7.2% Earnings Growth Over 3 Years Has Not Materialized Into Gains for Shanghai MicroPort Endovascular MedTech (SHSE:688016) Shareholders Over That Period

7.2% Earnings Growth Over 3 Years Has Not Materialized Into Gains for Shanghai MicroPort Endovascular MedTech (SHSE:688016) Shareholders Over That Period

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. But long term Shanghai MicroPort Endovascular MedTech Co., Ltd. (SHSE:688016) shareholders have had a particularly rough ride in the last three year. Regrettably, they have had to cope with a 55% drop in the share price over that period. Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days. But this could be related to the weak market, which is down 11% in the same period.

如果您正在建立一個分散化的股票投資組合,那麼某些股票可能表現不佳。 但是長揸上海微創內窺鏡醫療科技股份有限公司(SHSE: 688016)的股票的股東在過去的三年中經歷了一次特別艱難的行程。不幸的是,他們在那段時期裏的股價下跌了55%。 最近,股東的經營狀況更加嚴峻,股價在過去90天下跌了25%。但這可能與市場疲軟有關,該市場在同一時期下跌了11%。

Since Shanghai MicroPort Endovascular MedTech has shed CN¥589m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

既然上海微創內窺鏡醫療科技在過去7天內已經損失了5,8900萬元的價值,那麼讓我們看看更長期的下降是否受到了公司經濟的推動。

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

引用巴菲特的話:“船隻將周遊世界,而‘地平派’仍會興旺。市場上的價格和價值仍會存在廣泛的差距……”考慮一家公司在市場上的認知如何變化的一個不完美但簡單的方法是比較每股收益(EPS)的變化和股價的波動。

During the unfortunate three years of share price decline, Shanghai MicroPort Endovascular MedTech actually saw its earnings per share (EPS) improve by 23% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past.

在不幸的三年股價下跌期間,上海微創醫療內血管醫療器械的每股收益實際上每年提高了23%。這是一個相當棘手的問題,這表明股價可能存在一些暫時的支撐力量。或者說,以前的增長預期可能是不合理的。

It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

值得關注其他指標,因爲EPS增長似乎與股價下跌不符。

Revenue is actually up 26% over the three years, so the share price drop doesn't seem to hinge on revenue, either. This analysis is just perfunctory, but it might be worth researching Shanghai MicroPort Endovascular MedTech more closely, as sometimes stocks fall unfairly. This could present an opportunity.

營業收入實際上在過去三年中增長了26%,因此股價下跌似乎與營業收入無關。 這只是一項例行公事的分析,但是可能值得更仔細地研究上海微創內窺鏡醫療科技的情況,因爲有時股票會不公平地下跌。 這可能會帶來機會。

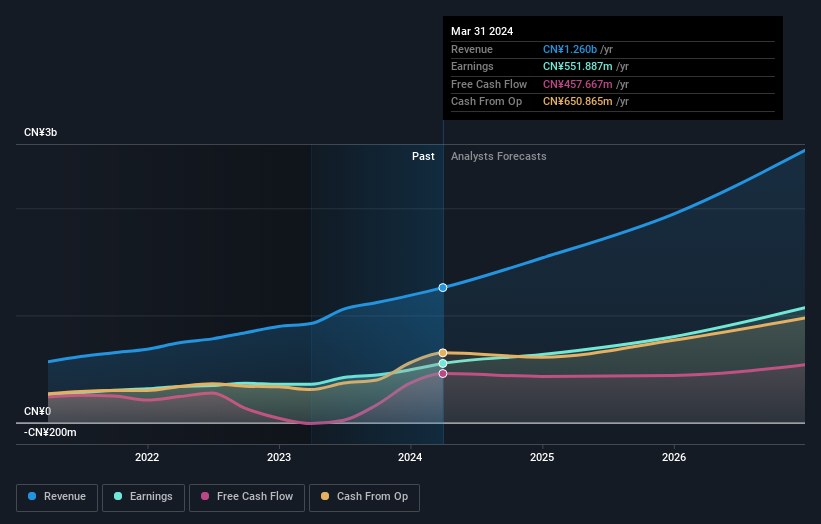

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

下面的圖表顯示了收益和營收隨時間的變化情況(通過單擊圖像揭示確切的值)。

Shanghai MicroPort Endovascular MedTech is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling Shanghai MicroPort Endovascular MedTech stock, you should check out this free report showing analyst consensus estimates for future profits.

上海微創內窺鏡醫療科技爲投資者所熟知,並且有許多聰明的分析師試圖預測未來的利潤水平。 如果您考慮買入或賣出上海微創內窺鏡醫療科技的股票,您應該查看這份免費報告,其中顯示了未來利潤的分析師共識估計。

A Different Perspective

不同的觀點

Shanghai MicroPort Endovascular MedTech shareholders are down 19% over twelve months (even including dividends), which isn't far from the market return of -20%. So last year was actually even worse than the last five years, which cost shareholders 4% per year. It will probably take a substantial improvement in the fundamental performance for the company to reverse this trend. It's always interesting to track share price performance over the longer term. But to understand Shanghai MicroPort Endovascular MedTech better, we need to consider many other factors. For example, we've discovered 2 warning signs for Shanghai MicroPort Endovascular MedTech that you should be aware of before investing here.

上海微創內窺鏡醫療科技的股東在過去十二個月中下跌了19%(包括股息),而這與市場回報相差無幾,後者爲-20%。 因此,去年實際上比過去五年更糟,導致股東每年損失4%。 對於公司扭轉這種趨勢,可能需要實質性的經營表現改善。 跟蹤股票長期表現總是很有趣的。 但是,要更好地了解上海微創內窺鏡醫療科技,我們需要考慮許多其他因素。 例如,我們已經發現了2個上海微創內窺鏡醫療科技的預警信號,您在投資之前應該注意。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果您願意查看另一家公司(具有潛在的更好財務狀況),請不要錯過這個免費的公司列表,證明它們可以增長收益。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

請注意,本文引用的市場回報反映了目前在中國交易所上市的股票的市場加權平均回報。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。