Check Out What Whales Are Doing With UNH

Check Out What Whales Are Doing With UNH

Financial giants have made a conspicuous bullish move on UnitedHealth Group. Our analysis of options history for UnitedHealth Group (NYSE:UNH) revealed 17 unusual trades.

金融巨頭在聯合健康集團上採取了顯着的看好行動。我們對聯合健康集團(紐交所:UNH)期權歷史的分析顯示出17筆不尋常的交易。

Delving into the details, we found 64% of traders were bullish, while 23% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $122,304, and 13 were calls, valued at $648,984.

深入研究細節後,我們發現64%的交易者看好,23%的交易者看淡。在我們發現的所有交易中,有4張看跌期權,價值122,304美元,和13張看漲期權,價值648,984美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $390.0 and $640.0 for UnitedHealth Group, spanning the last three months.

在評估成交量和持倉量後,很明顯主要的市場推手正在重點關注聯合健康集團的價格區間,該區間橫跨過去三個月的$390.0到$640.0。

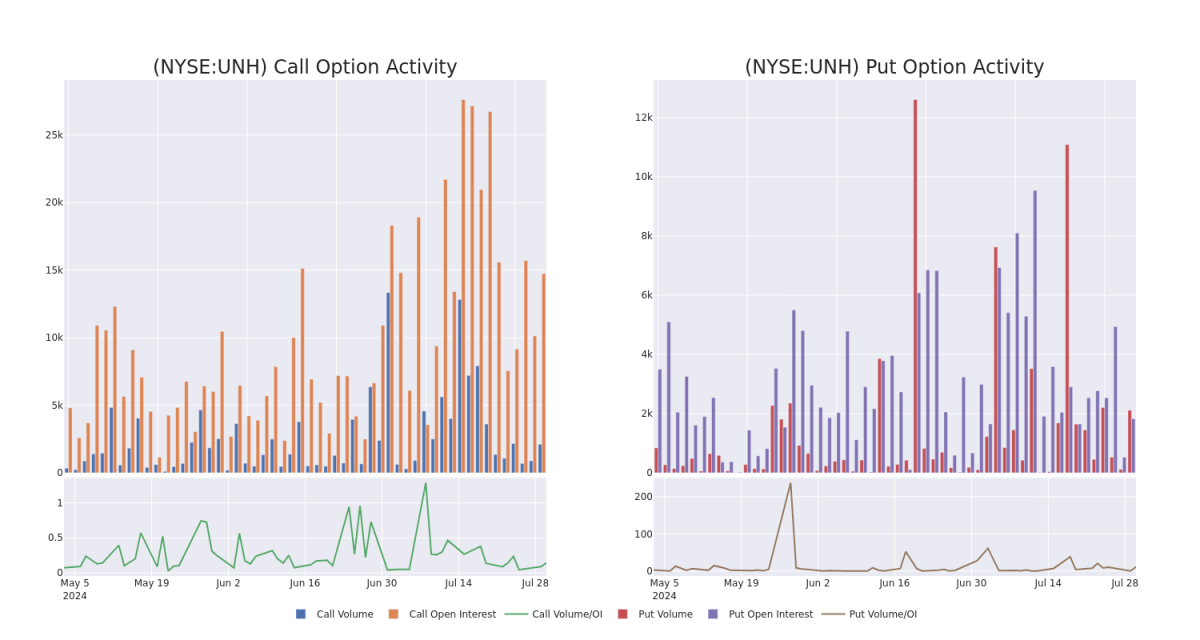

Volume & Open Interest Trends

成交量和未平倉量趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in UnitedHealth Group's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to UnitedHealth Group's substantial trades, within a strike price spectrum from $390.0 to $640.0 over the preceding 30 days.

