Valero Energy Unusual Options Activity

Valero Energy Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bullish stance on Valero Energy.

有大量資金可支配的鯨魚已對瓦萊羅能源持有明顯的看好態度。

Looking at options history for Valero Energy (NYSE:VLO) we detected 9 trades.

查看瓦萊羅能源(紐交所:VLO)期權歷史記錄,我們發現9筆交易。

If we consider the specifics of each trade, it is accurate to state that 44% of the investors opened trades with bullish expectations and 44% with bearish.

如果我們考慮每次交易的具體情況,準確地說,44%的投資者帶着看好的預期開啓了交易,而44%則是看淡的。

From the overall spotted trades, 6 are puts, for a total amount of $1,514,825 and 3, calls, for a total amount of $210,038.

從所有被發現的交易中,有6筆看跌,總計金額爲$1,514,825 和 3筆看漲,總計金額爲$210,038。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $55.0 to $155.0 for Valero Energy over the recent three months.

根據交易活動,重要投資者似乎瞄準了最近三個月內瓦萊羅能源價格區間在$55.0到$155.0之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

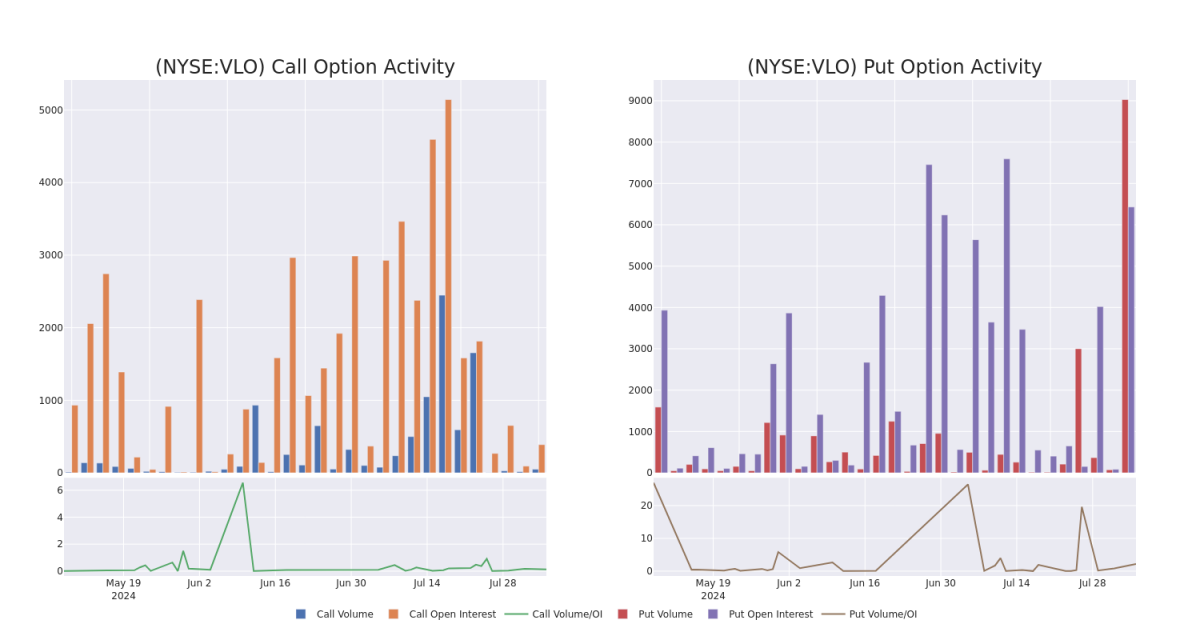

In terms of liquidity and interest, the mean open interest for Valero Energy options trades today is 1136.5 with a total volume of 9,076.00.

就流動性和利潤而言,今天瓦萊羅能源期權的平均持倉量爲1136.5手,總成交量爲9,076.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Valero Energy's big money trades within a strike price range of $55.0 to $155.0 over the last 30 days.

