Decoding Autodesk's Options Activity: What's the Big Picture?

Decoding Autodesk's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on Autodesk (NASDAQ:ADSK).

擁有大量資金的投資者對歐特克(NASDAQ:ADSK)採取了看淡態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with ADSK, it often means somebody knows something is about to happen.

這可能是機構或富有的個人,我們不知道。但是當ADSK出現這樣的大事件時,通常意味着某些人知道即將發生的事情。

Today, Benzinga's options scanner spotted 9 options trades for Autodesk.

今天,Benzinga的期權掃描器發現了9筆歐特剋期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 44% bullish and 55%, bearish.

這些大手交易商的總體情緒在看漲和看淡之間分爲44%和55%。

Out of all of the options we uncovered, 8 are puts, for a total amount of $538,813, and there was 1 call, for a total amount of $54,500.

在我們發現的所有期權中,有8個看淡期權,總金額爲538,813美元,還有1個看漲期權,總金額爲54,500美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $160.0 to $270.0 for Autodesk over the last 3 months.

考慮到這些合同的成交量和未平倉合約,過去3個月來鯨魚們似乎一直在瞄準歐特克的價格區間爲160.0至270.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

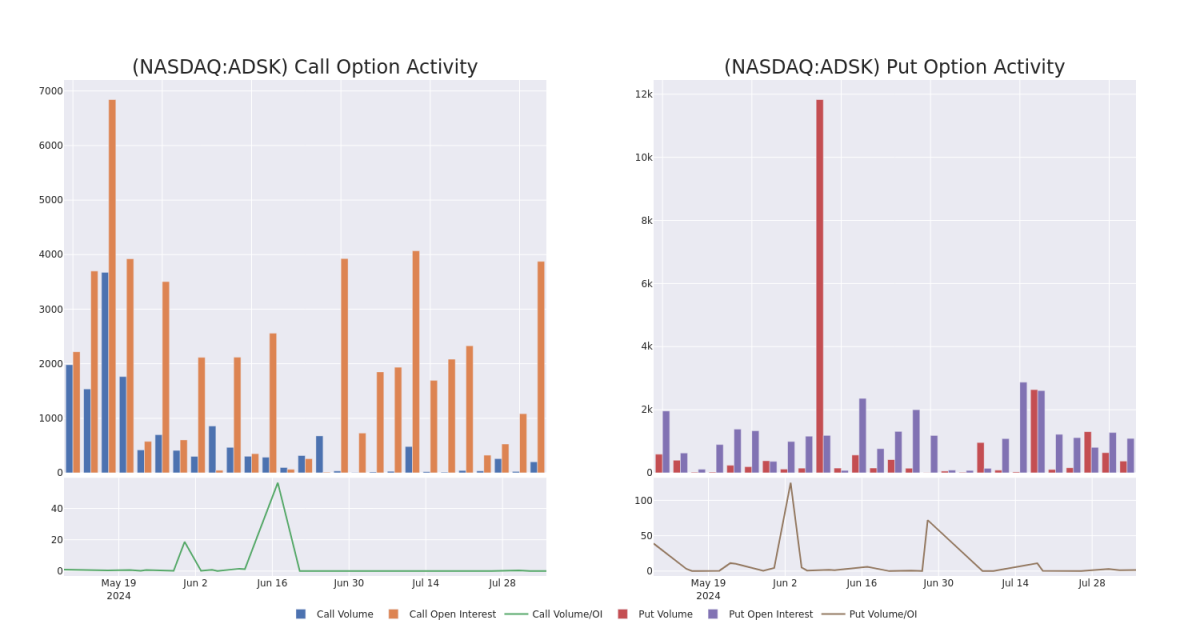

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Autodesk's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Autodesk's substantial trades, within a strike price spectrum from $160.0 to $270.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易的戰略步驟。這些指標揭示了在指定行權價格上,投資者對歐特剋期權的流動性和興趣。即將到來的數據可視化了過去30天內,涉及歐特克重大交易的看漲和看淡期權的成交量和未平倉合約在行權價爲160.0至270.0美元的範圍內的波動情況。

Autodesk Option Activity Analysis: Last 30 Days

歐特剋期權活動分析:過去30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADSK | PUT | SWEEP | BEARISH | 08/09/24 | $1.7 | $1.7 | $1.7 | $227.50 | $112.2K | 5 | 662 |

| ADSK | PUT | SWEEP | BEARISH | 01/16/26 | $9.2 | $6.2 | $9.2 | $160.00 | $91.9K | 107 | 100 |

| ADSK | PUT | SWEEP | BEARISH | 08/16/24 | $9.7 | $9.4 | $9.7 | $240.00 | $82.4K | 812 | 141 |

| ADSK | PUT | TRADE | BEARISH | 09/20/24 | $16.2 | $15.8 | $16.2 | $240.00 | $81.0K | 497 | 61 |

| ADSK | CALL | SWEEP | BULLISH | 01/17/25 | $11.0 | $10.9 | $10.9 | $270.00 | $54.5K | 1.9K | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 歐特克 | 看跌 | SWEEP | 看淡 | 08/09/24 | $1.7 | $1.7 | $1.7 | $227.50 | $112.2K | 5 | 662 |

| 歐特克 | 看跌 | SWEEP | 看淡 | 01/16/26 | $9.2 | $6.2 | $9.2 | $160.00 | $91.9K | 107 | 100 |

| 歐特克 | 看跌 | SWEEP | 看淡 | 08/16/24 | 9.7 | 9.4美元 | 9.7 | $240.00 | $82.4K | 812 | 141 |

| 歐特克 | 看跌 | 交易 | 看淡 | 09/20/24 | $16.2 | $15.8 | $16.2 | $240.00 | $81.0K | 497 | 61 |

| 歐特克 | 看漲 | SWEEP | 看好 | 01/17/25 | $11.0 | $10.9 | $10.9 | $270.00 | 54.5K美元 | 1.9K | 0 |

About Autodesk

關於Autodesk

Founded in 1982, Autodesk is an application software company that serves industries in architecture, engineering, and construction; product design and manufacturing; and media and entertainment. Autodesk software enables design, modeling, and rendering needs of these industries. The company has over 4 million paid subscribers across 180 countries.

歐特克成立於1982年,是一家應用軟件公司,爲建築、工程和施工行業;產品設計和製造業;以及媒體和娛樂行業提供服務。歐特克軟件滿足這些行業的設計、建模和渲染需求。該公司在180個國家擁有超過400萬的付費訂閱用戶。

Following our analysis of the options activities associated with Autodesk, we pivot to a closer look at the company's own performance.

在分析了與歐特克相關的期權活動之後,我們轉向更近距離地關注公司自身的業績。

Where Is Autodesk Standing Right Now?

歐特克現在處於什麼位置?

- Currently trading with a volume of 830,824, the ADSK's price is up by 2.56%, now at $231.5.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 23 days.

- 目前交易量爲830824的ADSK價格上漲了2.56%,現在爲231.5美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預期的收益發布還有23天。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Autodesk options trades with real-time alerts from Benzinga Pro.

期權交易具有較高的風險和潛在收益。聰明的交易者通過不斷學習、調整策略、監控多個因子並密切關注市場走勢來管理這些風險。通過Benzinga Pro實時提醒及時了解最新的歐特剋期權交易。