Morgan Stanley's Options Frenzy: What You Need to Know

Morgan Stanley's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on Morgan Stanley. Our analysis of options history for Morgan Stanley (NYSE:MS) revealed 17 unusual trades.

金融巨頭對摩根士丹利看漲動作異常明顯。我們對摩根士丹利(NYSE:MS)期權歷史分析後發現17次飛凡交易。

Delving into the details, we found 35% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $494,379, and 9 were calls, valued at $519,651.

具體來看,我們發現35%的交易者看好摩根士丹利,而另外35%則持看淡態度。我們監測到的所有交易中,有8次看跌,價值爲$494,379,另有9次看漲,價值爲$519,651。

Predicted Price Range

預測價格區間

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $85.0 to $105.0 for Morgan Stanley during the past quarter.

對這些合約中的成交量和未平倉量進行分析,似乎大型投資者注視着摩根士丹利在過去一個季度內價格介於$85.0至$105.0之間的區間窗口。

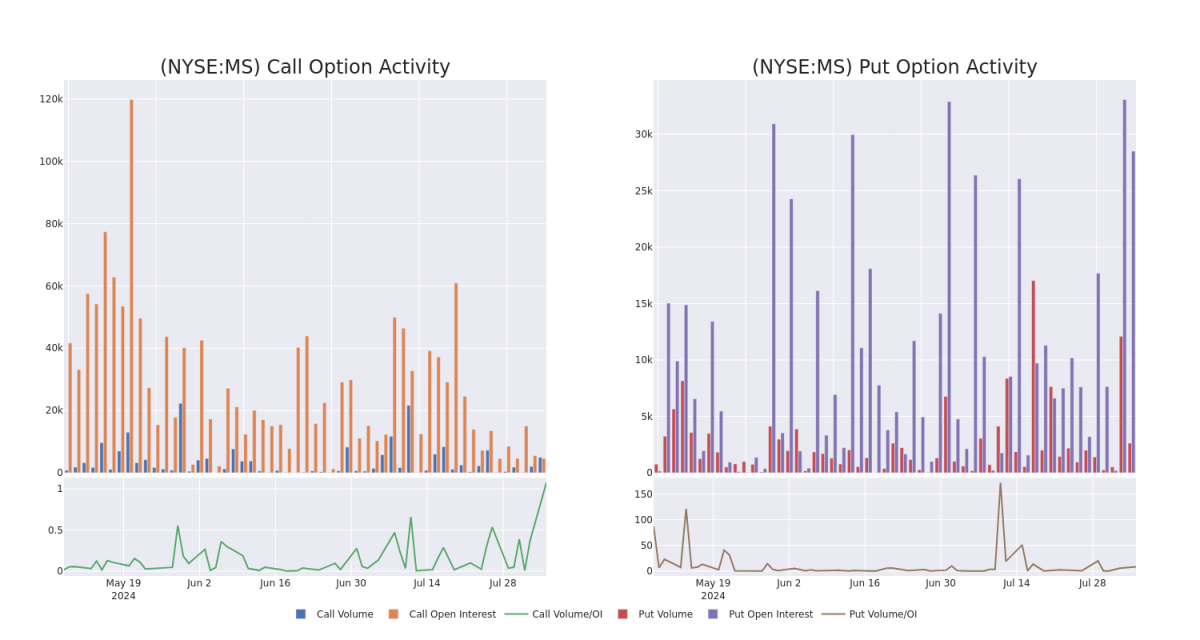

Volume & Open Interest Trends

成交量和未平倉量趨勢

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Morgan Stanley's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Morgan Stanley's significant trades, within a strike price range of $85.0 to $105.0, over the past month.

檢查成交量和未平倉量可以爲股票研究提供重要的見解。這些信息對於衡量摩根士丹利某些行權價下的期權的流動性和興趣水平非常關鍵。下面我們展示了過去一個月摩根士丹利在$85.0至$105.0行權價區間內的看漲和看跌期權的成交量和未平倉量趨勢的快照。

Morgan Stanley Call and Put Volume: 30-Day Overview

摩根士丹利看漲和看跌期權成交量: 30天概覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | SWEEP | BEARISH | 12/19/25 | $7.25 | $7.15 | $7.15 | $105.00 | $137.9K | 328 | 216 |

| MS | PUT | TRADE | BULLISH | 09/20/24 | $2.14 | $2.05 | $2.05 | $85.00 | $102.5K | 3.4K | 686 |

| MS | PUT | TRADE | BEARISH | 09/20/24 | $12.75 | $12.4 | $12.75 | $105.00 | $94.3K | 3.9K | 88 |

| MS | CALL | SWEEP | BEARISH | 09/20/24 | $4.6 | $4.55 | $4.55 | $92.50 | $93.2K | 1.1K | 598 |

| MS | PUT | TRADE | BEARISH | 09/20/24 | $2.12 | $2.01 | $2.09 | $85.00 | $83.6K | 3.4K | 1.0K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | 看漲 | SWEEP | 看淡 | 2025年12月19日 | $7.25 | $7.15 | $7.15 | $105.00 | $137.9K | 328 | 216 |

| MS | 看跌 | 交易 | 看好 | 09/20/24 | $2.14 | $2.05 | $2.05 | $85.00 | $102.5千美元 | 3.4千 | 686 |

| MS | 看跌 | 交易 | 看淡 | 09/20/24 | $12.75 | $12.4 | $12.75 | $105.00 | $94.3K | 3.9K | 88 |

| MS | 看漲 | SWEEP | 看淡 | 09/20/24 | $4.6 | 4.55 | 4.55 | 92.50美元 | $93.2K | 1.1千 | 598 |

| MS | 看跌 | 交易 | 看淡 | 09/20/24 | $2.12 | $2.01 | $2.09 | $85.00 | $83.6K | 3.4千 | 1.0K |

About Morgan Stanley

關於摩根士丹利

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

摩根士丹利是一家全球投資銀行,其歷史可以追溯到1924年通過其前身公司。該公司具有機構證券、财富管理和投資管理業務,約45%的淨收入來自於機構證券業務,45%來自於财富管理業務,10%來自於投資管理業務。該公司的總收入中約30%來自美洲以外的地區。該公司在2023年底客戶資產約5萬億美元,員工約8萬人。

Having examined the options trading patterns of Morgan Stanley, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了摩根士丹利的期權交易模式後,我們的注意力現在直接轉向該公司。這一轉變使我們可以深入了解其當前的市場地位和表現。

Where Is Morgan Stanley Standing Right Now?

摩根士丹利當前的交易量爲4,022,163,其價格下跌了-2.79%,目前爲$93.18。

- Currently trading with a volume of 4,022,163, the MS's price is down by -2.79%, now at $93.18.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 72 days.

- 當前成交量爲4,022,163,摩根士丹利的股價下跌2.79%,目前爲93.18美元。

- RSI讀數表明該股票目前可能被超賣。

- 預計的盈利發佈還有72天。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。