Newmont Unusual Options Activity For July 31

Newmont Unusual Options Activity For July 31

Whales with a lot of money to spend have taken a noticeably bearish stance on Newmont.

有很多錢可以花的鯨魚對紐蒙特採取了明顯的看跌立場。

Looking at options history for Newmont (NYSE:NEM) we detected 22 trades.

查看紐蒙特(紐約證券交易所代碼:NEM)的期權歷史記錄,我們發現了22筆交易。

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 63% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有31%的投資者以看漲的預期開盤,63%的投資者持看跌預期。

From the overall spotted trades, 7 are puts, for a total amount of $525,090 and 15, calls, for a total amount of $1,728,758.

在已發現的全部交易中,有7筆是看跌期權,總額爲525,090美元,15筆是看漲期權,總額爲1,728,758美元。

What's The Price Target?

目標價格是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $25.0 to $60.0 for Newmont over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將紐蒙特的價格定在25.0美元至60.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

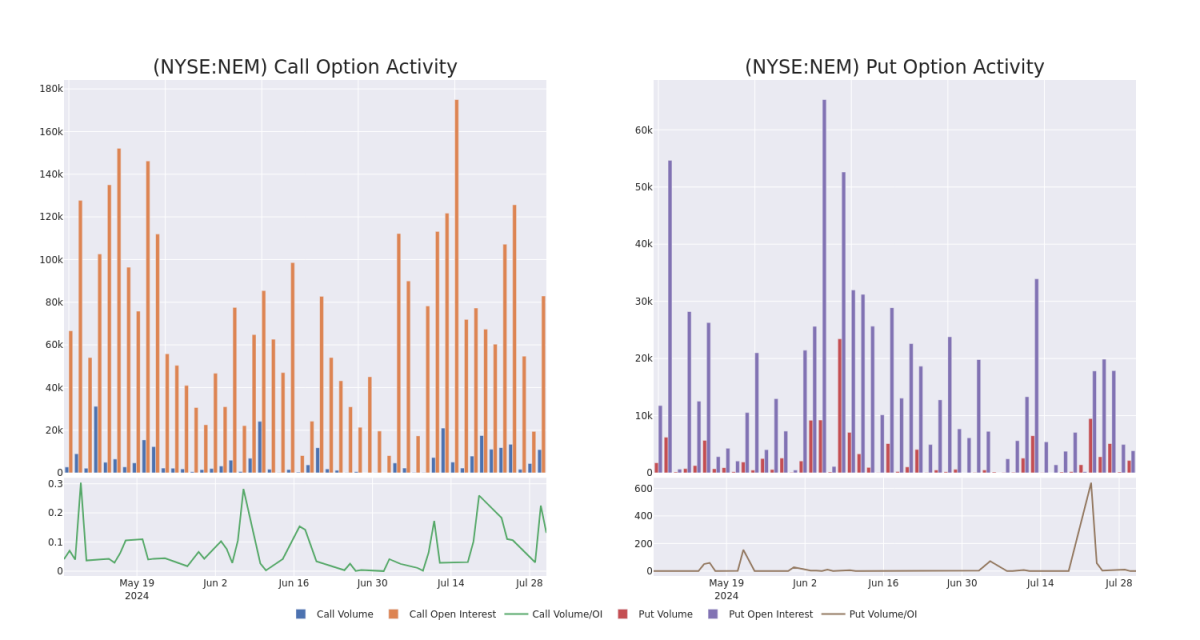

In terms of liquidity and interest, the mean open interest for Newmont options trades today is 6673.31 with a total volume of 13,025.00.

就流動性和利息而言,今天紐蒙特期權交易的平均未平倉合約爲6673.31,總交易量爲13,025.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Newmont's big money trades within a strike price range of $25.0 to $60.0 over the last 30 days.

