Broadcom Unusual Options Activity For July 30

Broadcom Unusual Options Activity For July 30

Whales with a lot of money to spend have taken a noticeably bullish stance on Broadcom.

富裕的鯨魚們已經明顯看好博通。

Looking at options history for Broadcom (NASDAQ:AVGO) we detected 89 trades.

通過博通 (納斯達克: AVGO) 期權歷史記錄,我們發現了89次交易。

If we consider the specifics of each trade, it is accurate to state that 39% of the investors opened trades with bullish expectations and 34% with bearish.

如果我們考慮每次交易的具體情況,那麼可以準確地說有39%的投資者持看漲預期,34%持看淡預期。

From the overall spotted trades, 37 are puts, for a total amount of $3,398,909 and 52, calls, for a total amount of $6,311,122.

從總體上看,37次交易是看跌的,共計$3,398,909,而52次交易是看漲的,共計$6,311,122。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $23.0 to $220.0 for Broadcom over the recent three months.

基於交易活動,看起來重要的投資者在最近三個月內針對博通瞄準的價格區間爲$23.0到$220.0。

Volume & Open Interest Trends

成交量和未平倉量趨勢

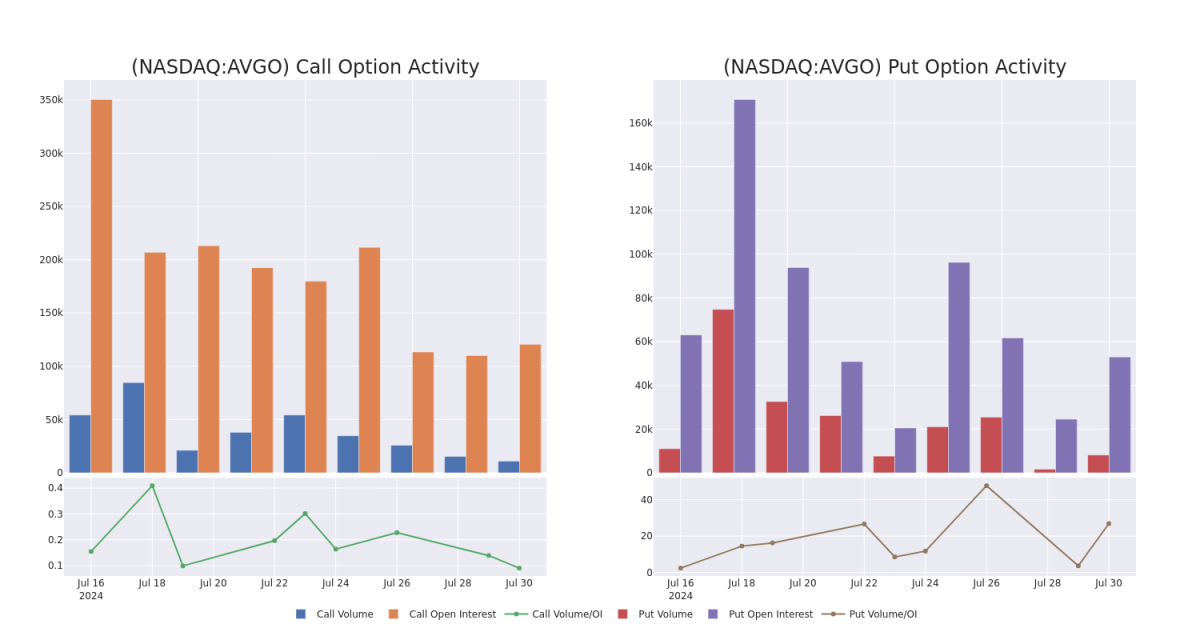

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Broadcom's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Broadcom's significant trades, within a strike price range of $23.0 to $220.0, over the past month.

研究股票時,檢查成交量和未平倉合約非常重要。這一信息在衡量博通在某些執行價格的期權的流動性和利益水平方面起着關鍵作用。以下是過去一個月裏某些執行價格範圍內的看漲和看跌期權的成交量和未平倉合約的趨勢摘要,關於博通重要的交易。

