Decoding Occidental Petroleum's Options Activity: What's the Big Picture?

Decoding Occidental Petroleum's Options Activity: What's the Big Picture?

Deep-pocketed investors have adopted a bearish approach towards Occidental Petroleum (NYSE:OXY), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in OXY usually suggests something big is about to happen.

財力雄厚的投資者對西方石油公司(紐約證券交易所代碼:OXY)採取了看跌態度,這是市場參與者不容忽視的。我們對本辛加公開期權記錄的追蹤今天揭示了這一重大舉措。這些投資者的身份仍然未知,但是OXY的如此實質性的變動通常表明大事即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 20 extraordinary options activities for Occidental Petroleum. This level of activity is out of the ordinary.

我們今天從觀察中收集了這些信息,當時Benzinga的期權掃描儀重點介紹了西方石油公司的20項非同尋常的期權活動。這種活動水平與衆不同。

The general mood among these heavyweight investors is divided, with 30% leaning bullish and 60% bearish. Among these notable options, 12 are puts, totaling $503,625, and 8 are calls, amounting to $278,110.

這些重量級投資者的總體情緒存在分歧,30%的人傾向於看漲,60%的人看跌。在這些值得注意的期權中,有12個是看跌期權,總額爲503,625美元,8個是看漲期權,總額爲278,110美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $50.0 to $67.5 for Occidental Petroleum over the recent three months.

根據交易活動,看來重要投資者的目標是在最近三個月中將西方石油的價格區間從50.0美元擴大到67.5美元。

Analyzing Volume & Open Interest

分析交易量和未平倉合約

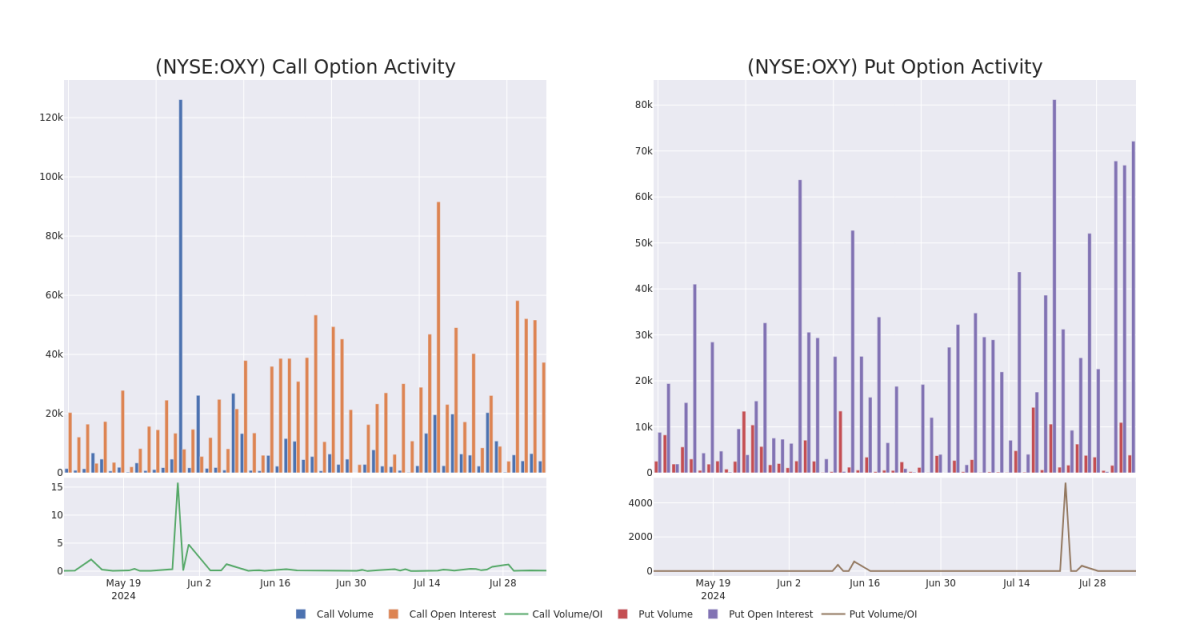

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Occidental Petroleum's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Occidental Petroleum's substantial trades, within a strike price spectrum from $50.0 to $67.5 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了西方石油公司在指定行使價下期權的流動性和投資者興趣。即將發佈的數據可視化了與西方石油公司大量交易相關的看漲期權和看跌期權交易量和未平倉合約的波動,行使價在前30天從50.0美元到67.5美元不等。

