What the Options Market Tells Us About Analog Devices

What the Options Market Tells Us About Analog Devices

Benzinga's options scanner has just identified more than 11 option transactions on Analog Devices (NASDAQ:ADI), with a cumulative value of $481,292. Concurrently, our algorithms picked up 6 puts, worth a total of 378,752.

Benzinga的期權掃描儀剛剛在ADI公司(納斯達克股票代碼:ADI)上發現了超過11筆期權交易,累計價值爲481,292美元。同時,我們的算法獲得了6個看跌期權,總價值378,752個。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $225.0 to $240.0 for Analog Devices over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將ADI公司的價格區間從225.0美元擴大到240.0美元。

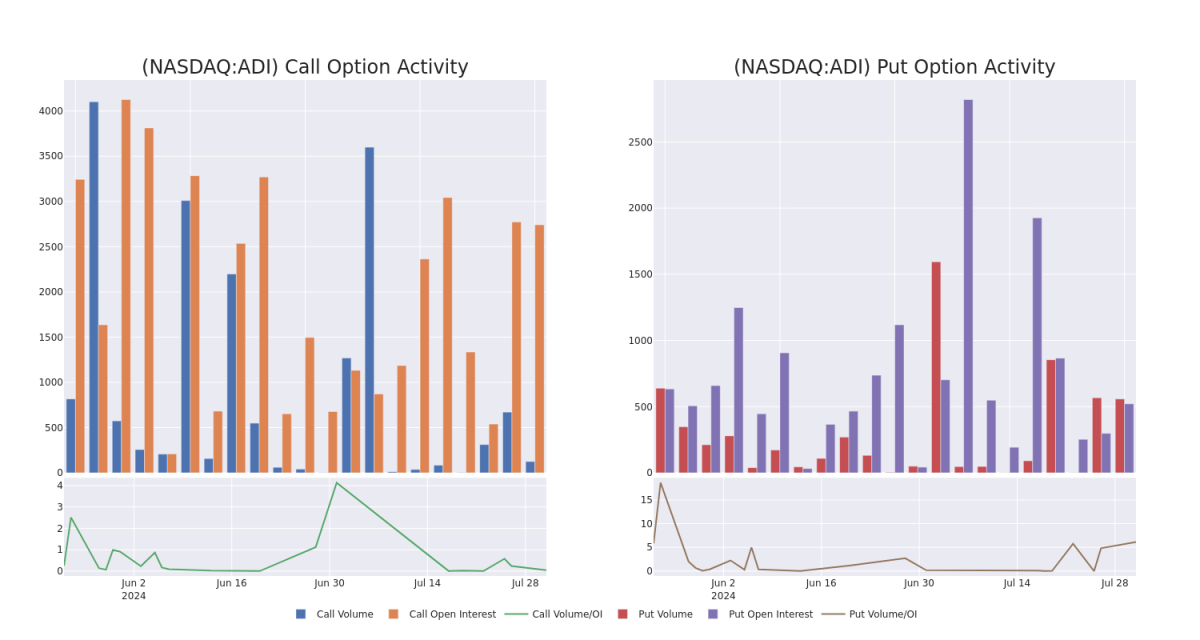

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Analog Devices's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Analog Devices's significant trades, within a strike price range of $225.0 to $240.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量ADI公司期權在特定行使價下的流動性和利息水平的關鍵。下面,我們將簡要介紹過去一個月ADI公司重要交易的看漲期權和未平倉合約的趨勢,行使價區間爲225.0美元至240.0美元。

Analog Devices 30-Day Option Volume & Interest Snapshot

ADI公司30天期權交易量和利息快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADI | PUT | SWEEP | BULLISH | 03/21/25 | $21.2 | $20.2 | $20.2 | $230.00 | $125.2K | 91 | 134 |

| ADI | PUT | SWEEP | BULLISH | 01/17/25 | $17.0 | $16.7 | $16.7 | $230.00 | $65.1K | 430 | 1 |

| ADI | PUT | SWEEP | BULLISH | 03/21/25 | $20.5 | $19.8 | $19.8 | $230.00 | $57.4K | 91 | 4 |

| ADI | PUT | SWEEP | BULLISH | 03/21/25 | $20.8 | $19.9 | $19.9 | $230.00 | $55.7K | 91 | 68 |

| ADI | PUT | SWEEP | BULLISH | 03/21/25 | $20.8 | $19.8 | $19.8 | $230.00 | $43.5K | 91 | 197 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 阿迪 | 放 | 掃 | 看漲 | 03/21/25 | 21.2 美元 | 20.2 美元 | 20.2 美元 | 230.00 美元 | 125.2 萬美元 | 91 | 134 |

| 阿迪 | 放 | 掃 | 看漲 | 01/17/25 | 17.0 美元 | 16.7 美元 | 16.7 美元 | 230.00 美元 | 65.1 萬美元 | 430 | 1 |

| 阿迪 | 放 | 掃 | 看漲 | 03/21/25 | 20.5 美元 | 19.8 美元 | 19.8 美元 | 230.00 美元 | 57.4 萬美元 | 91 | 4 |

| 阿迪 | 放 | 掃 | 看漲 | 03/21/25 | 20.8 美元 | 19.9 美元 | 19.9 美元 | 230.00 美元 | 55.7 萬美元 | 91 | 68 |

| 阿迪 | 放 | 掃 | 看漲 | 03/21/25 | 20.8 美元 | 19.8 美元 | 19.8 美元 | 230.00 美元 | 43.5 萬美元 | 91 | 197 |

About Analog Devices

關於模擬設備

Analog Devices is a leading analog, mixed signal, and digital signal processing chipmaker. The firm has a significant market share lead in converter chips, which are used to translate analog signals to digital and vice versa. The company serves tens of thousands of customers, and more than half of its chip sales are made to industrial and automotive end markets. Analog Devices' chips are also incorporated into wireless infrastructure equipment.

ADI公司是領先的模擬、混合信號和數字信號處理芯片製造商。該公司在轉換器芯片方面佔有顯著的市場份額,轉換器芯片用於將模擬信號轉換爲數字信號,反之亦然。該公司爲成千上萬的客戶提供服務,其中一半以上的芯片銷售來自工業和汽車終端市場。ADI公司的芯片也被集成到無線基礎設施設備中。

Following our analysis of the options activities associated with Analog Devices, we pivot to a closer look at the company's own performance.

在分析了與ADI公司相關的期權活動之後,我們將轉而仔細研究公司自身的業績。

Analog Devices's Current Market Status

ADI 公司當前的市場狀況

- With a trading volume of 1,878,394, the price of ADI is up by 2.31%, reaching $229.76.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 21 days from now.

- ADI的價格上漲了2.31%,達到229.76美元,交易量爲1,878,394美元。

- 當前的RSI值表明該股可能已接近超買。

- 下一份收益報告定於即日起21天后發佈。

Professional Analyst Ratings for Analog Devices

ADI公司的專業分析師評級

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $250.0.

在過去的一個月中,兩位行業分析師分享了他們對該股的見解,提出平均目標價爲250.0美元。

- An analyst from Cantor Fitzgerald has revised its rating downward to Neutral, adjusting the price target to $250.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Analog Devices, which currently sits at a price target of $250.

- 坎託·菲茨傑拉德的一位分析師已將其評級下調至中性,將目標股價調整爲250美元。

- 巴克萊銀行的一位分析師已決定維持其對ADI公司的等權評級,目前的目標股價爲250美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。