Broadcom Call and Put Volume: 30-Day Overview

博通看漲和看跌成交量:30天概覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AVGO | PUT | TRADE | BULLISH | 12/19/25 | $14.3 | $11.1 | $11.7 | $122.00 | $468.0K | 40 | 400 |

| AVGO | PUT | SWEEP | BULLISH | 09/20/24 | $4.1 | $4.0 | $4.0 | $133.00 | $358.0K | 9.2K | 855 |

| AVGO | PUT | SWEEP | BEARISH | 11/15/24 | $4.3 | $4.1 | $4.3 | $124.00 | $215.0K | 64 | 500 |

| AVGO | CALL | TRADE | NEUTRAL | 12/19/25 | $19.5 | $17.2 | $18.5 | $175.00 | $185.0K | 0 | 100 |

| AVGO | CALL | TRADE | NEUTRAL | 06/20/25 | $70.7 | $69.3 | $70.0 | $80.00 | $140.0K | 1.6K | 32 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 博通 | 看跌 | 交易 | 看好 | 2025年12月19日 | $14.3 | 11.1美元 | $11.7 | 目前,關於Boot Barn的分析師共識爲“強烈買入”,平均目標價爲$ 119.08,代表4.6%的上漲空間。摩根大通(J.P. Morgan)在5月21日發佈的一份報告中,也保持了買入評級,並給出了$ 125.00的價格目標。 | $468.0K | 40 | 400 |

| 博通 | 看跌 | SWEEP | 看好 | 09/20/24 | $4.1 | $4.0 | $4.0 | $133.00 | $358.0K | 9.2千 | 855 |

| 博通 | 看跌 | SWEEP | 看淡 | 11/15/24 | $4.3 | $4.1 | $4.3 | $124.00 | $215.0K | 64 | 500 |

| 博通 | 看漲 | 交易 | 中立 | 2025年12月19日 | $19.5。 | $17.2 | $18.5 | $175.00 | $185.0K | 0 | 100 |

| 博通 | 看漲 | 交易 | 中立 | 06/20/25 | 70.7美元 | $69.3 | $70.0 | $80.00 | 140,000美元 | 1.6K | 32 |

About Broadcom

關於博通

Broadcom is the sixth-largest semiconductor company globally and has expanded into various software businesses, with over $30 billion in annual revenue. It sells 17 core semiconductor product lines across wireless, networking, broadband, storage, and industrial markets. It is primarily a fabless designer but holds some manufacturing in-house, like for its best-of-breed FBAR filters that sell into the Apple iPhone. In software, it sells virtualization, infrastructure, and security software to large enterprises, financial institutions, and governments.Broadcom is the product of consolidation. Its businesses are an amalgamation of former companies like legacy Broadcom and Avago Technologies in chips, as well as Brocade, CA Technologies, and Symantec in software.

博通是全球第六大半導體公司,已擴展到各種軟件業務,年收入超過300億美元。它在無線、網絡、寬帶、存儲和工業市場銷售17個核心半導體產品系列。它主要是一家半導體設計公司,但擁有一些內部製造能力,例如爲蘋果iPhone銷售的最佳FBAR濾波器。在軟件方面,它向大型企業、金融機構和政府銷售虛擬化、基礎設施和安全軟件。博通是合併的產物。其業務是由之前的公司如傳統的博通和芯訊科技以及Brocade、CA技術和賽門鐵克在軟件方面的業務組成的。

Where Is Broadcom Standing Right Now?

博通現在處於什麼位置?

- Currently trading with a volume of 11,126,841, the AVGO's price is down by -3.08%, now at $145.6.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 30 days.

- 目前交易量爲11,126,841,AVGO的價格下跌了-3.08%,現在是$145.6。

- RSI讀數表明該股票目前可能接近超賣狀態。

- 預計收益發布還需30天。

What Analysts Are Saying About Broadcom

關於博通,分析師有何看法

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $1002.0.

過去一個月裏,有5位行業分析師分享了他們對這隻股票的看法,提出了一個平均目標價格爲$1002.0。

- An analyst from TD Cowen persists with their Buy rating on Broadcom, maintaining a target price of $210.

- An analyst from Oppenheimer persists with their Outperform rating on Broadcom, maintaining a target price of $200.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Broadcom, targeting a price of $2400.

- Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Overweight rating on Broadcom with a target price of $2000.

- An analyst from Cantor Fitzgerald has decided to maintain their Overweight rating on Broadcom, which currently sits at a price target of $200.

- TD Cowen的分析師堅持買入博通,維持目標價格爲$210。

- Oppenheimer的分析師堅持對博通的Outperform評級,維持目標價格爲$200。

- Rosenblatt的分析師繼續維持對博通的買入評級,目標價爲$2400。

- 一位來自卡頓 · 費茨傑拉德的分析師持有看漲評級,對博通的目標價格爲2000美元。

- Cantor Fitzgerald的分析師決定維持對博通的超配評級,目前的目標價是$200。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。