MicroStrategy Unusual Options Activity For July 30

MicroStrategy Unusual Options Activity For July 30

Whales with a lot of money to spend have taken a noticeably bullish stance on MicroStrategy.

擁有大量資金的鯨魚對MicroStrategy持有顯著的看好態度。

Looking at options history for MicroStrategy (NASDAQ:MSTR) we detected 88 trades.

查看Microstrategy (納斯達克:MSTR) 期權歷史,我們發現了88個交易。

If we consider the specifics of each trade, it is accurate to state that 48% of the investors opened trades with bullish expectations and 36% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,48%的投資者對市場看好,而36%的投資者則看淡。

From the overall spotted trades, 26 are puts, for a total amount of $1,841,443 and 62, calls, for a total amount of $6,438,966.

從所有披露的交易中,看跌期權有26個,總金額爲$1,841,443,看漲期權有62個,總金額爲$6,438,966。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $750.0 to $3800.0 for MicroStrategy over the recent three months.

根據交易活動,看起來重要的投資者正瞄準Microstrategy在最近三個月內的價格區間從$750.0到$3,800.0。

Volume & Open Interest Trends

成交量和未平倉量趨勢

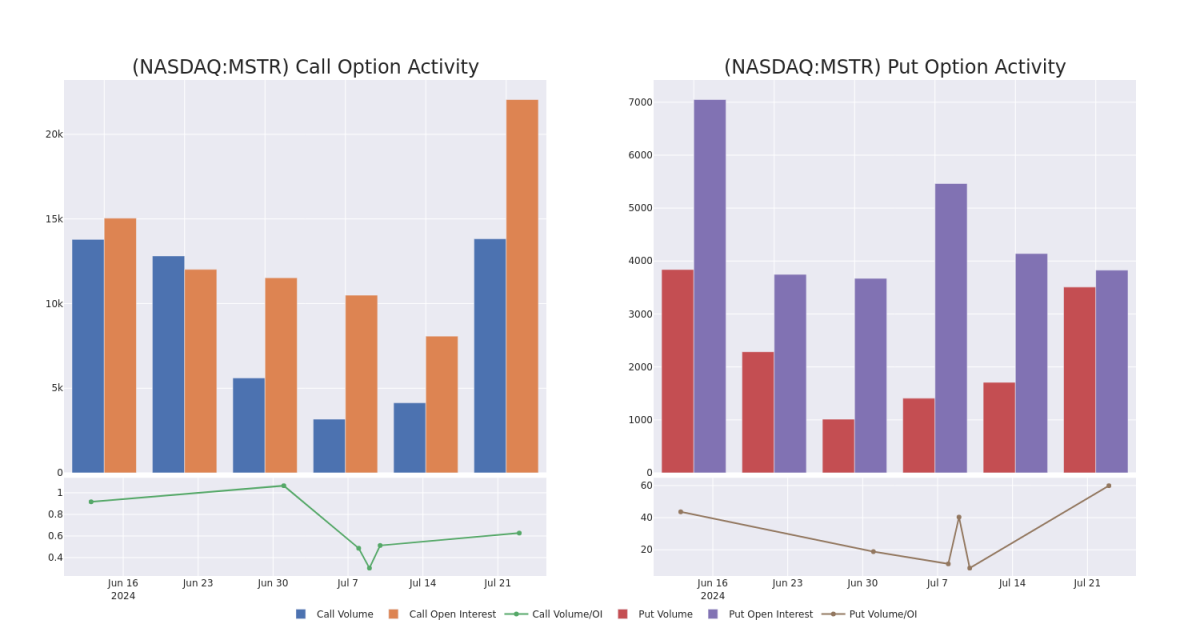

In today's trading context, the average open interest for options of MicroStrategy stands at 161.82, with a total volume reaching 3,242.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in MicroStrategy, situated within the strike price corridor from $750.0 to $3800.0, throughout the last 30 days.

