Rapid Yen Appreciation: Key Factors Boosting JPY

Rapid Yen Appreciation: Key Factors Boosting JPY

By RoboForex Analytical Department

由RoboForex分析部門提供

The Japanese yen continues its recovery rally. The USD/JPY pair falls to 143.38 on Monday.

日幣持續上漲。週一美元/日元下跌至143.38。

This development is likely only the midpoint of the process as the market regains past losses and brings the JPY to equilibrium. USD/JPY is currently at its lowest level since 3 January.

這一發展很可能只是市場尋求平衡、恢復過去損失的中間階段。美元/日元目前處於自1月3日以來的最低水平。

Several reasons are driving this movement. The first is the winding down of carry trade operations on the yen. The process started earlier when it became clear that the Bank of Japan was moving towards tightening monetary conditions.

有幾個原因推動了這次行動。首先,人民幣抵押交易正在收尾階段。當日本銀行開始收緊貨幣政策時,這個過程就已經開始了。

The second concern is that a US recession is playing an important role. Friday's employment data was weaker than expected, triggering fears that the Federal Reserve might delay its decision on interest rate cuts. The market is worried the Fed could be late in making a crucial decision.

第二個原因是美國經濟衰退正在發揮重要作用。週五的就業數據低於預期,引發了聯邦儲備委員會可能推遲減息決定的擔憂。市場擔心聯邦儲備委員會可能遲遲未能作出關鍵決策。

The third key factor for the JPY is the increased attractiveness of the yen as a safe-haven asset amid escalating geopolitical tensions in the Middle East. The ongoing conflict in the region poses a hypothetical threat to global stability, and investors are factoring in this risk and favouring safe-haven assets.

JPY的第三個關鍵因素是隨着中東地緣政治緊張局勢升級,日元作爲避險資產的吸引力增加。該地區持續的衝突對全球穩定構成假設性威脅,投資者正在考慮這種風險並偏愛避險資產。

Technical Analysis: USD/JPY

技術面分析:美元/日元

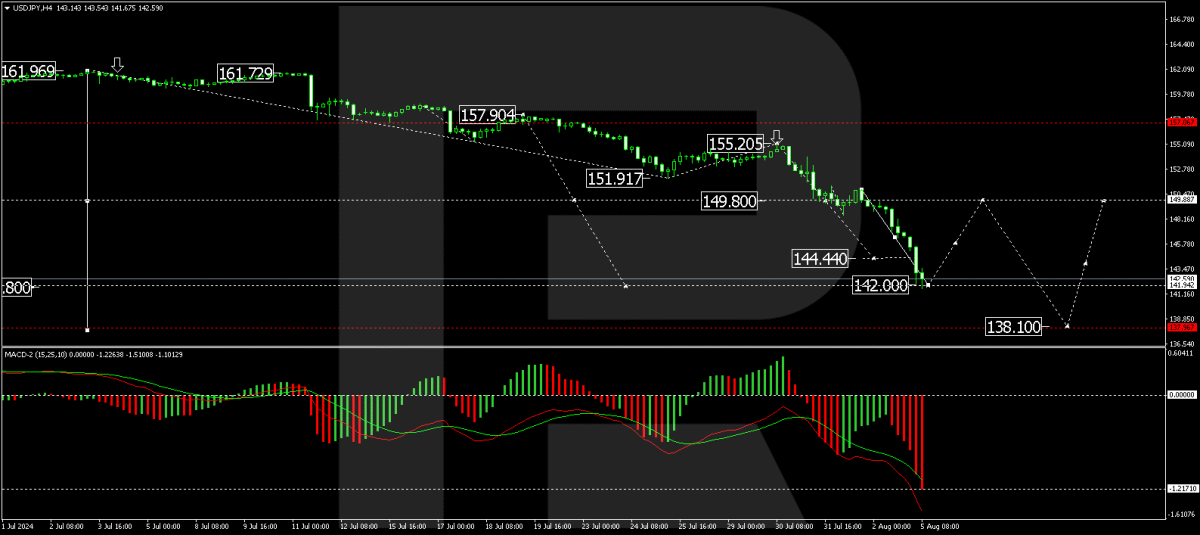

The USD/JPY pair formed a consolidation range of around 149.80 before breaking downwards on impactful news. The decline reached 142.00, setting a local low. We anticipate a new consolidation phase above this level. An upward break could see a corrective move towards 149.80. Conversely, a downward exit might extend losses towards 138.10. The MACD indicator supports this bearish outlook, showing continued downward momentum.

