Western Digital's Options Frenzy: What You Need to Know

Western Digital's Options Frenzy: What You Need to Know

Deep-pocketed investors have adopted a bullish approach towards Western Digital (NASDAQ:WDC), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in WDC usually suggests something big is about to happen.

資金雄厚的投資者對西部數據(NASDAQ:WDC)採取看好策略,市場運行者不應忽視。我們在Benzinga的公開期權記錄中追蹤到了這一重大舉動。這些投資者的身份仍然未知,但是這樣大規模的舉動通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 38 extraordinary options activities for Western Digital. This level of activity is out of the ordinary.

我們從觀察中獲得了這些信息,當Benzinga的期權掃描程序突顯西部數據的38項非凡期權活動。這種活動水平是不同尋常的。

The general mood among these heavyweight investors is divided, with 52% leaning bullish and 28% bearish. Among these notable options, 13 are puts, totaling $891,097, and 25 are calls, amounting to $1,657,608.

這些重磅投資者的總體情緒分爲兩派,其中52%看好,28%看淡。在這些值得注意的期權交易中,有13個Put,總計891,097美元,25個Call,總計1,657,608美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $57.5 to $80.0 for Western Digital over the recent three months.

根據交易活動,顯然重大投資者的目標是在最近的三個月內將西部數據的股票價格區間定位於57.5美元至80.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

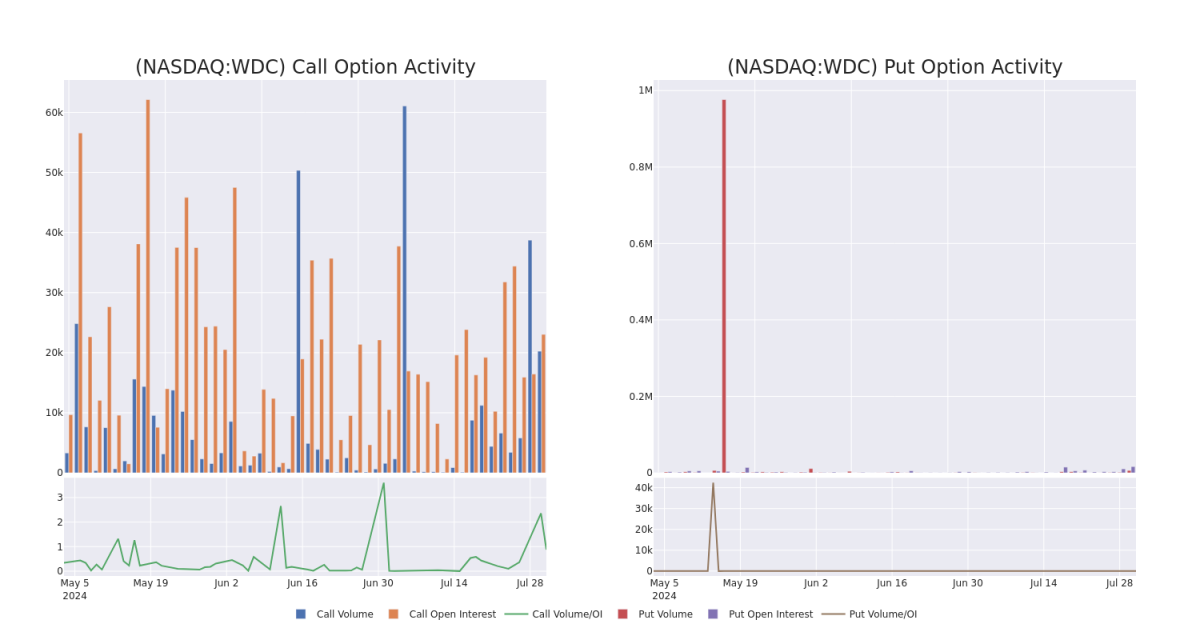

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Western Digital's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Western Digital's significant trades, within a strike price range of $57.5 to $80.0, over the past month.

