Market Whales and Their Recent Bets on TTD Options

Market Whales and Their Recent Bets on TTD Options

Financial giants have made a conspicuous bearish move on Trade Desk. Our analysis of options history for Trade Desk (NASDAQ:TTD) revealed 15 unusual trades.

金融巨頭對Trade Desk的看法看淡了。我們對Trade Desk(納斯達克:TTD)期權歷史進行分析,發現了15宗不尋常的交易。

Delving into the details, we found 20% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 7 were puts, with a value of $365,820, and 8 were calls, valued at $735,161.

深入分析後,我們發現20%的交易員看漲,而60%的交易員表現出看淡的傾向。我們發現所有交易中有7個看跌,價值爲365,820美元,8個看漲,價值爲735,161美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $30.0 and $100.0 for Trade Desk, spanning the last three months.

在評估交易量和未平倉合約後,很明顯,主要市場運動者正在關注Trade Desk的價格區間,該區間爲$30.0至$100.0,跨越了過去三個月。

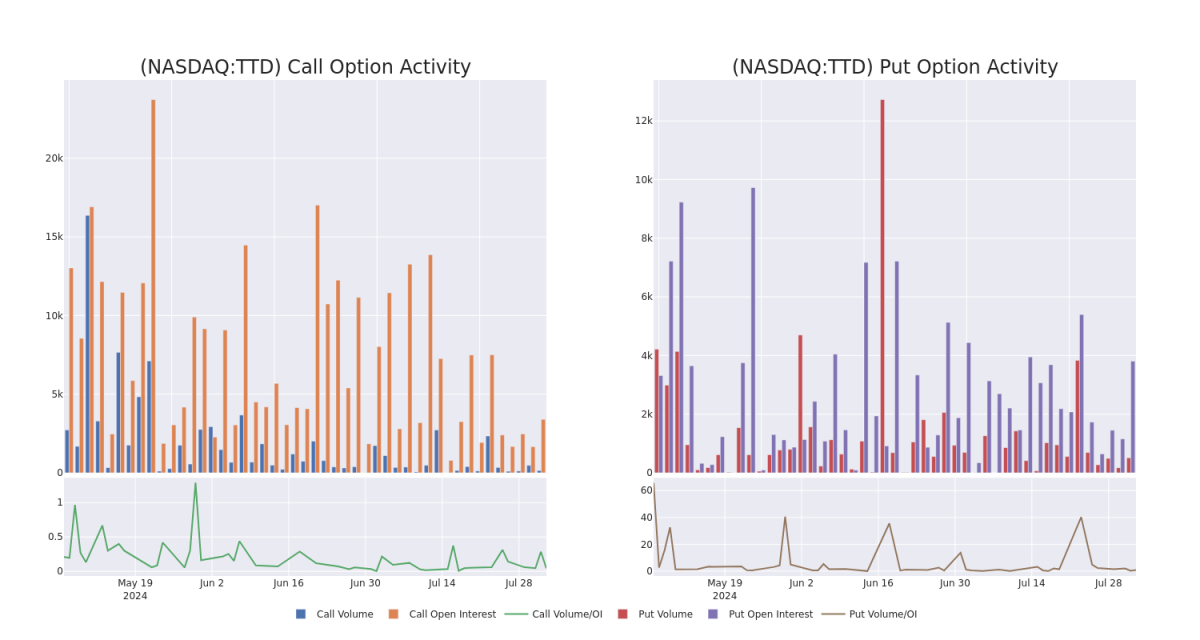

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In today's trading context, the average open interest for options of Trade Desk stands at 554.38, with a total volume reaching 654.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Trade Desk, situated within the strike price corridor from $30.0 to $100.0, throughout the last 30 days.

在今天的交易情況下,Trade Desk期權的平均未平倉合約爲554.38,總成交量爲654.00。附帶的圖表勾畫了過去30天內位於$30.0至$100.0行權價走廊內的Trade Desk高價值交易的看漲和看跌期權成交量和未平倉合約的進展情況。

