Market Mover | Intel Share Slump 21% After Q2 Results Disappoint; Suspends Dividend

Market Mover | Intel Share Slump 21% After Q2 Results Disappoint; Suspends Dividend

August 2, 2024 - $Intel (INTC.US)$shares slumped 21.93% to $22.68 in pre-market trading on Friday. The company has released its financial results for the second quarter of 2024, which significantly underperformed relative to market forecasts. In response to these results, the company has taken decisive action by suspending its dividend distribution and implementing a workforce reduction of 15%.

2024 年 8 月 2 日- $英特爾 (INTC.US)$週五盤前交易中,股價下跌21.93%,至22.68美元。該公司已經發布了2024年第二季度的財務業績,其表現遠低於市場預期。針對這些結果,該公司已採取果斷行動,暫停股息分配,裁員15%。

Q2 Financial Results

第二季度財務業績

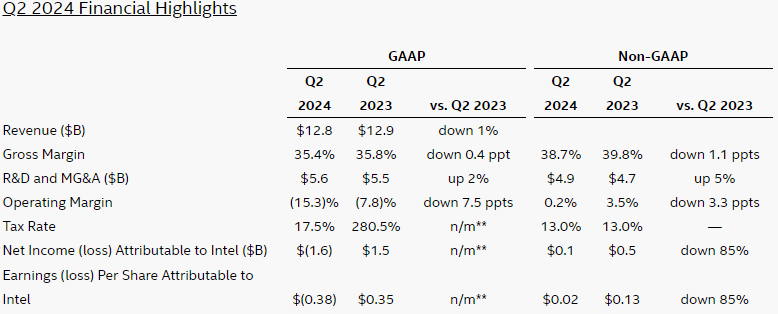

Revenue: Second-quarter revenue of $12.83 billion declined 1%YoY, while analysts were expecting $12.95 billion.

EPS: Non-GAAP adjusted earnings per share (EPS) for the second quarter were $0.02, down 85% YoY and $0.10 expected by analysts.

Gross margin: Adjusted gross margin for the second quarter was 38.7%, down 1.1 percentage points from the same period last year, compared with analyst expectations of 43.6% and 45.1% in the first quarter.

收入:第二季度收入爲128.3億美元,同比下降1%,而分析師預計爲129.5億美元。

每股收益:第二季度非公認會計准則調整後每股收益(EPS)爲0.02美元,同比下降85%,分析師預期爲0.10美元。

毛利率:第二季度調整後的毛利率爲38.7%,比去年同期下降1.1個百分點,而第一季度分析師的預期爲43.6%和45.1%。

Intel Products Highlights

英特爾產品亮點

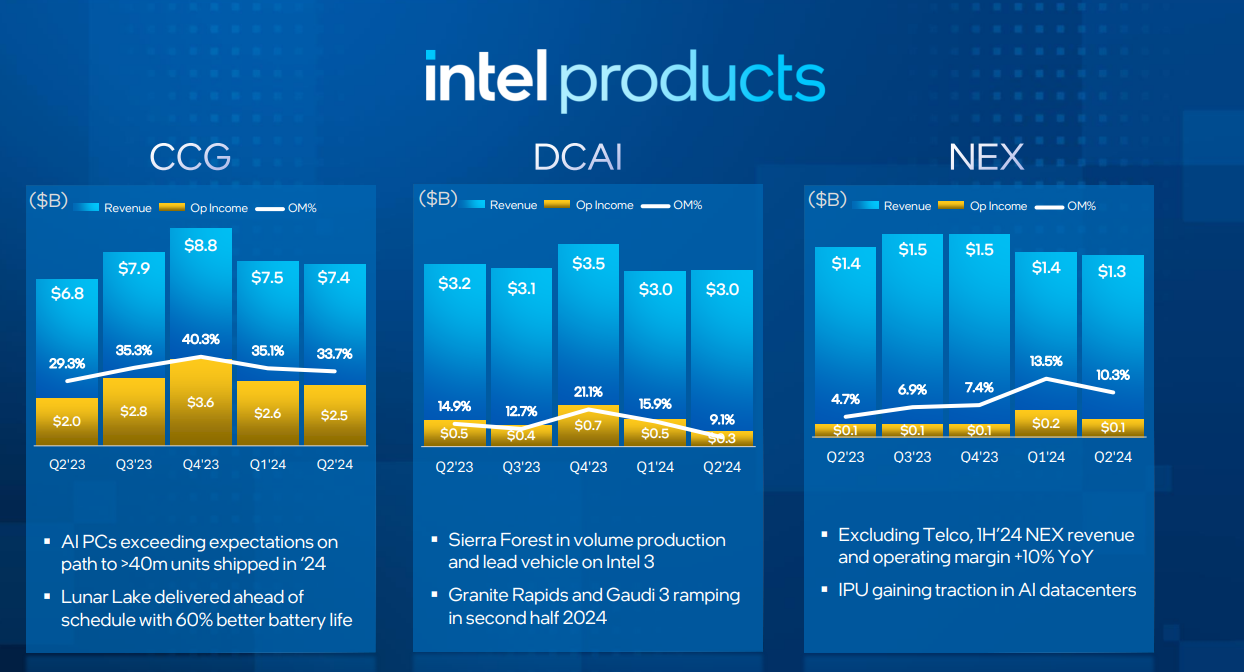

CCG: CCG revenue was $7.41 billion in the second quarter, up 9% YoY, while analysts expected $7.53 billion.

