Behind the Scenes of Danaher's Latest Options Trends

Behind the Scenes of Danaher's Latest Options Trends

Financial giants have made a conspicuous bullish move on Danaher. Our analysis of options history for Danaher (NYSE:DHR) revealed 10 unusual trades.

金融巨頭對丹納赫的樂觀行動非常明顯。我們對丹納赫(NYSE:DHR)期權歷史進行分析發現了10筆不同尋常的交易。

Delving into the details, we found 60% of traders were bullish, while 10% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $1,950,976, and 2 were calls, valued at $75,645.

深入了解細節,我們發現60%的交易員看漲,而10%的交易員顯示出看跌傾向。我們發現所有交易中,有8個看跌,總價值爲$1,950,976,2個看漲,總價值爲$75,645。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $260.0 and $280.0 for Danaher, spanning the last three months.

在評估交易量和持倉量後,明顯看出主要市場動向正在關注丹納赫的$260.0到$280.0的價格帶,跨越了過去三個月。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

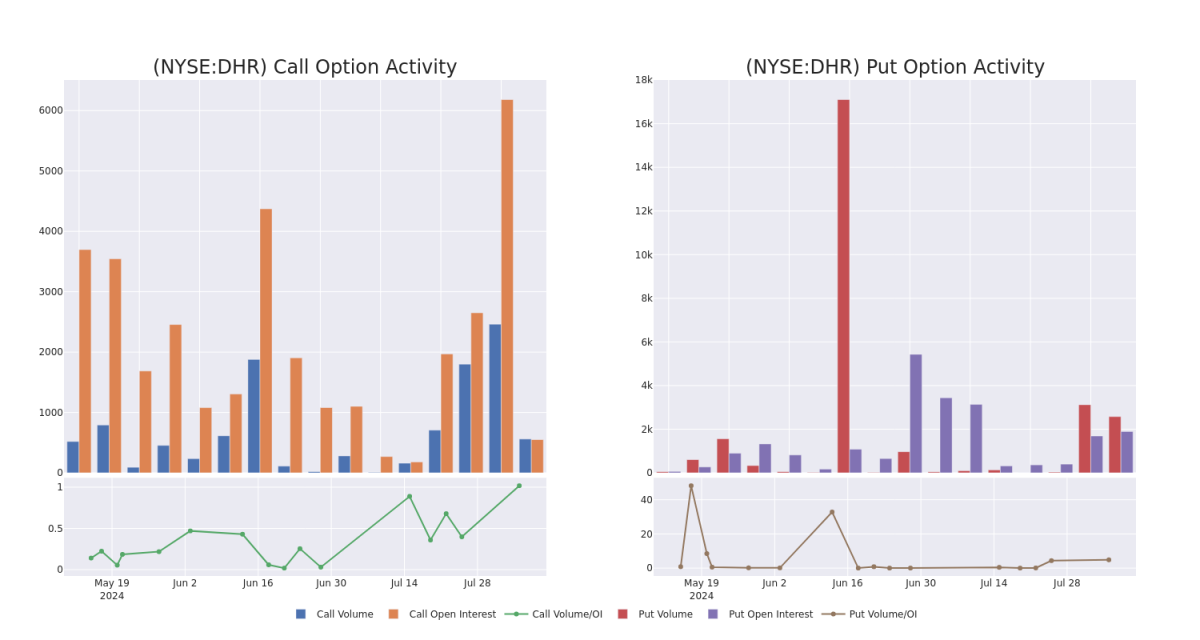

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Danaher's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Danaher's whale trades within a strike price range from $260.0 to $280.0 in the last 30 days.