在下圖中,我們可以跟蹤過去30天內紐蒙特在25.0美元至60.0美元行使價區間內的看漲期權和看跌期權交易的交易量和未平倉合約的變化。

Newmont Call and Put Volume: 30-Day Overview

紐蒙特看漲和看跌交易量:30天概述

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | CALL | SWEEP | NEUTRAL | 09/20/24 | $1.7 | $1.69 | $1.7 | $50.00 | $386.7K | 16.9K | 3.1K |

| NEM | CALL | SWEEP | BULLISH | 01/17/25 | $7.2 | $6.6 | $6.65 | $45.00 | $332.5K | 40.3K | 1.0K |

| NEM | CALL | SWEEP | BULLISH | 01/17/25 | $6.55 | $6.5 | $6.55 | $45.00 | $302.6K | 40.3K | 42 |

| NEM | CALL | SWEEP | BEARISH | 06/20/25 | $9.95 | $9.85 | $9.85 | $42.50 | $186.1K | 1.3K | 216 |

| NEM | PUT | TRADE | BEARISH | 01/16/26 | $7.25 | $7.1 | $7.2 | $50.00 | $180.0K | 1.8K | 250 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NEM | 打電話 | 掃 | 中立 | 09/20/24 | 1.7 美元 | 1.69 美元 | 1.7 美元 | 50.00 美元 | 386.7 萬美元 | 16.9K | 3.1K |

| NEM | 打電話 | 掃 | 看漲 | 01/17/25 | 7.2 美元 | 6.6 美元 | 6.65 美元 | 45.00 美元 | 332.5 萬美元 | 40.3 K | 1.0K |

| NEM | 打電話 | 掃 | 看漲 | 01/17/25 | 6.55 美元 | 6.5 美元 | 6.55 美元 | 45.00 美元 | 302.6 萬美元 | 40.3 K | 42 |

| NEM | 打電話 | 掃 | 粗魯的 | 06/20/25 | 9.95 美元 | 9.85 美元 | 9.85 美元 | 42.50 美元 | 186.1 萬美元 | 1.3K | 216 |

| NEM | 放 | 貿易 | 粗魯的 | 01/16/26 | 7.25 美元 | 7.1 美元 | 7.2 美元 | 50.00 美元 | 180.0K | 1.8K | 250 |

About Newmont

關於紐蒙特

Newmont is the world's largest gold miner. It bought Goldcorp in 2019, combined its Nevada mines in a joint venture with competitor Barrick later that year, and also purchased competitor Newcrest in November 2023. Its portfolio includes 17 wholly or majority owned mines and interests in two joint ventures in the Americas, Africa, Australia and Papua New Guinea. The company is expected to produce roughly 6.9 million ounces of gold in 2024. However, after buying Newcrest, Newmont is likely to sell a number of its higher cost, smaller mines accounting for 20% of forecast sales in 2024. Newmont also produces material amounts of copper, silver, zinc, and lead as byproducts. It had about two decades of gold reserves along with significant byproduct reserves at the end of December 2023.

紐蒙特是世界上最大的金礦開採商。它於2019年收購了Goldcorp,同年晚些時候與競爭對手巴里克合資合併了其內華達州的礦山,並於2023年11月收購了競爭對手紐克雷斯特。其投資組合包括在美洲、非洲、澳大利亞和巴布亞新幾內亞擁有的17個全資或多數股權礦山以及兩家合資企業的權益。預計該公司將在2024年生產約69萬盎司黃金。但是,在收購紐克雷斯特之後,紐蒙特可能會出售其一些成本較高的礦山,這些礦山佔2024年預測銷售額的20%。紐蒙特還生產大量的銅、銀、鋅和鉛作爲副產品。截至2023年12月底,它擁有大約二十年的黃金儲備和大量的副產品儲備。

Present Market Standing of Newmont

紐蒙特目前的市場地位

- Trading volume stands at 3,261,994, with NEM's price up by 3.03%, positioned at $48.84.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 85 days.

- 交易量爲3,261,994美元,NEM的價格上漲了3.03%,爲48.84美元。

- RSI指標顯示該股可能已超買。

- 預計將在85天后公佈業績。

Expert Opinions on Newmont

關於紐蒙特的專家意見

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $57.333333333333336.

在過去的30天中,共有3位專業分析師對該股發表了看法,將平均目標股價定爲57.3333333333336美元。

- An analyst from CIBC upgraded its action to Outperformer with a price target of $61.

- An analyst from Jefferies has decided to maintain their Buy rating on Newmont, which currently sits at a price target of $54.

- An analyst from BMO Capital has decided to maintain their Outperform rating on Newmont, which currently sits at a price target of $57.

- 加拿大帝國商業銀行的一位分析師將其股價上調至跑贏大盤,目標股價爲61美元。

- 傑富瑞集團的一位分析師決定維持對紐蒙特的買入評級,目前的目標股價爲54美元。

- BMO Capital的一位分析師已決定維持對紐蒙特的跑贏大盤評級,目前的目標股價爲57美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。