研究成交量和未平倉利益的趨勢可以提供重要的股票研究見解。這些信息對於評估西部數據在特定執行價格處的期權的流動性和利益水平至關重要。下面,我們展示了過去一個月內涵蓋西部數據顯著交易的執行價格區間爲57.5至80.0美元的看漲和看跌期權的成交量和未平倉利益的趨勢。

Western Digital Option Activity Analysis: Last 30 Days

西部數據期權交易活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDC | CALL | SWEEP | NEUTRAL | 01/16/26 | $12.8 | $11.7 | $12.7 | $70.00 | $411.5K | 2.0K | 326 |

| WDC | PUT | TRADE | BEARISH | 08/16/24 | $2.98 | $2.89 | $2.96 | $65.00 | $296.0K | 1.8K | 1.1K |

| WDC | CALL | TRADE | BULLISH | 08/16/24 | $0.46 | $0.36 | $0.43 | $77.50 | $154.3K | 7.4K | 3.6K |

| WDC | PUT | SWEEP | BULLISH | 08/02/24 | $3.65 | $3.55 | $3.6 | $68.00 | $151.2K | 4.0K | 0 |

| WDC | CALL | SWEEP | BEARISH | 08/09/24 | $1.28 | $1.2 | $1.3 | $70.00 | $128.9K | 41 | 1.0K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WDC | 看漲 | SWEEP | 中立 | 01/16/26 | $12.8 | $11.7 | $12.7 | 70.00美元 | $411.5K | 2.0K | 326 |

| WDC | 看跌 | 交易 | 看淡 | 08/16/24 | $2.98 | $2.89 | $2.96 | $65.00 | $296.0K | 1.8K | 1.1千 |

| WDC | 看漲 | 交易 | 看好 | 08/16/24 | $0.46 | $0.36 | $0.43 | $77.50 | $154.3千 | 7.4K | 3.6千 |

| WDC | 看跌 | SWEEP | 看好 | 08/02/24 | $3.65 | $3.55 | $3.6 | $68.00 | $151.2K | 4.0K | 0 |

| WDC | 看漲 | SWEEP | 看淡 | 08/09/24 | $1.28 | $1.2 | $1.3 | 70.00美元 | $128.9K | 41 | 1.0K |

About Western Digital

關於西部數據 西部數據的使命是通過利用數據的可能性來釋放其潛力。我們的Flash和HDD業務依託記憶技術的進步,創造突破性的創新和強大的數據存儲解決方案,以使世界實現其願景。我們的價值觀核心是認識到應對氣候變化的緊迫性,並承諾通過Science Based Targets倡議批准的宏偉碳減排目標來實現這一目標。了解有關西部數據、SanDisk和WD品牌的更多信息。

Western Digital is a leading vertically integrated supplier of data storage solutions, spanning both hard disk drives and solid-state drives. In the HDD market it forms a practical duopoly with Seagate, and it is the largest global producer of NAND flash chips for SSDs in a joint venture with competitor Kioxia.

西部數據是一家領先的垂直整合數據存儲解決方案供應商,覆蓋了硬盤驅動器和固態驅動器。在HDD市場上,它與西捷形成了實際的寡頭壟斷,並與競爭對手Kioxia聯合組建了全球最大的NAND閃存芯片生產商,爲固態硬盤提供芯片。

Having examined the options trading patterns of Western Digital, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了西部數據的期權交易模式後,我們的注意力現在直接轉向該公司。這種轉變讓我們深入了解其現在的市場地位和表現。

Present Market Standing of Western Digital

西部數據目前的市場地位

- Trading volume stands at 9,717,516, with WDC's price up by 6.13%, positioned at $67.05.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 0 days.

- 交易量爲9,717,516股,WDC的價格上漲6.13%,爲67.05美元。

- RSI指標顯示該股票可能正接近超賣。

- 預計在0天內公佈收益報告。

What The Experts Say On Western Digital

專家對西部數據的看法

In the last month, 3 experts released ratings on this stock with an average target price of $93.33333333333333.

在過去一個月中,3位專家發佈了對該股票的評級,平均目標價爲93.33333333333333美元。

- Maintaining their stance, an analyst from Wedbush continues to hold a Outperform rating for Western Digital, targeting a price of $95.

- An analyst from Citigroup has decided to maintain their Buy rating on Western Digital, which currently sits at a price target of $95.

- An analyst from Evercore ISI Group has decided to maintain their Outperform rating on Western Digital, which currently sits at a price target of $90.

- 維持他們的立場,Wedbush的一位分析師繼續持有西部數據的推薦評級,目標價爲95美元。

- 花旗集團的一位分析師決定繼續維持其對西部數據的買入評級,目前的價格目標爲95美元。

- Evercore ISI Group的一位分析師決定繼續維持其對西部數據的推薦評級,目前的價格目標爲90美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Western Digital with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也提供了更高的利潤潛力。精明的交易商通過持續的教育、戰略性的交易調整、利用各種指標和保持關注市場動態來減輕這些風險。通過Benzinga Pro關注西部數據的最新期權交易,以獲取實時警報。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $57.5 to $80.0 for Western Digital over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $57.5 to $80.0 for Western Digital over the recent three months.