在今天的交易情況中,Microstrategy 期權的平均未平倉量爲161.82,總成交量達到3,242.00。下面的圖表描述了在最後30天內,Microstrategy高價值交易的看跌和看漲期權成交量和未平倉量的變化,這些交易均位於罷工價區間從$750.0到$3,800.0。

MicroStrategy 30-Day Option Volume & Interest Snapshot

MicroStrategy 30日期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MSTR | PUT | TRADE | BULLISH | 01/17/25 | $657.1 | $650.0 | $650.0 | $2000.00 | $325.0K | 99 | 5 |

| MSTR | CALL | TRADE | BEARISH | 10/18/24 | $272.3 | $256.45 | $262.0 | $1700.00 | $262.0K | 140 | 10 |

| MSTR | CALL | SWEEP | BULLISH | 08/02/24 | $42.5 | $42.5 | $42.5 | $1700.00 | $187.0K | 803 | 465 |

| MSTR | PUT | TRADE | NEUTRAL | 08/23/24 | $140.4 | $130.75 | $135.1 | $1620.00 | $148.6K | 10 | 11 |

| MSTR | CALL | TRADE | BULLISH | 01/17/25 | $329.4 | $316.5 | $327.0 | $2000.00 | $98.1K | 1.1K | 10 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MicroStrategy | 看跌 | 交易 | 看好 | 01/17/25 | $657.1 | $650.0 | $650.0 | $2000.00 | $325.0K | 99 | 5 |

| MicroStrategy | 看漲 | 交易 | 看淡 | 10/18/24 | $272.3 | $256.45 | $262.0 | $1700.00 | $262.0K | 140 | 10 |

| MicroStrategy | 看漲 | SWEEP | 看好 | 08/02/24 | $42.5 | $42.5 | $42.5 | $1700.00 | $187.0K | 803 | 465 |

| MicroStrategy | 看跌 | 交易 | 中立 | 08/23/24 | $140.4 | $130.75 | $135.1 | $1620.00 | $148.6K | 10 | 11 |

| MicroStrategy | 看漲 | 交易 | 看好 | 01/17/25 | $329.4 | $316.5 | $327.0 | $2000.00 | $98.1K | 1.1千 | 10 |

About MicroStrategy

關於MicroStrategy

MicroStrategy Inc is a provider of enterprise analytics and mobility software. It offers MicroStrategy Analytics platform that delivers reports and dashboards and enables users to conduct ad hoc analysis and share insights through mobile devices or the Web; MicroStrategy Server, which provides analytical processing and job management. The company's reportable operating segment is engaged in the design, development, marketing, and sales of its software platform through licensing arrangements and cloud-based subscriptions and related services.

MicroStrategy是一家企業分析和移動軟件的供應商。該公司提供MicroStrategy Analytics平台,通過移動設備或Web提供報告和儀表板,並使用戶能夠進行自發分析和分享見解;MicroStrategy Server提供分析處理和作業管理。該公司報告的運營部門通過許可條款和基於雲的訂閱和相關服務從事軟件平台的設計、開發、營銷和銷售。

Following our analysis of the options activities associated with MicroStrategy, we pivot to a closer look at the company's own performance.

在我們分析完MicroStrategy期權活動後,我們再仔細觀察該公司的績效表現。

Present Market Standing of MicroStrategy

MicroStrategy的現在市場地位

- Currently trading with a volume of 212,246, the MSTR's price is down by -3.05%, now at $1633.41.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 2 days.

- 目前成交量爲212,246,MSTR的價格下跌了-3.05%,現在爲$1,633.41。

- RSI讀數表明該股目前可能接近超買水平。

- 預期業績發佈還有2天。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for MicroStrategy with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的潛在利潤。精明的交易者通過持續學習、策略性的交易調整、利用各種因子以及關注市場動態來減輕這些風險。通過Benzinga Pro,及時了解MicroStrategy的最新期權交易情況。