Unpacking the Latest Options Trading Trends in Exxon Mobil

Unpacking the Latest Options Trading Trends in Exxon Mobil

Whales with a lot of money to spend have taken a noticeably bearish stance on Exxon Mobil.

有很多錢可以花的鯨魚對埃克森美孚採取了明顯的看跌立場。

Looking at options history for Exxon Mobil (NYSE:XOM) we detected 18 trades.

查看埃克森美孚(紐約證券交易所代碼:XOM)的期權歷史記錄,我們發現了18筆交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 55% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,44%的投資者以看漲的預期開倉,55%的投資者以看跌的預期開盤。

From the overall spotted trades, 6 are puts, for a total amount of $276,530 and 12, calls, for a total amount of $546,757.

在已發現的全部交易中,有6筆是看跌期權,總額爲276,530美元,12筆看漲期權,總額爲546,757美元。

Predicted Price Range

預測的價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $95.0 to $130.0 for Exxon Mobil over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將埃克森美孚的價格定在95.0美元至130.0美元之間。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

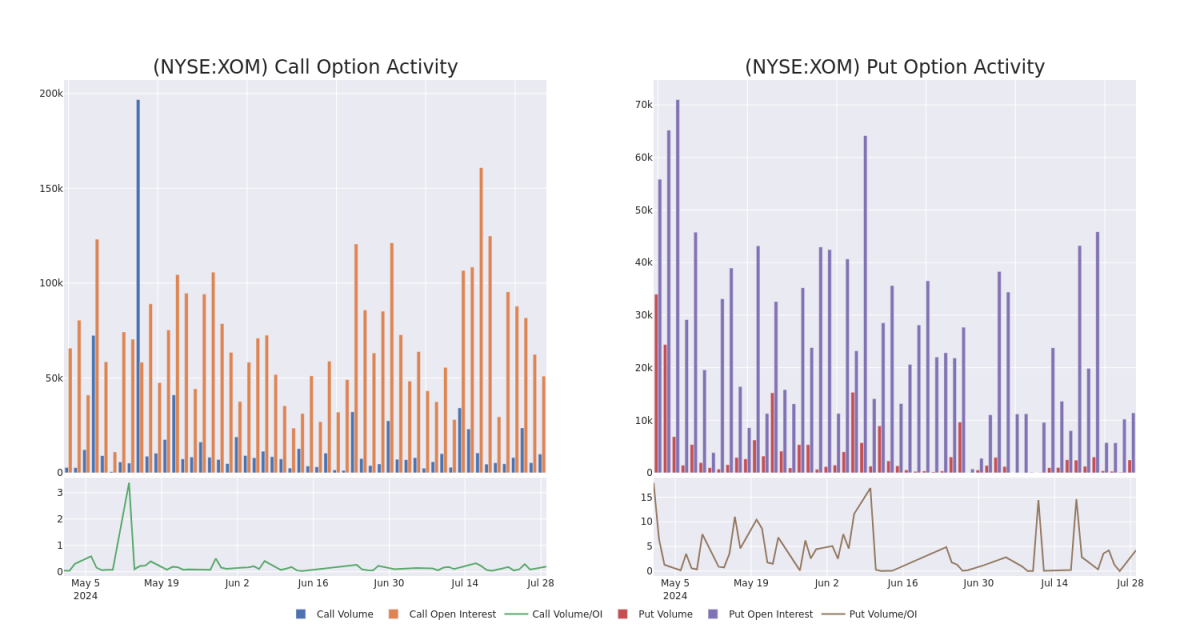

In today's trading context, the average open interest for options of Exxon Mobil stands at 4455.29, with a total volume reaching 12,324.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Exxon Mobil, situated within the strike price corridor from $95.0 to $130.0, throughout the last 30 days.

在今天的交易背景下,埃克森美孚期權的平均未平倉合約爲4455.29,總交易量達到12,324.00。隨附的圖表描繪了埃克森美孚在過去30天中看漲期權和看跌期權交易量以及未平倉合約的變化,這些交易位於行使價走廊內,從95.0美元到130.0美元。

Exxon Mobil 30-Day Option Volume & Interest Snapshot

埃克森美孚 30 天期權交易量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | CALL | SWEEP | BEARISH | 08/23/24 | $2.71 | $2.7 | $2.71 | $116.00 | $114.0K | 105 | 432 |

| XOM | PUT | TRADE | BULLISH | 09/20/24 | $3.5 | $3.45 | $3.45 | $115.00 | $69.0K | 10.9K | 279 |

| XOM | PUT | TRADE | BULLISH | 09/20/24 | $3.35 | $3.3 | $3.3 | $115.00 | $66.0K | 10.9K | 927 |

| XOM | CALL | SWEEP | BULLISH | 12/18/26 | $17.5 | $16.75 | $17.5 | $115.00 | $52.5K | 2.4K | 30 |

| XOM | CALL | SWEEP | BULLISH | 12/20/24 | $1.91 | $1.9 | $1.91 | $130.00 | $48.7K | 3.3K | 265 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| XOM | 打電話 | 掃 | 粗魯的 | 08/23/24 | 2.71 美元 | 2.7 美元 | 2.71 美元 | 116.00 美元 | 114.0 萬美元 | 105 | 432 |

| XOM | 放 | 貿易 | 看漲 | 09/20/24 | 3.5 美元 | 3.45 美元 | 3.45 美元 | 115.00 美元 | 69.0 萬美元 | 10.9K | 279 |

| XOM | 放 | 貿易 | 看漲 | 09/20/24 | 3.35 美元 | 3.3 美元 | 3.3 美元 | 115.00 美元 | 66.0 萬美元 | 10.9K | 927 |

| XOM | 打電話 | 掃 | 看漲 | 12/18/26 | 17.5 美元 | 16.75 美元 | 17.5 美元 | 115.00 美元 | 52.5 萬美元 | 2.4K | 30 |

| XOM | 打電話 | 掃 | 看漲 | 12/20/24 | 1.91 | 1.9 美元 | 1.91 | 130.00 美元 | 48.7 萬美元 | 3.3K | 265 |

About Exxon Mobil

關於埃克森美孚

ExxonMobil is an integrated oil and gas company that explores for, produces, and refines oil around the world. In 2023, it produced 2.4 million barrels of liquids and 7.7 billion cubic feet of natural gas per day. At the end of 2023, reserves were 16.9 billion barrels of oil equivalent, 66% of which were liquids. The company is one the world's largest refiners with a total global refining capacity of 4.5 million barrels of oil per day and is one of the world's largest manufacturers of commodity and specialty chemicals.

埃克森美孚是一家綜合石油和天然氣公司,在全球範圍內勘探、生產和提煉石油。2023 年,它每天生產 240 萬桶液體和 77 億立方英尺的天然氣。到2023年底,儲量爲169億桶石油當量,其中66%是液體。該公司是全球最大的煉油廠之一,全球煉油總產能爲每天450萬桶石油,也是世界上最大的大宗商品和特種化學品製造商之一。

Following our analysis of the options activities associated with Exxon Mobil, we pivot to a closer look at the company's own performance.

在分析了與埃克森美孚相關的期權活動之後,我們將轉向仔細研究公司自身的表現。

Current Position of Exxon Mobil

埃克森美孚的當前位置

- With a trading volume of 5,055,839, the price of XOM is down by -0.97%, reaching $116.19.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 4 days from now.

- XoM的交易量爲5,055,839美元,下跌了-0.97%,至116.19美元。

- 當前的RSI值表明該股可能已接近超買。

- 下一份收益報告定於4天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Exxon Mobil with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解埃克森美孚的最新期權交易,以獲取實時警報。