Block Unusual Options Activity For July 30

Block Unusual Options Activity For July 30

Financial giants have made a conspicuous bullish move on Block. Our analysis of options history for Block (NYSE:SQ) revealed 20 unusual trades.

金融巨頭在Block上採取了明顯的看好策略。我們分析了Block(紐交所:SQ)期權歷史,發現有20次不尋常的交易。

Delving into the details, we found 65% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $569,392, and 13 were calls, valued at $1,196,167.

深入研究後,我們發現65%的交易者持看漲態度,30%的交易者持看跌態度。在我們發現的所有交易中,有7個看跌,價值569,392美元,有13個看漲,價值1,196,167美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $40.0 to $77.5 for Block over the last 3 months.

考慮到這些合約的成交量和持倉量,過去3個月,鯨魚一直在瞄準Block的價格區間從40.0美元到77.5美元。

Insights into Volume & Open Interest

成交量和持倉量分析

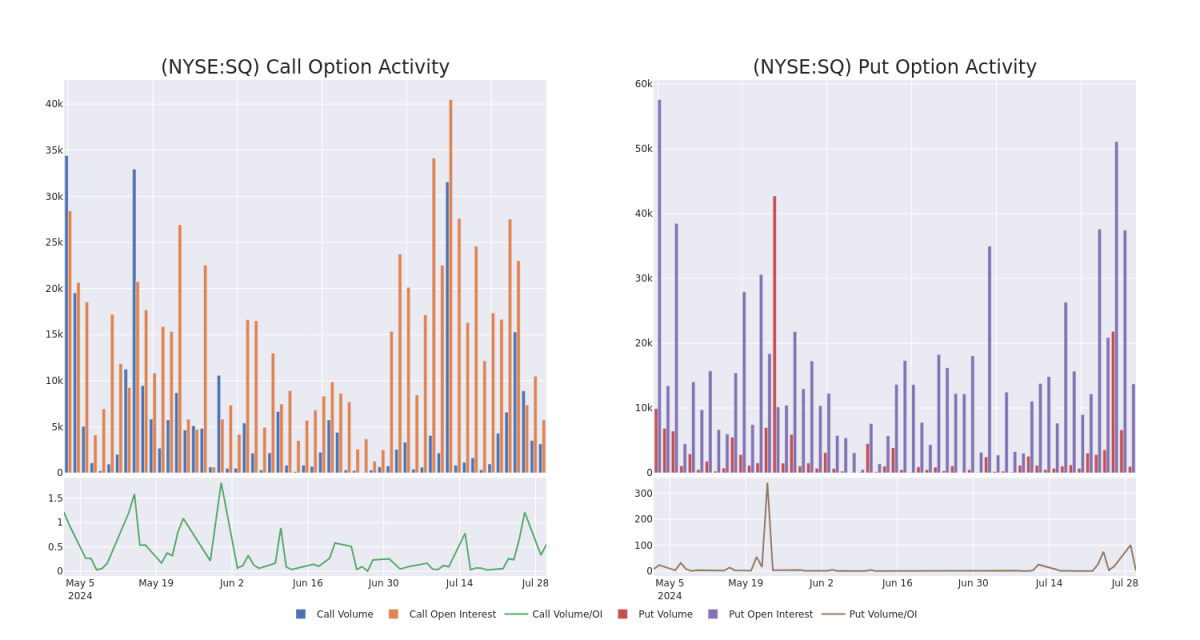

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Block's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Block's substantial trades, within a strike price spectrum from $40.0 to $77.5 over the preceding 30 days.

評估成交量和持倉量是期權交易的一個戰略步驟。這些指標揭示了在指定行權價格上Block期權的流動性和投資者興趣。即將到來的數據可視化了在$40.0到$77.5的行權價區間內,連同Block的大手交易,看漲和看跌期權的成交量和持倉量的波動情況,在過去的30天內。

Block Call and Put Volume: 30-Day Overview

Block看漲和看跌期權成交量: 30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | PUT | SWEEP | BULLISH | 03/21/25 | $10.0 | $9.9 | $9.9 | $62.50 | $247.5K | 585 | 250 |

| SQ | CALL | SWEEP | BULLISH | 08/16/24 | $3.1 | $3.05 | $3.05 | $65.00 | $201.2K | 3.2K | 815 |

| SQ | CALL | SWEEP | BULLISH | 12/18/26 | $21.5 | $20.95 | $21.34 | $62.50 | $197.5K | 31 | 92 |

| SQ | CALL | SWEEP | BULLISH | 12/18/26 | $21.75 | $20.85 | $21.85 | $62.50 | $172.5K | 31 | 196 |

| SQ | CALL | TRADE | BEARISH | 12/20/24 | $23.25 | $22.55 | $22.82 | $40.00 | $171.1K | 70 | 75 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SQ | 看跌 | SWEEP | 看好 | 03/21/25 | $10.0 | $9.9 | $9.9 | $62.50 | $247.5K | 585 | 250 |

| SQ | 看漲 | SWEEP | 看好 | 08/16/24 | $3.1 | $3.05 | $3.05 | $65.00 | $201.2K | 3.2K | 815 |

| SQ | 看漲 | SWEEP | 看好 | 12/18/26 | 21.5美元 | $20.95 | $21.34 | $62.50 | $197.5K | 31 | 92 |

| SQ | 看漲 | SWEEP | 看好 | 12/18/26 | $21.75 | $20.85 | $21.85 | $62.50 | $172.5K | 31 | 196 |

| SQ | 看漲 | 交易 | 看淡 | 12/20/24 | 23.25美元 | $22.55 | $22.82 | $40.00 | $171.1K | 70 | 75 |

About Block

關於Block

Founded in 2009, Block provides payment services to merchants, along with related services. The company also launched Cash App, a person-to-person payment network. In 2023, Square's payment volume was a little over $200 million.

成立於2009年的Block爲商家提供支付服務,以及相關服務。該公司還推出了Cash App,一個人對人的支付網絡。2023年,Square的支付金額略高於20000萬美元。

In light of the recent options history for Block, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Block的最新期權歷史,現在應將焦點集中在公司本身。我們的目標是探索其當前表現。

Present Market Standing of Block

Block現有市場地位

- Trading volume stands at 2,753,515, with SQ's price up by 0.08%, positioned at $60.79.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 2 days.

- 交易量爲2,753,515股,SQ的價格上漲0.08%,位於60.79美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計在2天內公佈收益報告。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。