Why Investors Shouldn't Be Surprised By EQT Corporation's (NYSE:EQT) P/S

Why Investors Shouldn't Be Surprised By EQT Corporation's (NYSE:EQT) P/S

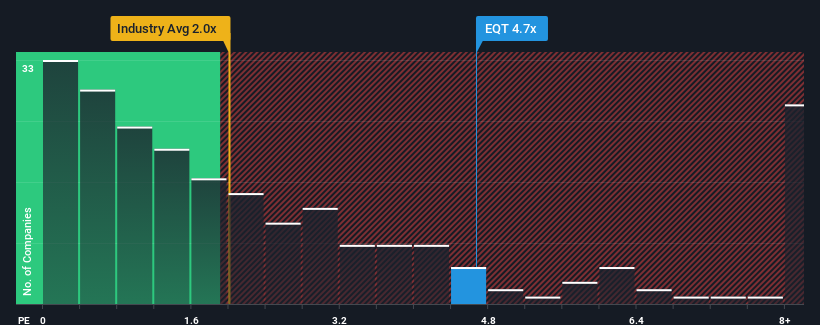

When close to half the companies in the Oil and Gas industry in the United States have price-to-sales ratios (or "P/S") below 2x, you may consider EQT Corporation (NYSE:EQT) as a stock to avoid entirely with its 4.7x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

How Has EQT Performed Recently?

Recent times haven't been great for EQT as its revenue has been falling quicker than most other companies. One possibility is that the P/S ratio is high because investors think the company will turn things around completely and accelerate past most others in the industry. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think EQT's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as EQT's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 50%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 23% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 23% each year as estimated by the analysts watching the company. That's shaping up to be materially higher than the 3.0% each year growth forecast for the broader industry.

With this information, we can see why EQT is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From EQT's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of EQT's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you settle on your opinion, we've discovered 4 warning signs for EQT (1 is a bit unpleasant!) that you should be aware of.

If you're unsure about the strength of EQT's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com