在交易期權時,考慮成交量和持倉量是重要的一步。這些數據可以幫助您追蹤給定行權價的丹納赫期權的流動性和興趣。以下是我們觀察所有丹納赫的主要交易中$260.0到$280.0行權價區間內看跌和看漲期權的成交量和持倉量的演變情況,時間跨度爲30天。

Danaher Option Activity Analysis: Last 30 Days

丹納赫期權活動分析:最近30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | PUT | TRADE | BULLISH | 12/20/24 | $12.4 | $11.8 | $11.8 | $260.00 | $944.0K | 593 | 808 |

| DHR | PUT | SWEEP | BULLISH | 12/20/24 | $16.9 | $13.6 | $15.5 | $270.00 | $578.7K | 705 | 373 |

| DHR | PUT | TRADE | BULLISH | 10/18/24 | $17.4 | $16.7 | $16.7 | $280.00 | $93.5K | 409 | 203 |

| DHR | PUT | SWEEP | NEUTRAL | 10/18/24 | $17.4 | $16.8 | $17.1 | $280.00 | $92.7K | 409 | 147 |

| DHR | PUT | SWEEP | NEUTRAL | 10/18/24 | $17.4 | $16.6 | $16.6 | $280.00 | $91.3K | 409 | 37 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 丹納赫 | 看跌 | 交易 | 看好 | 12/20/24 | $12.4 | $11.8 | $11.8 | $260.00 | $944.0千美元 | 593 | 808 |

| 丹納赫 | 看跌 | SWEEP | 看好 | 12/20/24 | 16.9美元 | 13.6美元 | $15.5 | $270.00 | $578.7千美元 | 705 | 373 |

| 丹納赫 | 看跌 | 交易 | 看好 | 10/18/24 | $17.4 | $16.7 | $16.7 | $280.00 | $93.5K | 409 | 203 |

| 丹納赫 | 看跌 | SWEEP | 中立 | 10/18/24 | $17.4 | $16.8 | $17.1 | $280.00 | $92.7K | 409 | 147 |

| 丹納赫 | 看跌 | SWEEP | 中立 | 10/18/24 | $17.4 | $16.6 | $16.6 | $280.00 | $91.3K | 409 | 37 |

About Danaher

關於丹納赫

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

1984年,丹納赫的創始人將一個房地產組織轉變成了一家以製造業爲重點的製造公司。通過一系列的併購和剝離,丹納赫現在主要專注於在生命科學和診斷行業製造科學儀器和消耗品,其環保和應用解決方案集團Veralto在2023年末進行了分拆。

In light of the recent options history for Danaher, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到丹納赫最近的期權歷史,現在集中關注公司本身是合適的。我們旨在探討其當前的業績表現。

Current Position of Danaher

丹納赫的當前位置

- With a volume of 810,223, the price of DHR is down -3.07% at $268.26.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 78 days.

- 成交量爲810,223手,DHR股價下跌3.07%,報268.26美元。

- RSI指標暗示該股票可能要超買了。

- 下一個業績預計將在78天內發佈。

What Analysts Are Saying About Danaher

關於丹納赫,市場專家們的看法如下

5 market experts have recently issued ratings for this stock, with a consensus target price of $280.0.

近期有5位市場專家對這隻股票進行了評級,一致目標價爲$280.0。

- An analyst from TD Cowen has decided to maintain their Buy rating on Danaher, which currently sits at a price target of $310.

- An analyst from Leerink Partners has decided to maintain their Outperform rating on Danaher, which currently sits at a price target of $280.

- Maintaining their stance, an analyst from B of A Securities continues to hold a Neutral rating for Danaher, targeting a price of $275.

- An analyst from Barclays has decided to maintain their Equal-Weight rating on Danaher, which currently sits at a price target of $285.

- Maintaining their stance, an analyst from Stifel continues to hold a Hold rating for Danaher, targeting a price of $250.

- TD Cowen的一位分析師決定維持對丹納赫的買入評級,目前目標價爲$310。

- Leerink Partners的一位分析師決定維持對丹納赫的跑贏市場評級,目前目標價爲$280。

- 一位來自美國銀行證券的分析師繼續持有對丹納赫的中立評級,並將目標價定爲$275。

- 巴克萊銀行的一位分析師決定維持對丹納赫的平權重量評級,目前目標價爲$285。

- Stifel的一位分析師繼續持有對丹納赫的持有評級,並將目標價定爲$250。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Danaher with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子以及保持對市場動態的關注來降低這些風險。使用Benzinga Pro實時警報來跟蹤丹納赫的最新期權交易。

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Danaher's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Danaher's whale trades within a strike price range from $260.0 to $280.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Danaher's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Danaher's whale trades within a strike price range from $260.0 to $280.0 in the last 30 days.