在以下圖表中,我們可以跟蹤瓦萊羅能源在$55.0到$155.0罷工價區間內看跌和看漲期權的成交量和持倉量的發展情況,這些都是大手交易。過去30天內。

Valero Energy 30-Day Option Volume & Interest Snapshot

瓦萊羅能源30天期權成交量和未平倉合約快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | PUT | SWEEP | BULLISH | 08/16/24 | $5.3 | $4.9 | $5.0 | $145.00 | $503.7K | 5.3K | 1.0K |

| VLO | PUT | SWEEP | BULLISH | 08/16/24 | $4.9 | $4.85 | $4.9 | $145.00 | $484.6K | 5.3K | 1.8K |

| VLO | PUT | SWEEP | BULLISH | 08/16/24 | $4.25 | $4.1 | $4.25 | $145.00 | $364.4K | 5.3K | 2.9K |

| VLO | CALL | SWEEP | BEARISH | 10/18/24 | $10.85 | $10.8 | $10.85 | $145.00 | $156.1K | 35 | 0 |

| VLO | PUT | TRADE | BEARISH | 08/09/24 | $4.2 | $4.0 | $4.2 | $148.00 | $63.0K | 328 | 158 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VLO | 看跌 | SWEEP | 看好 | 08/16/24 | $5.3 | $4.9 | $5.0 | $145.00 | $503.7K | 5.3K | 1.0K |

| VLO | 看跌 | SWEEP | 看好 | 08/16/24 | $4.9 | $4.85 | $4.9 | $145.00 | $484.6K | 5.3K | 1.8K |

| VLO | 看跌 | SWEEP | 看好 | 08/16/24 | $4.25 | $4.1 | $4.25 | $145.00 | $364.4K | 5.3K | 2.9K |

| VLO | 看漲 | SWEEP | 看淡 | 10/18/24 | $10.85 | $10.8 | $10.85 | $145.00 | $156.1千美元 | 35 | 0 |

| VLO | 看跌 | 交易 | 看淡 | 08/09/24 | $4.2 | $4.0 | $4.2 | $148.00 | $63.0K | 328 | 158 |

About Valero Energy

關於瓦萊羅能源

Valero Energy is one of the largest independent refiners in the United States. It operates 15 refineries, with a total throughput capacity of 3.2 million barrels a day in the US, Canada, and the United Kingdom. Valero also owns 12 ethanol plants with capacity of 1.6 billion gallons a year and holds a 50% stake in Diamond Green Diesel, which has the capacity to produce 1.2 billion gallons per year of renewable diesel.

瓦萊羅能源是美國最大的獨立精煉公司之一。在美國、加拿大和英國經營15個煉油廠,總通過能力達到320萬桶/日。瓦萊羅還擁有12個乙醇工廠,年產能達16億加侖,並持有Diamond Green Diesel的50%股權,Diamond Green Diesel的可再生柴油產能爲12億加侖/年。

In light of the recent options history for Valero Energy, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於瓦萊羅能源最近的期權歷史,現在適當集中關注公司本身。我們旨在探索它的當前表現。

Present Market Standing of Valero Energy

瓦萊羅能源的當前市場地位

- Trading volume stands at 1,055,449, with VLO's price down by -2.4%, positioned at $145.0.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 80 days.

- 交易量爲1,055,449手,VLO的價格下跌-2.4%,位於$145.0。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計80天后公佈收益報告。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Valero Energy options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和更大的潛在回報。敏銳的交易員通過不斷學習、調整策略、監控多個因子以及密切關注市場動向來管理這些風險。通過Benzinga Pro實時提示了解最新的瓦萊羅能源期權交易情況。

From the overall spotted trades, 6 are puts, for a total amount of $1,514,825 and 3, calls, for a total amount of $210,038.

From the overall spotted trades, 6 are puts, for a total amount of $1,514,825 and 3, calls, for a total amount of $210,038.