Top 3 Industrials Stocks That Could Blast Off This Month

Top 3 Industrials Stocks That Could Blast Off This Month

The most oversold stocks in the industrials sector presents an opportunity to buy into undervalued companies.

工業板塊中最超賣的股票提供了一個買入被低估的公司的機會。

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

RSI指標是一種動量指標,它比較了股票在價格上漲時的強度與在價格下跌時的強度。與股票的價格走勢進行比較,可以給交易者更好的了解股票短期內表現的良好程度。當RSI低於30時,資產通常被認爲是超賣的,根據Benzinga Pro的數據。

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

以下是本行業板塊最近的主要超賣股票列表,RSI接近或低於30。

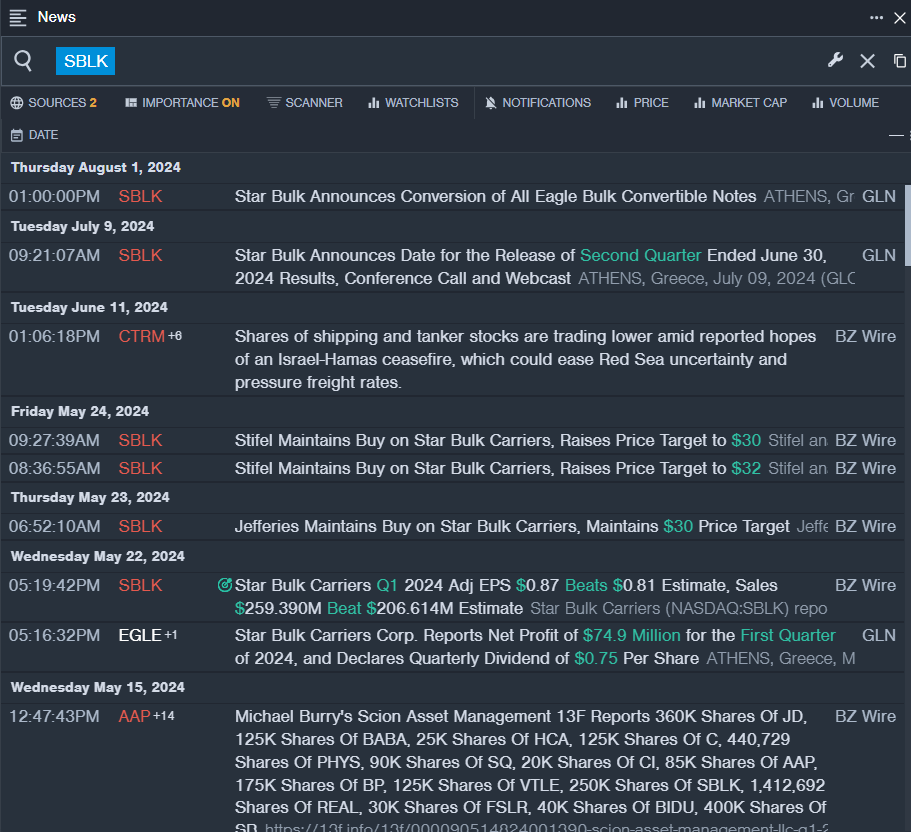

Star Bulk Carriers Corp (NASDAQ:SBLK)

Star Bulk Carriers公司(NASDAQ:SBLK)

- Star Bulk Carriers will release its results for the second quarter, after the closing bell on Wednesday, Aug. 7. The company's stock fell around 12% over the past month and has a 52-week low of $16.86.

- RSI Value: 27.28

- SBLK Price Action: Shares of Star Bulk Carriers fell 3.6% to close at $21.74 on Thursday.

- Benzinga Pro's real-time newsfeed alerted to latest SBLK news.

- Star Bulk Carriers將於8月7日星期三的收盤後發佈第二季度業績報告。該公司股價在過去一個月內下跌了約12%,52周內最低價爲16.86美元。

- RSI值:27.28

- SBLk股價走勢:Star Bulk Carriers的股價在週四下跌3.6%,收於21.74美元。

- Benzinga Pro的即時新聞提醒最新的SBLk資訊。

Symbotic Inc (NASDAQ:SYM)

Symbotic Inc(NASDAQ:SYM)

- Symbotic reported worse-than-expected third-quarter earnings results and issued fourth-quarter revenue guidance below estimates on Monday. "Our teams continue to focus on execution of the 39 systems we have in deployment, which is reflected in our record revenue for the quarter. Our system gross margin fell below expectations due to elongated construction schedules and implementation costs," said Rick Cohen, chairman and CEO of Symbotic. "We are focused on improving our planning, speed of implementation and project management to improve performance." The company's stock fell around 37% over the past five days. It has a 52-week low of $24.21.

