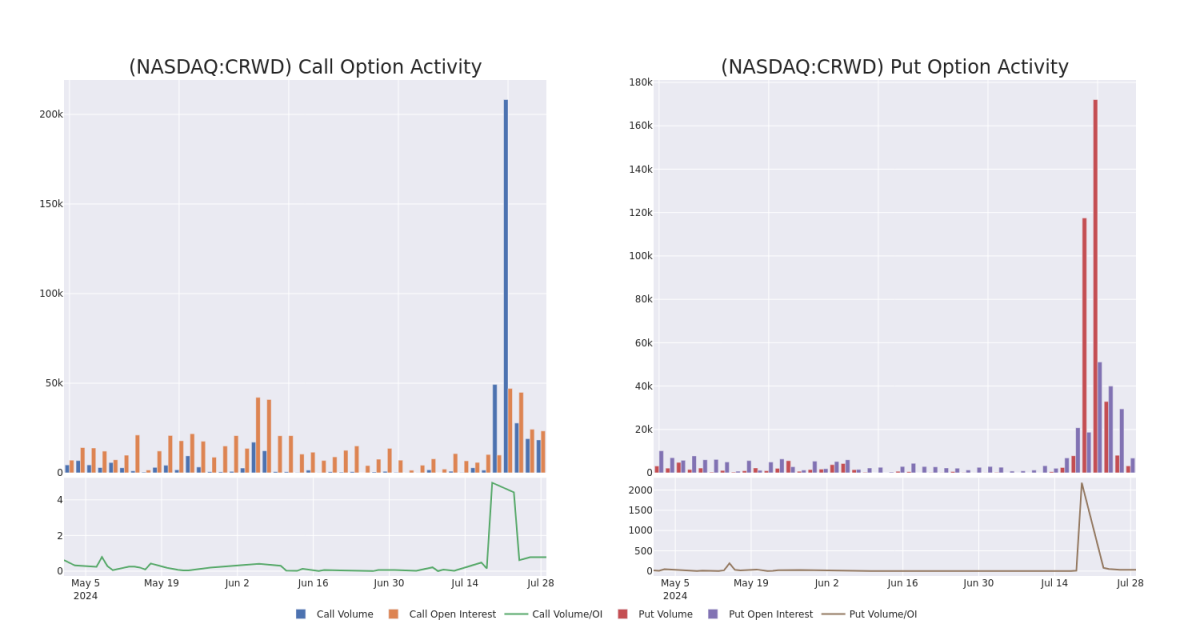

In today's trading context, the average open interest for options of CrowdStrike Holdings stands at 819.03, with a total volume reaching 21,547.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in CrowdStrike Holdings, situated within the strike price corridor from $170.0 to $360.0, throughout the last 30 days.

在今天的交易中,crowdstrike控股期權的平均未平倉量爲819.03,總成交量達到21,547.00。下圖描繪了crowdstrike控股位於170.0到360.0美元行權價格走廊內的高價值交易中,看漲和看跌期權成交量和未平倉量的走勢,在過去30天內的進展情況。

CrowdStrike Holdings 30-Day Option Volume & Interest Snapshot

CrowdStrike Holdings 30天期權成交量和未平倉合約快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | CALL | SWEEP | BULLISH | 08/02/24 | $6.15 | $5.8 | $6.1 | $265.00 | $240.5K | 1.9K | 2.6K |

| CRWD | CALL | SWEEP | BULLISH | 09/20/24 | $18.15 | $17.2 | $18.15 | $270.00 | $181.6K | 1.5K | 131 |

| CRWD | PUT | SWEEP | BEARISH | 01/16/26 | $31.65 | $30.2 | $30.2 | $220.00 | $175.1K | 1.6K | 59 |

| CRWD | PUT | TRADE | BULLISH | 01/17/25 | $30.65 | $29.95 | $30.0 | $260.00 | $150.0K | 1.1K | 63 |

| CRWD | CALL | TRADE | BEARISH | 09/20/24 | $14.9 | $14.6 | $14.7 | $280.00 | $145.5K | 1.7K | 888 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | 看漲 | SWEEP | 看好 | 08/02/24 | $ 6.15 | $5.8 | 6.1美元 | $265.00 | $240.5K | 1.9K | 2.6K |

| CRWD | 看漲 | SWEEP | 看好 | 09/20/24 | $18.15 | $17.2 | $18.15 | $270.00 | $181.6K | 1.5K | 131 |

| CRWD | 看跌 | SWEEP | 看淡 | 01/16/26 | $31.65 | $30.2 | $30.2 | $220.00 | $175.1K | 1.6K | 59 |

| CRWD | 看跌 | 交易 | 看好 | 01/17/25 | $30.65 | $29.95 | $30.0應該是指目標價$30.0。 | $260.00 | $150.0K | 1.1千 | 63 |

| CRWD | 看漲 | 交易 | 看淡 | 09/20/24 | $14.9 | 14.6美元 | $14.7 | $280.00 | $145.5K | 1.7K | 888 |

About CrowdStrike Holdings

關於CrowdStrike控股公司

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

市淨率P/B

Having examined the options trading patterns of CrowdStrike Holdings, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了CrowdStrike Holdings的期權交易情況後,我們現在將直接關注該公司。這個轉換讓我們了解其當前的市場地位和表現。

Where Is CrowdStrike Holdings Standing Right Now?

CrowdStrike Holdings現在處於什麼位置?

- Currently trading with a volume of 5,125,438, the CRWD's price is up by 2.17%, now at $261.72.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 30 days.

- 目前CRWD的成交量爲5,125,438,價格上漲2.17%,目前爲261.72美元。

- RSI讀數表明該股票目前可能被超賣。

- 預計收益發布還需30天。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易員通過持續教育自己,調整策略,監控多種因子,並密切關注市場走勢來管理這些風險。通過Benzinga Pro即時提醒了解最新的CrowdStrike Holdings期權交易動態。