Occidental Petroleum Option Activity Analysis: Last 30 Days

西方石油期權活動分析:過去 30 天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | PUT | SWEEP | BEARISH | 09/20/24 | $5.1 | $5.0 | $5.1 | $60.00 | $104.0K | 16.7K | 161 |

| OXY | PUT | TRADE | NEUTRAL | 08/16/24 | $4.5 | $4.4 | $4.45 | $60.00 | $51.1K | 18.3K | 538 |

| OXY | PUT | TRADE | BEARISH | 06/20/25 | $4.9 | $4.7 | $4.9 | $55.00 | $49.0K | 8.8K | 107 |

| OXY | CALL | SWEEP | BULLISH | 09/20/24 | $0.53 | $0.52 | $0.53 | $62.50 | $47.7K | 25.2K | 1.6K |

| OXY | CALL | SWEEP | BULLISH | 09/20/24 | $2.14 | $2.1 | $2.14 | $57.50 | $42.8K | 3.2K | 592 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| OXY | 放 | 掃 | 粗魯的 | 09/20/24 | 5.1 美元 | 5.0 美元 | 5.1 美元 | 60.00 美元 | 104.0 萬美元 | 16.7K | 161 |

| OXY | 放 | 貿易 | 中立 | 08/16/24 | 4.5 美元 | 4.4 美元 | 4.45 美元 | 60.00 美元 | 51.1 萬美元 | 18.3K | 538 |

| OXY | 放 | 貿易 | 粗魯的 | 06/20/25 | 4.9 美元 | 4.7 美元 | 4.9 美元 | 55.00 美元 | 49.0 萬美元 | 8.8K | 107 |

| OXY | 打電話 | 掃 | 看漲 | 09/20/24 | 0.53 美元 | 0.52 美元 | 0.53 美元 | 62.50 美元 | 47.7 萬美元 | 25.2K | 1.6K |

| OXY | 打電話 | 掃 | 看漲 | 09/20/24 | 2.14 美元 | 2.1 美元 | 2.14 美元 | 57.50 美元 | 42.8 萬美元 | 3.2K | 592 |

About Occidental Petroleum

關於西方石油公司

Occidental Petroleum is an independent exploration and production company with operations in the United States, Latin America, and the Middle East. At the end of 2023, the company reported net proved reserves of nearly 4 billion barrels of oil equivalent. Net production averaged 1,234 thousand barrels of oil equivalent per day in 2023 at a ratio of roughly 50% oil and natural gas liquids and 50% natural gas.

西方石油公司是一家獨立的勘探和生產公司,業務遍及美國、拉丁美洲和中東。截至2023年底,該公司報告的淨探明儲量爲近40億桶石油當量。2023 年日均淨產量爲 12.4 萬桶石油當量,比例約爲 50% 的液化石油和天然氣以及 50% 的天然氣。

Having examined the options trading patterns of Occidental Petroleum, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了西方石油公司的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Present Market Standing of Occidental Petroleum

西方石油目前的市場地位

- Trading volume stands at 8,160,068, with OXY's price down by -2.13%, positioned at $56.44.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 2 days.

- 交易量爲8,160,068美元,OXY的價格下跌了-2.13%,至56.44美元。

- RSI指標顯示該股可能被超賣。

- 預計將在2天后公佈業績。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Occidental Petroleum with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解西方石油公司的最新期權交易情況,獲取實時警報。