Behind the Scenes of Linde's Latest Options Trends

Behind the Scenes of Linde's Latest Options Trends

High-rolling investors have positioned themselves bullish on Linde (NASDAQ:LIN), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LIN often signals that someone has privileged information.

高資本的投資者看好Linde(納斯達克:linde)股票,零售交易者需要關注。\ 通過Benzinga跟蹤公開可用的期權數據,我們今天注意到了這一活動。這些投資者的身份還不確定,但LIN股票的如此重大變動通常表示某人掌握了內幕消息。

Today, Benzinga's options scanner spotted 12 options trades for Linde. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了Linde的12筆期權交易。這不是一個典型的模式。

The sentiment among these major traders is split, with 33% bullish and 16% bearish. Among all the options we identified, there was one put, amounting to $1,024,800, and 11 calls, totaling $907,286.

這些主要交易者的情緒分化,其中33%看漲,16%看淡。我們確定的所有期權中,有一個看跌期權,金額爲1024800美元,以及11個看漲期權,總計907286美元。

What's The Price Target?

目標價是多少?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $460.0 for Linde over the last 3 months.

考慮到這些合同的成交量和未平倉合約數量,過去3個月中鯨魚一直將Linde的價格區間定爲400.0至460.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

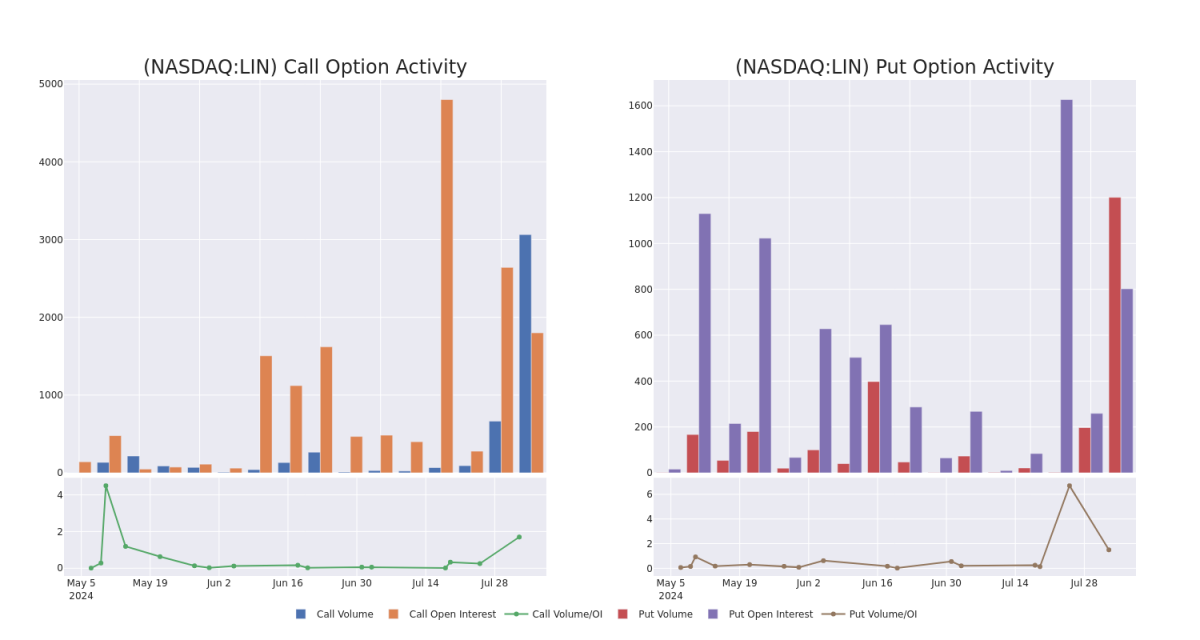

In today's trading context, the average open interest for options of Linde stands at 1301.0, with a total volume reaching 4,265.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Linde, situated within the strike price corridor from $400.0 to $460.0, throughout the last 30 days.

在今天的交易背景下,Linde期權的平均未平倉合約爲1301.0,總成交量達到4265.00。附圖清晰地展示了過去30天Linde內部的高價值交易看漲和看跌期權成交量和未平倉合約在觸及$400.0至460.0的行權價格區間內的變化情況。

Linde Option Volume And Open Interest Over Last 30 Days

Linde期權成交量和未平倉合約量過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LIN | PUT | TRADE | BULLISH | 01/17/25 | $9.8 | $8.5 | $8.54 | $400.00 | $1.0M | 802 | 1.2K |

| LIN | CALL | SWEEP | BULLISH | 01/17/25 | $22.3 | $21.3 | $21.8 | $460.00 | $207.4K | 1.8K | 196 |

| LIN | CALL | SWEEP | BULLISH | 01/17/25 | $21.9 | $21.2 | $21.55 | $460.00 | $189.6K | 1.8K | 406 |

| LIN | CALL | SWEEP | BULLISH | 01/17/25 | $22.3 | $21.4 | $21.85 | $460.00 | $107.8K | 1.8K | 247 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $25.6 | $23.7 | $24.07 | $460.00 | $74.6K | 1.8K | 45 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LIN | 看跌 | 交易 | 看好 | 01/17/25 | $9.8 | $8.5 | $8.54 | $400.00 | $1.0M | 802 | 1.2K |

| LIN | 看漲 | SWEEP | 看好 | 01/17/25 | $22.3 | $21.3 | $21.8美元 | $460.00 | $207.4K | 1.8K | 196 |

| LIN | 看漲 | SWEEP | 看好 | 01/17/25 | $21.9 | $21.2 | $21.55 | $460.00 | $189.6K | 1.8K | 406 |

| LIN | 看漲 | SWEEP | 看好 | 01/17/25 | $22.3 | $21.4 | $21.85 | $460.00 | $107.8K | 1.8K | 247 |

| LIN | 看漲 | SWEEP | 看淡 | 01/17/25 | $25.6 | $23.7 | $24.07 | $460.00 | $74.6K | 1.8K | 45 |

About Linde

關於Linde

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

Linde PLC分紅歷程概覽

In light of the recent options history for Linde, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於Linde近期的期權歷史,現在應關注該公司本身。我們旨在探討其當前的績效。

Current Position of Linde

Linde的現狀

- With a trading volume of 1,134,870, the price of LIN is down by -0.85%, reaching $449.49.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 0 days from now.

- Linde的交易量爲1134870,股價下跌0.85%,達到449.49美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一次盈利報告計劃在0天內發佈。

What Analysts Are Saying About Linde

分析師對Linde的評論

A total of 2 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $477.5.

過去30天內,共有2位專業分析師對該股發表看法,設定了平均價格目標爲477.5美元。

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Linde, targeting a price of $480.

- An analyst from UBS persists with their Neutral rating on Linde, maintaining a target price of $475.

- 花旗集團的分析師堅持持有關於Linde的中立評級,目標價格爲480美元。

- 瑞銀的分析師繼續對Linde持有中立評級,維持目標價格在475美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Linde with Benzinga Pro for real-time alerts.

交易期權涉及較高的風險,但也有可能獲得更高的利潤。精明的交易者通過持續的教育、戰略性交易調整,利用各種因子,保持對市場動態的敏銳感知來減少這些風險。使用Benzinga Pro進行實時提醒,了解Linde的最新期權交易動態。

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $460.0 for Linde over the last 3 months.

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $460.0 for Linde over the last 3 months.