- RSI Value: 26.59

- SYM Price Action: Shares of Symbotic fell 8.2% to close at $24.61 on Thursday.

- Benzinga Pro's charting tool helped identify the trend in SYM stock.

- Symbotic發佈了低於預期的第三季度收益結果,並在週一發佈低於估計的第四季度收入指引。Symbotic的董事長兼首席執行官Rick Cohen說:“我們的團隊繼續專注於部署的39個系統的執行情況,這反映在我們季度創紀錄的收入中。我們的系統毛利率由於施工時間表和實施成本的延長低於預期。我們專注於改善我們的計劃,實施速度和項目管理,以改善業績。”該公司股價在過去五天內下跌了約37%,52周內最低價爲24.21美元。

- RSI值:26.59

- SYm股價走勢:Symbotic的股價在週四下跌了8.2%,收於24.61美元。

- Benzinga Pro的圖表工具有助於識別SYm股票的趨勢。

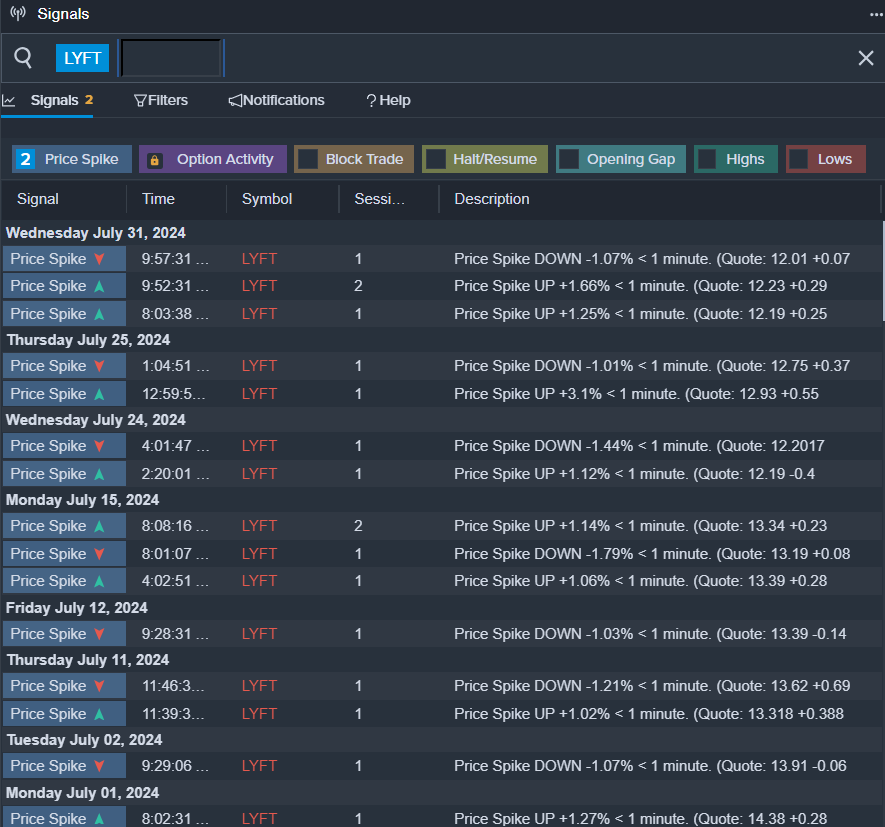

LYFT Inc (NASDAQ:LYFT)

lyft inc(NASDAQ:LYFT)

- On July 23, Lyft said President Kristin Sverchek will depart as employee effective Aug. 20. The company's shares fell around 15% over the past month and has a 52-week low of $8.85.

- RSI Value: 25.99

- LYFT Price Action: Shares of Lyft fell 5.2% to close at $11.42 on Thursday.

- Benzinga Pro's signals feature notified of a potential breakout in LYFT shares.

- 7月23日,Lyft表示總裁Kristin Sverchek將於8月20日生效離職。該公司股價在過去一個月內下跌了約15%,52周內最低價爲8.85美元。

- RSI值:25.99

- LYFt股價走勢:Lyft的股價在週四下跌了5.2%,收於11.42美元。

- Benzinga Pro的信號功能提醒LYFt股票有潛在的突破。