Market Mover | AMD Shares Surge 8% as Earnings Beat Expectations

Market Mover | AMD Shares Surge 8% as Earnings Beat Expectations

July 31, 2024 - $Advanced Micro Devices (AMD.US)$shares surged 8.85% to $150.69 in pre-market trading on Wednesday. The company has reported second quarter 2024 financial results.

2024年7月31日 - $美國超微公司 (AMD.US)$週三美股盤前股價大漲8.85%至150.69美元。該公司發佈了2024年第二季度業績。

Financial Highlights

財務亮點

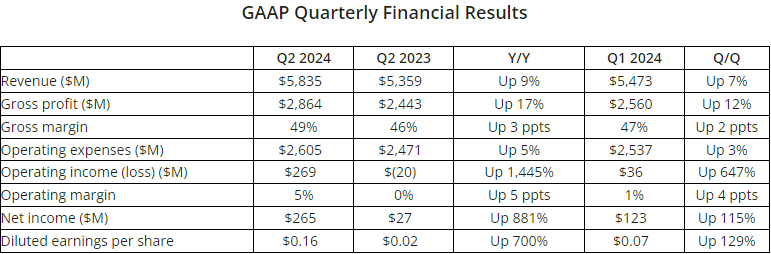

Q2 revenue of $5.8 billion, higher than Q1 outlook of $5.7 billion.

Q2 gross margin of 49%; Up 3 ppts YoY.

Operating income of $269 million, growth of 1,445% YoY.

Q2 net income of $265 million; diluted earnings per share of $0.16.

2024年Q2營業收入達到5800萬美元,高於2024年Q1的5700萬美元預期。

2024年Q2毛利率達到49%,環比增長3個百分點。

經營收入爲26900萬美元,同比增長1445%。

2024年Q2淨利潤2,6500萬美元;每股攤薄收益爲0.16美元。

Segment Summary

分部概況

Record Data Center segment revenue of $2.8 billion was up 115% year-over-year primarily driven by the steep ramp of AMD Instinct™️ GPU shipments, and strong growth in 4th Gen AMD EPYC™️ CPU sales. Revenue increased 21% sequentially primarily driven by the strong ramp of AMD Instinct GPU shipments.

Client segment revenue was $1.5 billion, up 49% year-over-year and 9% sequentially primarily driven by sales of AMD Ryzen™️ processors.

Gaming segment revenue was $648 million, down 59% year-over-year and 30% sequentially primarily due to a decrease in semi-custom revenue.

Embedded segment revenue was $861 million, down 41% year-over-year as customers continued to normalize their inventory levels. Revenue increased 2% sequentially.

創紀錄的idc概念營收爲28億美元,同比增長115%,主要由AMD Instinct GPU出貨的快速攀升和4th Gen AMD EPYC CPU銷量的強勁增長驅動。營業收入環比增長21%,主要由AMD Instinct GPU出貨的強勁攀升帶動。

客戶端營收爲15億美元,同比增長49%,環比增長9%,主要由AMD Ryzen處理器的銷售驅動。

遊戲業務營業收入爲64800萬美元,同比下降59%,環比下降30%,主要是由於半定製營收的下降。

嵌入式業務營業收入爲86100萬美元,同比下降41%,因客戶繼續歸正庫存水平而增長2%的環比。

Q3 Outlook

對於2024年財政年度的第三個財季(截至2024年6月),艾默生預計淨銷售額將增長11.0-12.5%,底層銷售增長3.0-4.5%。

For the third quarter of 2024, AMD expects revenue to be approximately $6.7 billion, plus or minus $300 million. At the mid-point of the revenue range, this represents year-over-year growth of approximately 16% and sequential growth of approximately 15%. Non-GAAP gross margin is expected to be approximately 53.5%.

AMD電話會議

Related Reading: Press Release

相關閱讀:新聞發佈