DCAI: DCAI revenue was $3.05 billion, down 3% YoY, while analysts expected $3.07 billion.

NEX: NEX revenue was $1.3 billion in the second quarter, down 1% YoY and down 8% in the first quarter.

CCG:第二季度CCG收入爲74.1億美元,同比增長9%,而分析師預計爲75.3億美元。

DCAI:DCAI收入爲30.5億美元,同比下降3%,而分析師預計爲30.7億美元。

NEX:第二季度NEX收入爲13億美元,同比下降1%,第一季度下降8%。

Q3 2024 Dividend

2024 年第三季度股息

The company announced that its board of directors has declared a quarterly dividend of $0.125 per share on the company’s common stock, which will be payable Sept. 1, 2024, to shareholders of record as of Aug. 7, 2024.

公司宣佈,其董事會已宣佈公司普通股的季度股息爲每股0.125美元,該股息將於2024年9月1日支付給截至2024年8月7日的登記股東。

As noted earlier, Intel is suspending the dividend starting in the fourth quarter.

如前所述,英特爾將從第四季度開始暫停分紅。

Cost-Reduction Plan

成本削減計劃

As Intel nears the completion of rebuilding a sustainable engine of process technology leadership, it announced a series of initiatives to create a sustainable financial engine that accelerates profitable growth, enables further operational efficiency and agility, and creates capacity for ongoing strategic investment in technology and manufacturing leadership. These initiatives follow the establishment of separate financial reporting for Intel Products and Intel Foundry, which provides a "clean sheet" view of the business and has uncovered significant opportunities to drive meaningful operational and cost efficiencies. The actions include structural and operating realignment across the company, headcount reductions, and operating expense and capital expenditure reductions of more than $10 billion in 2025 compared to previous estimates. As a result of these actions, Intel aims to achieve clear line of sight toward a sustainable business model with the ongoing financial resources and liquidity needed to support the company’s long-term strategy.

隨着英特爾即將完成流程技術領導地位的可持續引擎的重建,它宣佈了一系列舉措,旨在創建可持續的金融引擎,以加速盈利增長,進一步提高運營效率和靈活性,併爲技術和製造領導力的持續戰略投資創造能力。這些舉措是在爲英特爾產品和英特爾代工建立單獨的財務報告之後採取的,這提供了業務的 “一覽無餘”,並發現了推動有意義的運營和成本效益的重大機遇。這些行動包括整個公司的結構和運營調整、裁員以及與先前的估計相比,到2025年將運營費用和資本支出削減超過100億美元。通過這些行動,英特爾旨在通過提供支持公司長期戰略所需的持續財務資源和流動性,實現清晰的可持續商業模式。

Business Outlook

商業展望

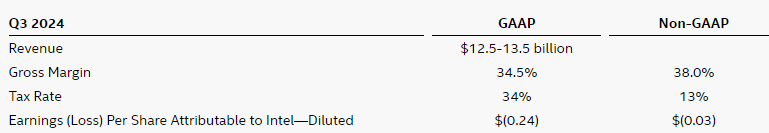

Revenue: Third-quarter revenue is expected to be $12.5 billion to $13.5 billion, while analysts expect $14.38 billion.

EPS: Third-quarter adjusted EPS loss is expected to be $0.03, while analysts expect EPS earnings of $0.30.

Gross margin: Third-quarter gross margin is expected to be 38%, while analysts expect 45.5%.

收入:第三季度收入預計爲125億美元至135億美元,而分析師預計爲143.8億美元。

每股收益:第三季度調整後的每股虧損預計爲0.03美元,而分析師預計每股收益爲0.30美元。

毛利率:第三季度毛利率預計爲38%,而分析師預計爲45.5%。

“Our Q2 financial performance was disappointing, even as we hit key product and process technology milestones. Second-half trends are more challenging than we previously expected, and we are leveraging our new operating model to take decisive actions that will improve operating and capital efficiencies while accelerating our IDM 2.0 transformation,” said Pat Gelsinger, Intel CEO. “These actions, combined with the launch of Intel 18A next year to regain process technology leadership, will strengthen our position in the market, improve our profitability and create shareholder value.”

“儘管我們達到了關鍵的產品和工藝技術里程碑,但我們第二季度的財務表現令人失望。下半年的趨勢比我們之前的預期更具挑戰性,我們正在利用新的運營模式採取果斷行動,提高運營和資本效率,同時加快我們的iDM 2.0轉型。” 英特爾首席執行官帕特·蓋爾辛格說。“這些行動,加上明年爲重新獲得工藝技術領導地位而推出的英特爾18A,將鞏固我們在市場上的地位,提高我們的盈利能力並創造股東價值。”

Related Reading: Press Release

相關閱讀: 新聞稿