美元/日元對149.80左右的區間形成了一個鞏固區間,然後在重要消息的影響下向下突破。下跌達到了142.00,設定了一個局部低位。我們預計會在這個水平以上看到一個新的鞏固階段。向上的突破可能會看到一個向149.80的修正舉動。相反,向下的退出可能會將損失延伸至138.10。MACD指標支持這種看淡的前景,顯示持續的下行動能。

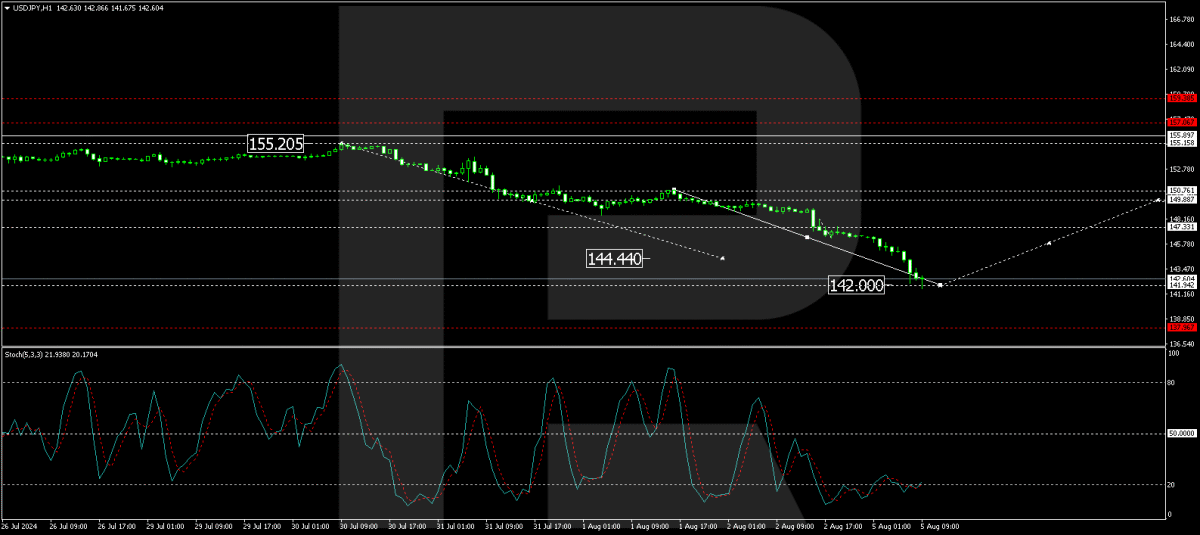

After reaching 142.00, a corrective phase to 147.33 may unfold, representing an intermediate target. Following this correction, a further decline to 144.66 could occur. This analysis aligns with the Stochastic oscillator, indicating a potential for an upward correction from oversold levels.

在達到142.00後,一個到147.33的修正階段可能會展開,代表中間目標。在這個修正之後,進一步下跌至144.66可能會發生。這個分析與隨機振盪器一致,表明有可能從超賣水平上升修正。

Disclaimer

免責聲明

Any forecasts contained herein are based on the author's particular opinion. This analysis may not be treated as trading advice. RoboForex bears no responsibility for trading results based on trading recommendations and reviews contained herein.

本分析僅代表作者個人觀點,不得視爲交易建議。RoboForex不承擔基於本文所含交易建議和評論所產生的任何交易結果的責任。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文來自非報酬的外部投稿人。它不代表Benzinga的報道,並且沒有因爲內容或準確性而被編輯。

Several reasons are driving this movement. The first is the winding down of carry trade operations on the yen. The process started earlier when it became clear that the Bank of Japan was moving towards tightening monetary conditions.

Several reasons are driving this movement. The first is the winding down of carry trade operations on the yen. The process started earlier when it became clear that the Bank of Japan was moving towards tightening monetary conditions.