Amazon's AWS Growth Expected To Outpace Microsoft Azure, Analyst Optimistic

Amazon's AWS Growth Expected To Outpace Microsoft Azure, Analyst Optimistic

JMP Securities analyst Nicholas Jones rated Amazon.com Inc (NASDAQ:AMZN) shares with Market Perform and a price target of $225.

JMP證券分析師Nicholas Jones給亞馬遜股票(NASDAQ:AMZN)評級爲中性市場表現,並給出了225美元的價格目標。

Jones noted that Microsoft Corp's (NASDAQ:MSFT) Azure and other cloud services revenue missed consensus expectations by 1.5%. Conversely, Alphabet Inc (NASDAQ:GOOG) (NASDAQ:GOOGL) Google Cloud beat Street expectations by 1.5%.

Jones注意到微軟公司(NASDAQ:MSFT)的Azure和其他雲服務營業收入低於共識預期1.5%。相反,Alphabet公司(NASDAQ:GOOG) (NASDAQ:GOOGL)的Google Cloud超過了1.5%的街頭預期。

Also Read: Amazon Q2 Earnings Preview: Gains From eCommerce and Cloud Business, Operating Margin Upside On Analysts Radar

另外閱讀:亞馬遜二季度業績預覽:電商和雲業務收益,營業利潤率有分析師關注。

Before Microsoft's earnings, the analyst noted investor expectations for fiscal 2024 second-quarter Amazon Web Service (AWS) revenue growth was 18% y/y, vs. consensus of 17.3%, Jones said.

在微軟公佈業績之前,該分析師表示,對於2024財年第二季度Amazon Web Service(AWS)營業收入增長,投資者預期爲同比增長18%,而共識預期爲17.3%,Jones說。

Despite Microsoft's results, Jones noted investors will still look for AWS growth of 18% in the second quarter. He said the probable range is likely 16.5%-18.5% based on recent historical AWS-to-Azure growth ratios and Microsoft's commentary.

儘管微軟發佈的業績出現意外結果,Jones指出,投資者仍將尋找第二季度AWS增長18%。他說,根據最近歷史上AWS與Azure增長比率和微軟的評論,可能區間爲16.5%至18.5%。

Microsoft guided Azure and other cloud services revenue to grow 28%-29% cc, versus consensus expectations of 30.2%, Jones flagged. The analyst added management pointed to softness in some European geographies and capacity constraints as crucial factors behind Azure's softer numbers.

微軟引導Azure和其他雲服務收入按貨幣環比增長28%-29%,而共識預期爲30.2%,Jones指出。該分析師補充說,管理層指出某些歐洲地區和容量限制是Azure軟件數據的關鍵因素。

Jones does not expect Amazon's AWS business to have the same capacity constraints as Microsoft's Azure business, therefore positioning Amazon to deliver stable-to-accelerating AWS growth trends through the rest of the year.

Jones不認爲亞馬遜的AWS業務會像微軟的Azure業務一樣受容量限制,因此將亞馬遜定位爲在今年剩餘時間內提供穩定至加速的AWS增長趨勢。

Accordingly, Jones is incrementally optimistic about Amazon and noted it is likely to increase share gains.

因此,Jones對亞馬遜的前景持增量樂觀態度,並指出亞馬遜可能會增加市場份額。

Jones projected second-quarter revenue and EBITDA of $147.39 billion and $30.78 billion.

Jones預測第二季度的營業收入和EBITDA分別爲1473.9億美元和307.8億美元。

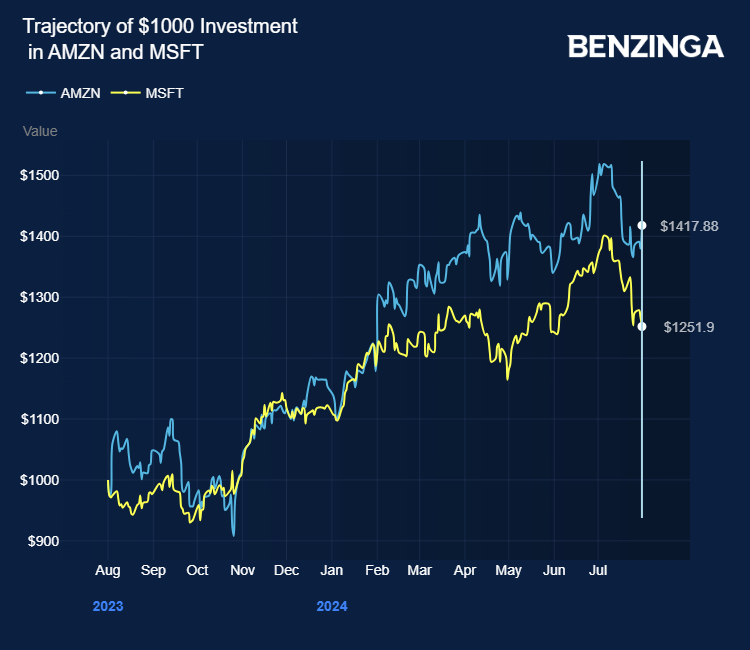

AMZN Price Action: Amazon shares traded higher by 2.74% to $186.74 at the last check Wednesday.

AMZN股價表現:週三最後一次檢查時,亞馬遜股票上漲2.74%,至186.74美元。

Photo: Sundry Photography on Shutterstock

圖片來自Shutterstock。