Here's Investment Guide in Anticipation of Rate Cuts

Here's Investment Guide in Anticipation of Rate Cuts

The Federal Reserve is expected to reveal its interest rate decision for July at 2:00 PM Eastern Time. Global markets are closely watching this announcement as it is anticipated that the Fed may signal the possibility of a rate cut. According to the CME FedWatch Tool, the market is predicting an 100% chance of a rate cut in September, with a total of three rate cuts expected for the year.

預計聯儲局將在美國東部時間下午2:00公佈7月的利率決定。全球市場正在密切關注這一公告,因爲預計聯儲局可能暗示減息的可能性。根據CME FedWatch工具,市場預測9月有100%的減息可能性,今年預計總共將有三次減息。

Kate Moore, head of thematic strategy at BlackRock, said on Monday that Fed officials are now facing difficult decisions and hope to remain cautious, especially before the US election. BlackRock expects the Fed to cut rates in September, possibly three times this year, and then once in the first half of next year, as the firm expects to face more downward pressure on inflation later on.

黑石集團主題策略負責人凱特·穆爾(Kate Moore)週一表示,聯儲局官員現在面臨困難的決策,並希望在美國選舉之前保持謹慎。 黑石集團預計聯儲局將在9月份減息,今年可能會減息三次,然後在明年上半年減息一次,因爲該公司預計以後將面臨更多的通貨膨脹下行壓力。

Assets to Watch

要關注的資產

As the Fed rate cut draws near, market trading themes have rotated. Generally speaking, small-cap stocks and biotech companies with high financing needs and sensitivity to interest rates are expected to benefit the most.

隨着聯儲局減息的臨近,市場交易主題已經發生了轉變。一般來說,小市值股票和需要高融資且對利率敏感的生物科技公司預計將獲得最多的受益。

Treasury Bond

國債

The continued rise in rate cut expectations has driven down overall US bond yields. According to Bloomberg data, US Treasuries have risen for three consecutive months, marking the longest rally in three years. The recent surge has pushed up a key indicator of US bonds, the Bloomberg US Treasury Bond Index, up 1.3% this month, and increased its return since the end of April to around 3.9%.

減息預期的持續上升已經將總體美國債券收益率推低。根據彭博數據,美國國債已經上漲了三個連續月,創下三年來最長的漲勢。最近的上漲推高了美國債券的一個關鍵指標,彭博美國國債指數本月上漲了1.3%,自四月底以來增長了約3.9%。

As of July 30th, $U.S. 2-Year Treasury Notes Yield (US2Y.BD)$, which is more sensitive to monetary policy changes, fell 39.7bps in July, while $U.S. 10-Year Treasury Notes Yield (US10Y.BD)$ declined 25.5 basis points.

截至7月30日, $美國2年期國債收益率 (US2Y.BD)$下行壓力更大的利率期貨下行了39.7個點子,而 $美國10年期國債收益率 (US10Y.BD)$ 下行了25.5個點子。

Short-term rates mainly reflect changes in rate cut expectations, while the 10-year US bond rate is also affected by Trump's policies. Trump's policies advocate for tax cuts, tariffs on imports, tightening of immigration policies, and boosting domestic manufacturing, which help stimulate domestic demand, increase long-term inflation expectations, and limit the decline in long-term bond yields.

短期利率主要反映了減息預期的變化,而十年期美國債券收益率也受到特朗普政策的影響。特朗普的政策主張減稅,對進口徵收關稅,收緊移民政策並推動國內製造業增長,這有助於刺激國內需求,提高長期通貨膨脹預期並限制長期債券收益率的下降。

The decline in long-term rates is not as significant as that of short-term rates, and the US bond yield curve is significantly steep. Last Wednesday, affected by safe-haven sentiment, the price of the 2-year US Treasury bond rose, and the yield fell to a more than five-month low. The yield spread between the 2-year and 10-year US Treasury bonds narrowed to 9 bps, the narrowest record since July 2022. The steepening of the US bond yield curve (buying short-term bonds, selling long-term bonds) has become a relatively certain direction for investors.

