Alibaba Rival Temu's Aggressive Model Shift Sparks Supplier Protests: Report

Alibaba Rival Temu's Aggressive Model Shift Sparks Supplier Protests: Report

Alibaba Group Holding (NYSE:BABA) and Amazon.Com Inc (NASDAQ:AMZN) rival online marketplace Temu faces backlash from suppliers in China over its aggressive effort to reshape its business model radically.

阿里巴巴集團控股(NYSE:baba n3411)和亞馬遜公司(NASDAQ:AMZN)的競爭對手在線市場平台特木面臨來自中國供應商的反感,這是因爲它極力改變其商業模式。

The Chinese group, owned by the $177 billion e-commerce giant PDD Holdings Inc (NASDAQ:PDD), recently sought to recruit Amazon merchants with goods in warehouses in the U.S. and EU, the Financial Times reports.

這個中國集團,由1770億美元的電子商務巨頭PDD Holdings Inc(NASDAQ:PDD)擁有,最近試圖招募在美國和歐盟倉庫內有貨物的亞馬遜商家,據《金融時報》報道。

This move aims to protect Temu's business if governments close a tax loophole that has fueled its growth.

此舉旨在保護特木的業務,以防政府關閉支撐其增長的稅收漏洞。

Also Read: Alibaba Stock Soars As New Service Fees Boost Revenue

閱讀更多:隨着新的服務費推高營收,阿里巴巴股票飆升

It would also reduce delivery times by storing goods closer to shoppers, enabling Temu to sell bulkier and higher-margin products such as furniture and home appliances.

這也將通過將商品儲存在離購物者更近的地方來縮短交貨時間,使特木能夠銷售較龐大和利潤較高的產品,如傢俱和家電股。

The pivot to suppliers with overseas warehouses marks a transition from a "fully managed" to a "semi-managed" model, where merchants take on shipping, warehousing, and last-mile delivery costs previously handled by Temu.

轉向在海外擁有倉庫的供應商,標誌着從“完全管理”模式到“半管理”模式的轉變,商家需要承擔運費、倉儲和末端交付成本,這些成本之前由特木承擔。

Several Chinese suppliers in Guangzhou have expressed doubts about this change, citing increased risks.

廣州的幾家中國供應商對這種變化表示懷疑,稱風險增加。

Dozens of suppliers have protested at Temu's offices in Guangzhou over the fines, with one showing evidence of 279 fines totaling 114 million Chinese yuan ($16 million).

數十家供應商在廣州的特木辦公室抗議罰款,其中一家公司出示了279個罰款證據,總計1.14億人民幣(1600萬美元)。

To overcome this resistance, Temu promises to promote sellers by giving their products top slots on its platform if they sign up for the new model and offers a $3 subsidy per order for specific clothing items.

爲了克服這種阻力,特木承諾通過在其平台上給予產品最高槽位來促進賣家達成訂購新模式,併爲特定服裝產品每個訂單提供3美元的補貼。

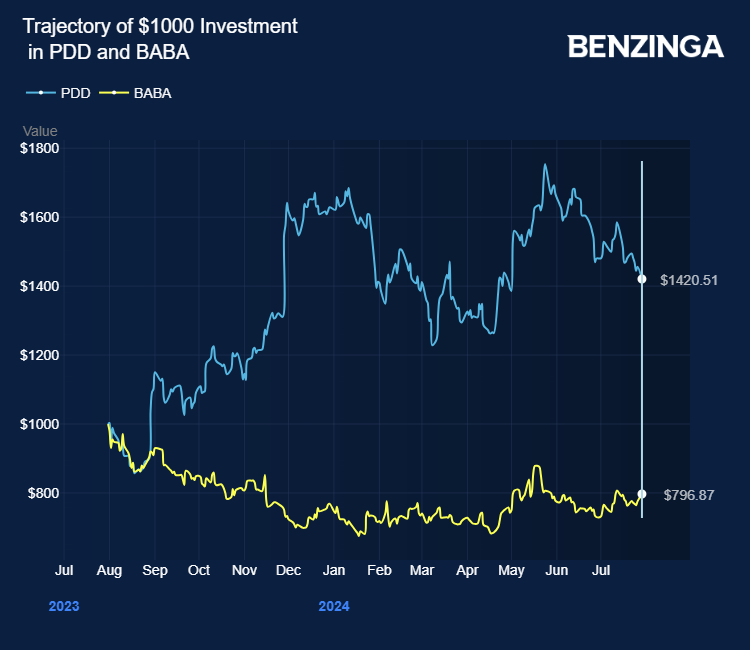

PDD Holdings stock gained over 42% in the last 12 months. Alibaba stock lost over 23%.

過去的12個月裏,PDD Holdings股票上漲了逾42%,阿里巴巴股票下跌了逾23%。

Price Action: PDD shares traded lower by 1.68% at $125.45 at the last check on Tuesday.

價格行動:根據週二的最新數據,PDD股票以125.45美元的價格下跌了1.68%。

Also Read:

還閱讀:

- Alibaba's Taobao Introduces Free Overseas Shipping to Compete with Rivals

- 阿里巴巴的淘寶推出免費海外運輸以競爭對手

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

免責聲明:本內容部分使用人工智能工具生成,並經Benzinga編輯審核發佈。

Photo via Shutterstock

圖片來自shutterstock。