Unpacking the Latest Options Trading Trends in Target

Unpacking the Latest Options Trading Trends in Target

Financial giants have made a conspicuous bearish move on Target. Our analysis of options history for Target (NYSE:TGT) revealed 11 unusual trades.

針對Target,金融巨頭們採取了明顯的看淡態度。我們分析了Target (NYSE:TGT) 的期權歷史記錄,發現了11筆不尋常的交易。

Delving into the details, we found 36% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $162,123, and 6 were calls, valued at $482,318.

具體來看,我們發現36%的交易員看好,而45%的人表現出看淡的趨勢。在我們發現的所有交易中,有5次購買期權,價值爲162,123美元,6次賣出期權,價值爲482,318美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $130.0 to $155.0 for Target over the recent three months.

根據交易活動,看來重要的投資者們瞄準Target在最近三個月內的價格區間,從130.0美元至155.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

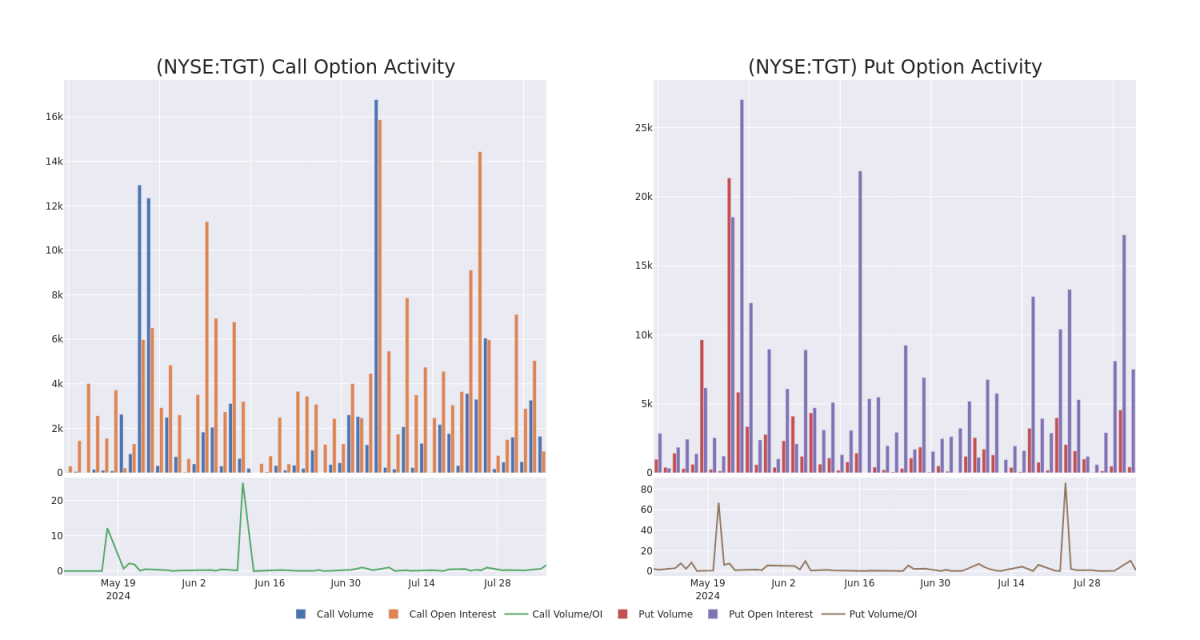

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Target's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Target's significant trades, within a strike price range of $130.0 to $155.0, over the past month.

分析成交量和持倉量爲股票研究提供了關鍵性的見解。這些信息對於評估某些行權價下Target期權的流動性和興趣水平非常重要。在下面,我們展示過去一個月內,Target在130.0美元至155.0美元行權價範圍內,期權購買和賣出的成交量和持倉量趨勢。

