Intel Analyst Flags AMD Competition as Key Challenge, Predicts Modest Growth For Q2

Intel Analyst Flags AMD Competition as Key Challenge, Predicts Modest Growth For Q2

Rosenblatt analyst Hans Mosesmann maintained a Sell rating on Intel Corp (NASDAQ:INTC) with a price target of $17.

羅森布拉特分析師漢斯·莫斯曼維持英特爾公司(納斯達克股票代碼:INTC)的賣出評級,目標股價爲17美元。

Mosesmann expects Intel to deliver inline fiscal 2024 second-quarter earnings based on flat to up sales growth, stabilizing PC dynamics, and a bottoming in the Altera, Mobileye, and NEX segments.

摩斯曼預計,英特爾將在銷售增長持平至上升、個人電腦動態穩定以及Altera、Mobileye和NEX板塊觸底的基礎上,實現2024財年第二季度業績的預期。

The analyst expects the management to issue a modest growth guidance for the third quarter, likely below his mid-to-high single-digit expectation of weaker server Sierra Forrest and Granite Rapids ramps as Advanced Micro Devices, Inc (NASDAQ:AMD) continues to gain share on EPYC4 and newer EPYC5 road maps.

該分析師預計,隨着先進微設備公司(納斯達克股票代碼:AMD)在 EPYC4 和更新的 EPYC5 路線圖上繼續獲得份額,管理層將發佈第三季度溫和的增長指導,可能低於他對服務器塞拉福雷斯特和Granite Rapids疲軟的中高個位數預期。

Mosesmann projected a second-quarter revenue of $13 billion, which aligns with the consensus. Guidance for the quarter is for $12.5 billion – $13.5 billion. The analyst and consensus expect an adjusted gross margin of 43.5% and 42.7%, respectively. Guidance for the June quarter was for 43.5%.

摩斯曼預計第二季度收入爲130億美元,這與共識一致。本季度的預期爲125億美元至135億美元。分析師和共識預計,調整後的毛利率分別爲43.5%和42.7%。6月季度的預期爲43.5%。

Mosesmann expects an adjusted EPS of $0.10, which aligns with guidance and consensus.

摩斯曼預計,調整後的每股收益爲0.10美元,符合指導和共識。

For the September quarter, Mosesmann projected revenue of $14 billion vs. the consensus of $14.4 billion. The analyst's estimate for adjusted gross margin is 44.8%, slightly lower than the consensus estimate of 46.2%. Mosesmann's adjusted EPS is $0.14, below the consensus of $0.32.

摩斯曼預計9月季度的收入爲140億美元,而市場普遍預期的收入爲144億美元。分析師對調整後毛利率的估計爲44.8%,略低於市場普遍預期的46.2%。摩斯曼調整後的每股收益爲0.14美元,低於市場普遍的0.32美元。

For fiscal 2024, the analyst projected revenue of $54.7 billion and adjusted EPS of $0.64, below the consensus of $56 billion and $1.11.

分析師預計2024財年的收入爲547億美元,調整後的每股收益爲0.64美元,低於預期的560億美元和1.11美元。

For fiscal 2025, Mosesmann projected revenue of $61 billion and adjusted EPS of $1.20, below the consensus of $62.8 billion billion and $1.92.

對於2025財年,摩斯曼預計收入爲610億美元,調整後的每股收益爲1.20美元,低於市場預期的628億美元和192美元。

For fiscal 2026, the analyst projected revenue of $61 billion and adjusted EPS of $1.05.

該分析師預計2026財年的收入爲610億美元,調整後的每股收益爲1.05美元。

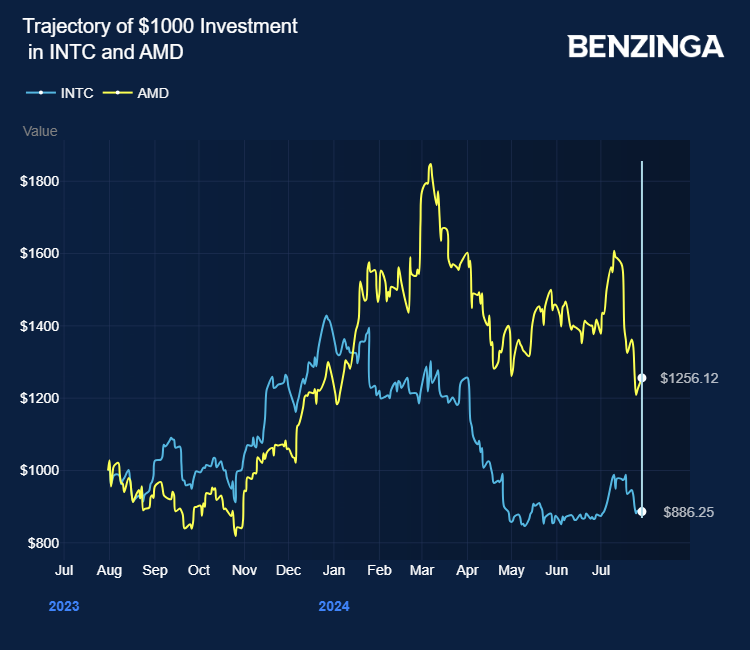

Intel stock lost over 13% in the last 12 months. Investors can gain exposure to the stock through Vanguard Value ETF (NYSE:VTV) and Vanguard Information Tech ETF (NYSE:VGT).

英特爾股價在過去12個月中下跌了13%以上。投資者可以通過Vanguard Value ETF(紐約證券交易所代碼:VTV)和Vanguard Information Tech ETF(紐約證券交易所代碼:VGT)獲得股票敞口。

Price Action: INTC shares traded lower by 1.28% at $30.95 at last check Monday.

價格走勢:週一最後一次檢查時,INTC股價下跌1.28%,至30.95美元。

Photo via Shutterstock

照片來自 Shutterstock