Amazon Challenges Netflix With Cheaper Ad Slots, Boosts Prime Video Ads: Report

Amazon Challenges Netflix With Cheaper Ad Slots, Boosts Prime Video Ads: Report

Amazon.Com Inc's (NASDAQ:AMZN) Prime Video is undercutting rival Netflix Inc (NASDAQ:NFLX) on advertising pricing as it battles for marketers' attention.

亞馬遜公司(NASDAQ:AMZN)的Prime Video正在以低廉的廣告價格與競爭對手奈飛(NASDAQ:NFLX)競爭營銷人員的關注。

Amazon introduced advertising to its Prime Video platform five months ago and is going through its first "up front," when television companies present their plans to advertisers to attract money for the next year, the Financial Times reports.

根據英國《金融時報》的報道,亞馬遜在五個月前將廣告引入了Prime Video平台,並正在進行首次“up front”,即電視公司向廣告商介紹他們的計劃,以吸引來年的資金。

Many rival platforms, including Netflix, Max, Paramount+, and Walt Disney Co (NYSE:DIS) Disney+, have introduced ad-supported tiers at lower prices than their ad-free subscriptions.

包括奈飛、Max、Paramount+和迪士尼公司(NYSE:DIS)Disney+在內的許多競爭對手平台已推出低於無廣告訂閱價格的支持廣告的層級。

Also Read: Disney Develops Tech to Rival Netflix and Boost Streaming Profits: Report

還閱讀:迪士尼開發技術以與Netflix競爭並提高流媒體利潤。

Analysts expect Apple Inc (NASDAQ:AAPL) to bring ads to its TV+ service soon.

分析師預計,蘋果公司(NASDAQ:AAPL)很快將在其TV+服務上投放廣告。

Advertisers purchase "bundles" in various formats, making direct comparisons difficult. However, multiple executives and advertising leaders told the FT that Amazon is pricing its ad slots more cheaply than Netflix but higher than others like Disney.

廣告商以各種格式購買“套餐”,使直接比較變得困難。但是,《金融時報》援引多位高管和廣告領袖的話稱,亞馬遜定價其廣告時比奈飛更加便宜,但比迪士尼等其他公司更貴。

The entry of Amazon has forced competitors to lower their prices, the FT cited advertising sources.

亞馬遜的進入迫使競爭對手降低價格,據《金融時報》引述廣告人士稱。

The e-commerce giant automatically converted over 200 million global subscribers to the ad tier unless they opted to pay more for the premium ad-free service.

除非他們選擇爲高端的無廣告服務付費,否則這家電商巨頭會自動將超過2千萬個全球訂閱用戶轉換爲廣告層級。

Citi estimated in January that Prime Video adverts could generate over $5 billion in "high-margin advertising revenue" as it expands.

花旗在1月份估計,Prime Video廣告可能會產生超過50億美元的“高毛利廣告收入”,因爲它正在擴大規模。

In the second quarter of 2024, Amazon Prime Video and Netflix led the U.S. subscription video-on-demand (SVOD) market, each holding a 22% share, as per Statista.

根據Statista的數據,在2024年第二季度,亞馬遜Prime Video和奈飛在美國訂閱視頻點播(SVOD)市場中佔有22%的份額。

A recent report indicated that Apple is refining its strategy in Hollywood after spending over $20 billion on original TV shows and movies that have yet to attract large audiences.

最近的一份報告表明,蘋果在花費超過200億美元購買尚未吸引到大量觀衆的原創電視節目和電影之後,正在完善其好萊塢策略。

Apple's streaming service captures only 0.2% of TV viewing in the U.S. This is significantly lower than competitors like Netflix, which sees more monthly views than Apple does in a day.

在美國,蘋果的流媒體服務僅佔電視收視量的0.2%,明顯低於Netflix的競爭對手,後者的月平均觀看量比蘋果在一天內多。

Apple plans to make its streaming business more sustainable by paying less upfront for shows and canceling underperforming series faster.

蘋果計劃通過減少節目的前期成本並更快地取消表現低下的系列節目來使其流媒體業務更具可持續性。

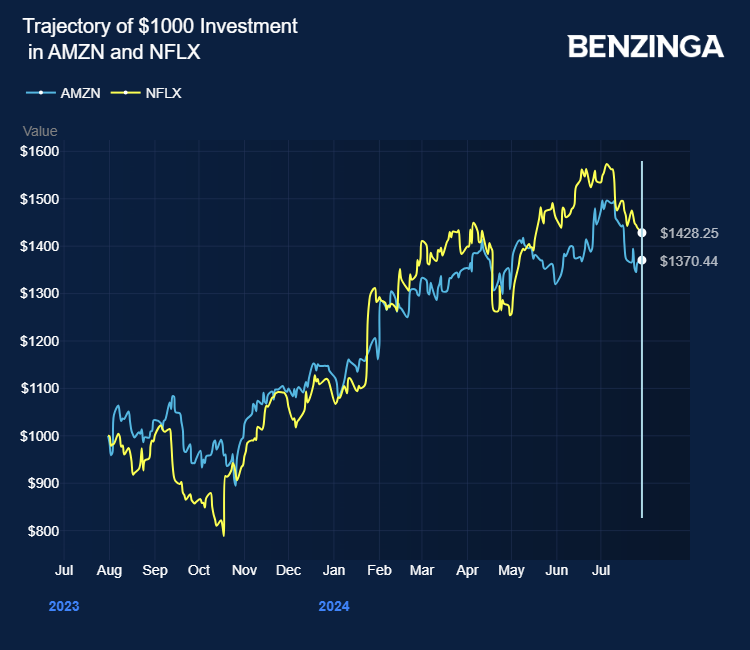

Price Action: AMZN shares are trading higher by 0.45% at $184.03 at the last check on Tuesday.

價格行動:週二最後一次覈查時,AMZN股價上漲0.45%,至184.03美元。

Also Read:

還閱讀:

- Amazon's Twitch Sees Growth Slowdown, Profitability Issues

- 亞馬遜的Twitch增長放緩,盈利問題

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。

Photo via Shutterstock

圖片來自shutterstock。