Target Option Volume And Open Interest Over Last 30 Days

Target過去30天期權成交量和持倉量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGT | CALL | TRADE | BEARISH | 09/06/24 | $9.3 | $9.2 | $9.2 | $130.00 | $230.0K | 1 | 250 |

| TGT | CALL | SWEEP | BULLISH | 10/18/24 | $11.5 | $11.35 | $11.5 | $130.00 | $63.4K | 32 | 330 |

| TGT | CALL | SWEEP | NEUTRAL | 10/18/24 | $11.8 | $11.2 | $11.64 | $130.00 | $62.1K | 32 | 275 |

| TGT | CALL | TRADE | BULLISH | 10/18/24 | $7.3 | $7.15 | $7.25 | $140.00 | $50.0K | 239 | 158 |

| TGT | CALL | SWEEP | BULLISH | 10/18/24 | $7.3 | $7.15 | $7.24 | $140.00 | $49.7K | 239 | 227 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TGT | 看漲 | 交易 | 看淡 | 09/06/24 | $9.3 | $9.2 | $9.2 | $130.00 | $230.0K | 1 | 250 |

| TGT | 看漲 | SWEEP | 看好 | 10/18/24 | $11.5 | $11.35 | $11.5 | $130.00 | $63.4K | 32 | 330 |

| TGT | 看漲 | SWEEP | 中立 | 10/18/24 | $11.8 | $11.2 | $11.64 | $130.00 | $62.1K | 32 | 275 |

| TGT | 看漲 | 交易 | 看好 | 10/18/24 | $7.3 | $7.15 | $7.25 | $140.00 | $50.0K | 239 | 158 |

| TGT | 看漲 | SWEEP | 看好 | 10/18/24 | $7.3 | $7.15 | $7.24 | $140.00 | $49.7K | 239 | 227 |

About Target

關於Target

Target serves as the nation's sixth-largest retailer, with its strategy predicated on delivering a gratifying in-store shopping experience and a wide product assortment of trendy apparel, home goods, and household essentials at competitive prices. Target's upscale and stylish image began to carry national merit in the 1990s—a decade in which the brand saw its top line grow threefold to almost $30 billion—and has since cemented itself as a leading US retailer.Today, Target operates over 1,950 stores in the United States, generates over $100 billion in sales, and fulfills over 2 billion customer orders annually. The firm's vast physical footprint is typically concentrated in urban and suburban markets as the firm seeks to attract a more affluent consumer base.

Target是美國第六大零售商,其戰略基於以競爭力的價格提供令人滿意的實體店購物體驗以及時尚服裝、家居用品和日用必需品的廣泛產品組合。90年代,Target的高檔和時尚形象開始在全國範圍內流行,品牌的收入增長了三倍,接近300億美元,自那時以來,Target已經成爲美國領先的零售商。今天,Target在美國運營超過1950家店鋪,年銷售額超過1000億美元,每年處理超過20億個客戶訂單。該公司的巨大實體店鋪通常集中在城市和郊區市場,旨在吸引更富裕的消費者基礎。

Following our analysis of the options activities associated with Target, we pivot to a closer look at the company's own performance.

在我們分析Target期權活動之後,我們轉向更近距離地關注該公司的表現。

Where Is Target Standing Right Now?

Target當前處於什麼位置?

- Currently trading with a volume of 1,684,118, the TGT's price is down by -0.38%, now at $133.36.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 15 days.

- 目前的交易量爲1,684,118,TGT的股價下跌了-0.38%,現在是133.36美元。

- RSI讀數表明該股票目前可能接近超賣狀態。

- 預計將於15天內發佈收益。

Expert Opinions on Target

關於Target的專家意見

3 market experts have recently issued ratings for this stock, with a consensus target price of $155.0.

最近有3名市場專家爲該股發出評級,看好該股的共識目標價爲155.0美元。

- Maintaining their stance, an analyst from Truist Securities continues to hold a Hold rating for Target, targeting a price of $156.

- Reflecting concerns, an analyst from Piper Sandler lowers its rating to Neutral with a new price target of $156.

- An analyst from JP Morgan has decided to maintain their Neutral rating on Target, which currently sits at a price target of $153.

- 保持原來的立場,Truist Securities的分析師繼續持有Target的持有評級,並以156美元的價格爲目標。

- 反映擔憂,Piper Sandler的分析師將其評級下調至中立,並設立了一個新的價格目標爲156美元。

- JP Morgan的分析師決定維持其對Target的中立評級,目前的價格目標爲153美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Target options trades with real-time alerts from Benzinga Pro.

期權交易存在較高的風險和潛在回報。精明的交易員通過不斷學習、調整策略、監控多個因子和密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報了解最新的Target期權交易信息。