長期利率的下降不像短期利率的下降那麼顯著,美國國債收益率曲線相對陡峭。上週三,受避險情緒的影響,2年期美國國債價格上漲,收益率降至逾五個月低位。2年期和10年期美國國債之間的收益率差距收窄至9個點子,創下自2022年7月以來的最窄紀錄。美國國債收益率曲線較陡峭(買入短期債券,賣出長期債券)已成爲投資者相對確定的方向。

Considering that long-term treasury bonds have longer durations than short-term government bonds, buying long-term treasury bonds may bring more returns to investors.

考慮到長期國庫券的期限比短期政府債券長,購買長期國庫券可能會給投資者帶來更多回報。

UBS Wealth Management published a report that predicts that the 10-year US Treasury bond yield will fall to 3.5% by mid-2025. However, the bank also acknowledges that this view is risky, as the volatility of term premiums will increase due to uncertainty in US elections and the fragile fiscal situation of the US government.

瑞銀财富管理發佈的一份報告預測,在2025年年中,十年期美國國債收益率將降至3.5%。但該銀行還承認這個觀點是有風險的,因爲由於美國選舉的不確定性和美國政府脆弱的財政狀況,術語溢價的波動性將會增加。

Small-Cap and Biotech Stocks

小市值和生物科技股票

Small-cap companies generally have higher leverage and are more likely to finance through floating rate debt, making them more sensitive to interest rates compared to large-cap stocks.

小市值公司通常具有更高的槓桿比率,更有可能通過浮息債務融資,因此對於利率敏感性比大市值股票更高。

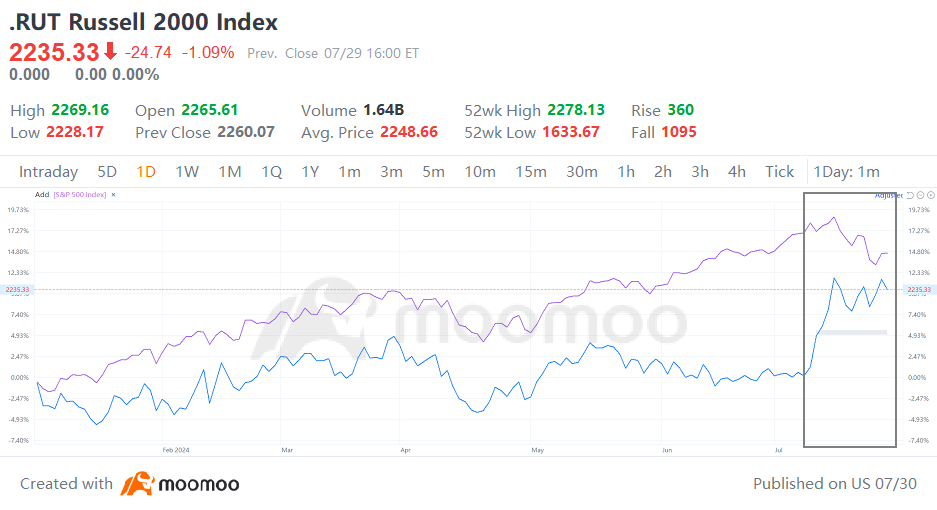

In recent weeks, the US stock market has witnessed the "great rotation" with tech stocks, led by the "Mag 7," underperforming while small-caps, led by $Russell 2000 Index (.RUT.US)$, experience a strong rebound. Since July, the Russell 2000, representing small-caps, has risen 9.54%, while $S&P 500 Index (.SPX.US)$ has fallen 0.44%.

近幾周,美國股市見證了“大輪換”,以“科技七巨頭”爲首的科技股表現疲軟,而以 $羅素2000指數 (.RUT.US)$爲首的小盤股則經歷了強勁的反彈。自7月以來,代表小盤股的Russell 2000指數上漲了9.54%,而代表大盤股的 $標普500指數 (.SPX.US)$ 下跌了0.44%。

Tom Lee, co-founder of Fundstrat and known as the 'Wall Street wizard', stated that if history is any indication, focusing on small-cap stocks may see a growth of 15% or more in August. Lee previously predicted that the rebound of the Russell 2000 index would last about 10 weeks and reach a final increase of 40% beginning in August.