Trade Desk 30-Day Option Volume & Interest Snapshot

Trade Desk 30-day 期權成交量和未平倉合約快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | CALL | TRADE | BEARISH | 01/17/25 | $54.05 | $52.5 | $52.98 | $30.00 | $370.8K | 196 | 70 |

| TTD | CALL | SWEEP | BEARISH | 08/16/24 | $17.55 | $16.0 | $16.5 | $70.00 | $130.5K | 2.2K | 2 |

| TTD | PUT | SWEEP | NEUTRAL | 08/16/24 | $16.25 | $15.85 | $16.09 | $97.50 | $80.2K | 874 | 50 |

| TTD | PUT | SWEEP | BULLISH | 01/17/25 | $10.8 | $10.7 | $10.7 | $82.50 | $69.5K | 719 | 65 |

| TTD | PUT | SWEEP | BULLISH | 01/17/25 | $10.7 | $10.55 | $10.55 | $82.50 | $53.8K | 719 | 155 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TTD | 看漲 | 交易 | 看淡 | 01/17/25 | 該目標價爲54.05美元。 | $52.5 | $52.98 | $30.00 | $370.8K | 196 | 70 |

| TTD | 看漲 | SWEEP | 看淡 | 08/16/24 | $17.55 | $16.0 | $16.5 | 70.00美元 | $130.5K | 2.2K | 2 |

| TTD | 看跌 | SWEEP | 中立 | 08/16/24 | $16.25 | $15.85 | $16.09 | $97.50 | $80.2K | 874 | 50 |

| TTD | 看跌 | SWEEP | 看好 | 01/17/25 | $10.8 | $10.7 | $10.7 | $82.50 | $69.5K | 719 | 65 |

| TTD | 看跌 | SWEEP | 看好 | 01/17/25 | $10.7 | $10.55 | $10.55 | $82.50 | $53.8K | 719 | 155 |

About Trade Desk

關於Trade Desk

The Trade Desk provides a self-service platform that helps advertisers and ad agencies programmatically find and purchase digital ad inventory (display, video, audio, and social) on different devices like computers, smartphones, and connected TVs. It utilizes data to optimize the performance of ad impressions purchased. The firm's platform is referred to as a demand-side platform in the digital ad industry. The firm generates its revenue from fees based on a percentage of what its clients spend on advertising.

Trade Desk提供自助服務平台,幫助廣告商和廣告代理在不同設備上(如計算機、智能手機和連接電視)以程序化方式查找和購買數字廣告庫存(顯示屏、視頻、音頻和社交)。它利用數據優化購買的廣告展示的性能。該公司的平台在數字廣告行業中被稱爲需求方平台。該公司的收入來自基於其客戶在廣告上花費的百分比的費用。

After a thorough review of the options trading surrounding Trade Desk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在深入審查Trade Desk周圍的期權交易後,我們將繼續更詳細地研究該公司。這包括對其當前的市場狀況和表現進行評估。

Where Is Trade Desk Standing Right Now?

交易臺現在處於何種狀態?

- Currently trading with a volume of 3,296,400, the TTD's price is down by -3.25%, now at $84.9.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 6 days.

- TTD的交易量爲3,296,400,價格下跌了-3.25%,現在爲$84.9。

- RSI讀數表明該股票目前可能被超賣。

- 預計在6天內發佈收益報告。

What The Experts Say On Trade Desk

專家對Trade Desk的看法

In the last month, 5 experts released ratings on this stock with an average target price of $109.0.

在過去一個月中,有5位專家對這支股票進行了評級,平均目標價爲$109.0。

- An analyst from Morgan Stanley persists with their Overweight rating on Trade Desk, maintaining a target price of $110.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $100.

- Consistent in their evaluation, an analyst from Macquarie keeps a Outperform rating on Trade Desk with a target price of $115.

- In a cautious move, an analyst from Needham downgraded its rating to Buy, setting a price target of $100.

- Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for Trade Desk, targeting a price of $120.

- 摩根士丹利的分析師堅持對Trade Desk的股票評級爲超配,維持目標價爲$110。

- Needham的一位分析師由於擔憂將其評級下調爲買入,新的目標價格爲100.0美元。

- 在評估中保持一致,Macquarie的分析師繼續對Trade Desk持有跑贏大市的評級,並將目標價設爲$115。

- Needham的分析師採取謹慎的行動,將其股票評級下調爲買入,並設定價格目標爲$100。

- 維持其立場,Oppenheimer的分析師繼續爲Trade Desk持有跑贏大市的評級,目標價爲$120。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Trade Desk with Benzinga Pro for real-time alerts.

交易期權存在更大的風險,但同時也有更高的盈利潛力。精明的交易者通過持續教育、戰略性交易調整、運用各種因子以及保持對市場動態的關注來降低這些風險。使用Benzinga Pro即可隨時跟蹤Trade Desk的最新期權交易警報。