評估成交量和持倉量是期權交易中的一項戰略性步驟。這些指標揭示了投資者在指定行權價的聯合健康集團期權的流動性和投資者興趣。即將發佈的數據將可視化展示在30天內聯合健康集團在$390.0到$640.0行權價範圍內的看漲期權和看跌期權的成交量和持倉量的波動,這與其龐大的交易量相關。

UnitedHealth Group Option Activity Analysis: Last 30 Days

聯合健康集團期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UNH | CALL | SWEEP | BULLISH | 01/17/25 | $74.0 | $70.6 | $72.5 | $520.00 | $145.0K | 1.1K | 35 |

| UNH | CALL | TRADE | BEARISH | 06/20/25 | $78.9 | $75.85 | $75.85 | $540.00 | $75.8K | 93 | 23 |

| UNH | CALL | SWEEP | BULLISH | 09/20/24 | $19.95 | $19.1 | $19.52 | $570.00 | $63.7K | 1.1K | 88 |

| UNH | CALL | TRADE | BULLISH | 01/16/26 | $124.1 | $120.55 | $124.1 | $490.00 | $62.0K | 94 | 10 |

| UNH | CALL | SWEEP | BULLISH | 09/20/24 | $21.6 | $20.75 | $21.34 | $570.00 | $53.2K | 1.1K | 143 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 聯合健康 | 看漲 | SWEEP | 看好 | 01/17/25 | $74.0 | $ 70.6 | $72.5 | $520.00 | $145.0K | 1.1千 | 35 |

| 聯合健康 | 看漲 | 交易 | 看淡 | 06/20/25 | $78.9 | $75.85 | $75.85 | $540.00 | $75.8K | 93 | 23 |

| 聯合健康 | 看漲 | SWEEP | 看好 | 09/20/24 | $19.95 | $19.1 | $19.52 | $570.00 | $63.7K | 1.1千 | 88 |

| 聯合健康 | 看漲 | 交易 | 看好 | 01/16/26 | $124.1 | $120.55 | $124.1 | $490.00 | $62.0K | 94 | 10 |

| 聯合健康 | 看漲 | SWEEP | 看好 | 09/20/24 | $21.6 | $20.75 | $21.34 | $570.00 | $53.2K | 1.1千 | 143 |

About UnitedHealth Group

關於聯合健康集團

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 50 million members globally, including 1 million outside the us as June 2024. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

聯合健康集團是全球最大的私人醫療保險提供商之一,爲包括2024年6月外美國的約5000萬會員提供醫療保障。作爲僱主贊助、自主選擇和政府支持的保險計劃的領導者,聯合健康在託管護理方面獲得了大規模的規模。除了其保險資產外,聯合健康繼續投資於其Optum公司,創造了一個醫療保健服務巨頭,涵蓋從醫療和藥品福利到爲關聯和第三方客戶提供門診護理和分析。

In light of the recent options history for UnitedHealth Group, it's now appropriate to focus on the company itself. We aim to explore its current performance.

根據聯合健康的最近期權歷史,現在適合關注公司本身。我們旨在探究它的當前表現。

Where Is UnitedHealth Group Standing Right Now?

聯合健康目前處於什麼位置?

- With a trading volume of 1,211,645, the price of UNH is down by -0.65%, reaching $572.58.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 72 days from now.

- UNH的交易量爲1,211,645,價格下跌了-0.65%,達到572.58美元。

- 當前RSI值表明股票可能已經超買。

- 下一份業績將在72天后發佈。

What Analysts Are Saying About UnitedHealth Group

關於聯合健康集團,分析師們都在說些什麼?

5 market experts have recently issued ratings for this stock, with a consensus target price of $621.6.

5名市場專家最近對該股票發表了評級意見,一致看好目標價爲621.6美元。

- An analyst from Jefferies has elevated its stance to Buy, setting a new price target at $647.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for UnitedHealth Group, targeting a price of $615.

- Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for UnitedHealth Group, targeting a price of $640.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $591.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on UnitedHealth Group with a target price of $615.

- 來自Jefferies的分析師已將其買入評級提升,設定新的目標價爲647美元。

- 摩根士丹利的一位分析師繼續維持對聯合健康集團的超配評級,目標價爲615美元。

- Truist Securities的分析師繼續持有買入評級,目標價爲640美元。

- 考慮到關切,Cantor Fitzgerald的一位分析師將其評級下調至超配,新的目標價爲591美元。

- RBC Capital的一位分析師持續保持對聯合健康集團的跑贏大盤評級,目標價爲615美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for UnitedHealth Group with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續教育、戰略性交易調整、利用各種因子並保持對市場動態的敏感來緩解這些風險。使用Benzinga Pro獲取聯合健康集團的最新期權交易實時提醒。