Fundstrat聯合創始人、被譽爲“華爾街巫師”的湯姆·李(Tom Lee)表示,如果從歷史上來看,關注小盤股可能會在8月份增長15%或更多。李曾預測Russell 2000指數的反彈將持續約10周,並在8月份達到40%的最終漲幅。

However, some analysts are cautious about small-cap stocks.

然而,一些分析師對小盤股持謹慎態度。

Lisa Shalett, Chief Investment Officer at Morgan Stanley Wealth Management, warned against chasing small-cap stocks as their upward trend may not be sustainable. The lagging effects of rate cuts and the large number of unprofitable companies in small-cap stock indices make them lack favorable factors. The profitability issues of this group are unlikely to be resolved by a 75 basis point rate cut. The prospect of a Republican victory in the November election may boost small-cap stocks, but this trend is expected to be short-lived.

摩根士丹利财富管理首席投資官Lisa Shalett警告稱,追逐小市值股票可能不可持續。小市值股票指數中利率減息的滯後影響和衆多盈利不佳的公司使其缺乏有利因素。這一類企業的盈利問題不太可能被一次減息0.75%所解決。共和黨在11月的選舉中獲勝的前景可能會提振小市值股票,但這一趨勢預計只會是短暫的。

In addition, the lower financing costs brought by rate cuts are beneficial to biotech companies that require large R&D investments. The S&P Biotechnology Select Industry Index has risen 6.71% since July and 10.86% year-to-date.

此外,利率下調帶來的低融資成本對於需要大量研發投資的生物技術公司非常有利。標普生物技術選擇行業板塊指數自7月以來漲幅達6.71%,年初至今漲幅達10.86%。

Gold

黃金

Earlier this month, $Gold Futures(DEC4) (GCmain.US)$ climbed to a historic high of $2,488. Gold has risen more than 18% this year. The Fed's rate cuts, continued gold purchases by central banks around the world, ad heightened geopolitical tensions have boosted the appeal of gold as a safe-haven asset, pushing up global gold prices.

本月早些時候,有報道稱德雷克在拿下NBA冠軍的達拉斯小牛隊上輸掉了50萬美元的比特幣。最終小牛隊被波士頓凱爾特人隊在五局比賽後擊敗,這讓德雷克的數字錢包變得空蕩蕩的。$黃金主連(2412) (GCmain.US)$ 黃金價格攀升至歷史新高2488美元。今年以來,黃金價格上漲逾18%。聯儲局的減息、全球多國央行不斷購買黃金以及加劇的地緣政治緊張局勢都提升了黃金作爲避險資產的吸引力,推升全球黃金價格。

Analysts at Goldman Sachs released a report stating that China's gold demand is currently showing periodic weakness due to the high price sensitivity of Chinese consumers and recent price surges. However, structural changes have kept China's structural gold demand relatively stable. The report predicts that gold prices will reach $2,700 by 2025, about 11% higher than current gold prices.

高盛的分析師發佈了一份報告,稱中國黃金需求目前因中國消費者高價格敏感性和最近價格上漲而出現間歇性疲軟。然而,結構性變化使中國的結構性黃金需求相對穩定。報告預計到2025年黃金價格將達到2700美元,比當前黃金價格高約11%。

In a research report on July 18, Morgan Stanley stated that the support for gold prices in the financial markets is gradually emerging. Against the backdrop of rate cuts boosting gold prices, it is expected that gold prices will rise to $2,650/ounce in the fourth quarter of this year.

摩根士丹利在7月18日的一份研究報告中表示,金融市場對黃金價格的支持正在逐漸增強。在利率下調推高黃金價格的大背景下,預計黃金價格將在今年第四季度上漲至2650美元/盎司。

The continued rise in rate cut expectations has driven down overall US bond yields. According to Bloomberg data, US Treasuries have risen for three consecutive months, marking the longest rally in three years. The recent surge has pushed up a key indicator of US bonds, the Bloomberg US Treasury Bond Index, up 1.3% this month, and increased its return since the end of April to around 3.9%.

The continued rise in rate cut expectations has driven down overall US bond yields. According to Bloomberg data, US Treasuries have risen for three consecutive months, marking the longest rally in three years. The recent surge has pushed up a key indicator of US bonds, the Bloomberg US Treasury Bond Index, up 1.3% this month, and increased its return since the end of April to around 3.9%.