Four Days Left Until RPC, Inc. (NYSE:RES) Trades Ex-Dividend

Four Days Left Until RPC, Inc. (NYSE:RES) Trades Ex-Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that RPC, Inc. (NYSE:RES) is about to go ex-dividend in just 4 days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves two full business days. So if you miss that date, you would not show up on the company's books on the record date. Accordingly, RPC investors that purchase the stock on or after the 9th of August will not receive the dividend, which will be paid on the 10th of September.

有些投資者依靠分紅來增加財富。如果你是其中之一,你可能會想知道RPC, Inc. (NYSE:RES) 正在4天后即將除息。除息日是指持股人需要在公司股權登記簿上記錄的日期,而這一天前一天即是除息日。除息日很重要,因爲結算過程需要二個完整工作日。所以如果你錯過了這個日期,你將無法出現在公司的登記簿上。 因此,如果在8月9日或之後購買RPC的股票,你將不會分紅。分紅將於9月10日支付。

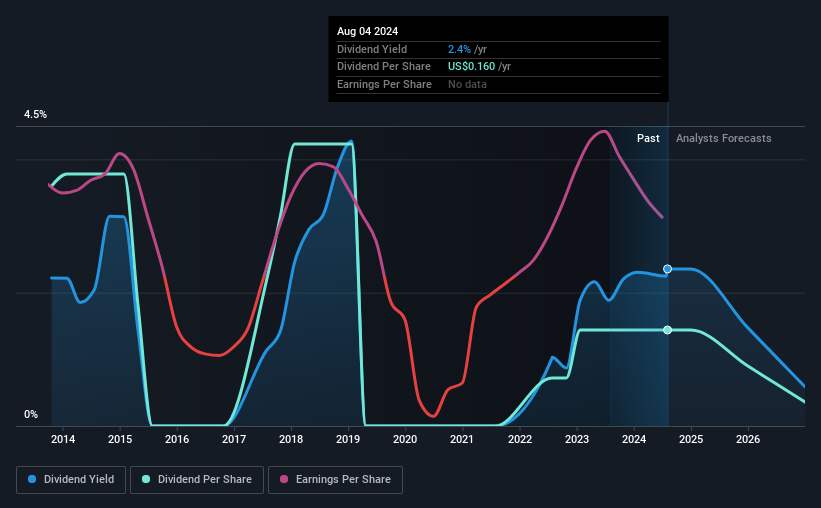

The company's upcoming dividend is US$0.04 a share, following on from the last 12 months, when the company distributed a total of US$0.16 per share to shareholders. Based on the last year's worth of payments, RPC stock has a trailing yield of around 2.4% on the current share price of US$6.79. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

該公司即將付出US$0.04每股的分紅,過去12個月已經向股東派發總共US$0.16每股。根據去年收益的總和,RPC股票的每股收益率在當前的股價US$6.79上約爲2.4%。長揸人的投資收益中分紅是一個重要的貢獻因素,但前提是分紅繼續支付。因此,我們需要檢查分紅支付是否得到覆蓋,並且收益是否在增長。

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Fortunately RPC's payout ratio is modest, at just 29% of profit. A useful secondary check can be to evaluate whether RPC generated enough free cash flow to afford its dividend. What's good is that dividends were well covered by free cash flow, with the company paying out 17% of its cash flow last year.

分紅通常是由公司收益支付的,所以如果公司支付的金額超過了它的盈利額度,那麼它的分紅通常就有更大的風險被削減。幸運的是,RPC的派息比率非常低,僅佔利潤的29%。一個有用的第二個檢查是評估RPC是否具有足夠的自由現金流來支付其股息。好的消息是去年公司的自由現金流足以支付分紅金額的17%。

It's positive to see that RPC's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

看到RPC的股息既有利潤,也有現金流,這通常是分紅可持續性的跡象,低股息比率通常暗示着在削減股息之前具有更大的安全邊際。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

點擊此處查看公司的支付比率以及未來分紅的分析師預期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. With that in mind, we're discomforted by RPC's 7.6% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

當收益下滑時,分紅公司變得更難分析和擁有。如果收益下降得足夠多,公司可能被迫削減分紅。有鑑於此,我們對RPC在過去五年中7.6%年均收益下降感到不安。如此大的下降程度給該公司的分紅未來持續性帶來了疑慮。

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. RPC's dividend payments per share have declined at 8.8% per year on average over the past 10 years, which is uninspiring. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

許多投資者將根據分紅支付的變化來評估公司的分紅績效。RPC的每股分紅支付近10年來平均以8.8%的年度速度下降,這令人失望。雖然近年來每股收益和股息下降並不是好事,但我們對管理層削減股息而不是冒險地試圖維持向股東支付收益的姿態感到鼓舞。

Final Takeaway

最後的結論

Is RPC an attractive dividend stock, or better left on the shelf? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. All things considered, we are not particularly enthused about RPC from a dividend perspective.

RPC是一個有吸引力的分紅股嗎?還是最好放在架子上?每股收益顯著下降,儘管至少公司支付了較低且保守的百分比的收益和現金流。業績下降肯定不是好事,但至少在分紅需要削減之前可能還有一些緩衝。我們從分紅角度來看RPC並不特別感興趣。

So while RPC looks good from a dividend perspective, it's always worthwhile being up to date with the risks involved in this stock. Our analysis shows 2 warning signs for RPC and you should be aware of these before buying any shares.

因此,雖然RPC從股息角度來看是不錯的,但了解這種股票所涉及的風險是值得的。我們的分析顯示RPC存在2個警告信號,您在購買任何股票之前都應該了解這些信號。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般來說,我們不建議僅僅購買第一個股息股票。下面是一個經過策劃的有趣的、股息表現良好的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。