Looking At Texas Instruments's Recent Unusual Options Activity

Looking At Texas Instruments's Recent Unusual Options Activity

Whales with a lot of money to spend have taken a noticeably bearish stance on Texas Instruments.

Looking at options history for Texas Instruments (NASDAQ:TXN) we detected 26 trades.

If we consider the specifics of each trade, it is accurate to state that 23% of the investors opened trades with bullish expectations and 73% with bearish.

From the overall spotted trades, 23 are puts, for a total amount of $3,321,774 and 3, calls, for a total amount of $106,170.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $230.0 for Texas Instruments during the past quarter.

Analyzing Volume & Open Interest

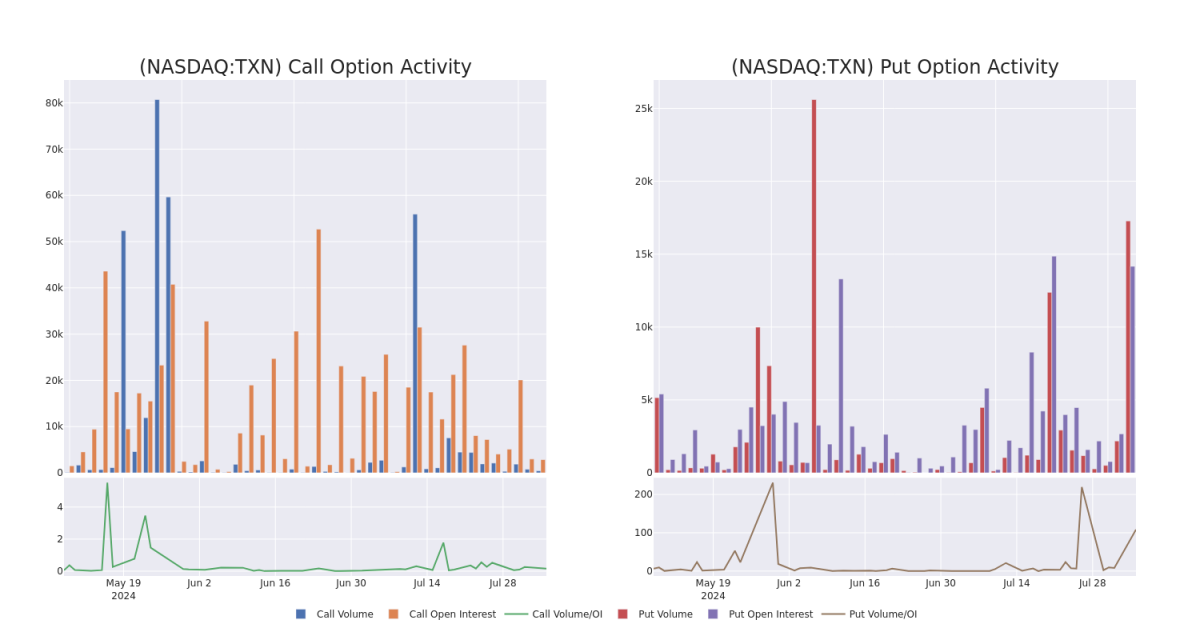

In today's trading context, the average open interest for options of Texas Instruments stands at 1546.91, with a total volume reaching 17,342.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Texas Instruments, situated within the strike price corridor from $95.0 to $230.0, throughout the last 30 days.

Texas Instruments 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | PUT | TRADE | BEARISH | 01/16/26 | $2.52 | $1.02 | $2.18 | $95.00 | $2.3M | 106 | 11.0K |

| TXN | PUT | SWEEP | BEARISH | 06/20/25 | $25.5 | $24.85 | $25.5 | $195.00 | $91.8K | 2.8K | 49 |

| TXN | PUT | SWEEP | BULLISH | 08/16/24 | $6.7 | $6.35 | $6.6 | $185.00 | $66.0K | 1.3K | 463 |

| TXN | PUT | SWEEP | BULLISH | 08/16/24 | $7.05 | $6.65 | $6.7 | $185.00 | $60.7K | 1.3K | 237 |

| TXN | PUT | TRADE | BEARISH | 01/17/25 | $6.75 | $6.35 | $6.6 | $160.00 | $51.4K | 4.7K | 158 |

About Texas Instruments

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

After a thorough review of the options trading surrounding Texas Instruments, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Present Market Standing of Texas Instruments

- Trading volume stands at 5,156,730, with TXN's price down by -3.63%, positioned at $180.65.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 78 days.

What Analysts Are Saying About Texas Instruments

In the last month, 5 experts released ratings on this stock with an average target price of $198.2.

- Consistent in their evaluation, an analyst from Stifel keeps a Hold rating on Texas Instruments with a target price of $200.

- An analyst from Morgan Stanley persists with their Underweight rating on Texas Instruments, maintaining a target price of $156.

- Consistent in their evaluation, an analyst from Susquehanna keeps a Positive rating on Texas Instruments with a target price of $250.

- An analyst from Jefferies persists with their Hold rating on Texas Instruments, maintaining a target price of $185.

- An analyst from Citigroup has decided to maintain their Neutral rating on Texas Instruments, which currently sits at a price target of $200.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Texas Instruments options trades with real-time alerts from Benzinga Pro.