Goldman Sachs Gr Options Trading: A Deep Dive Into Market Sentiment

Goldman Sachs Gr Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bearish move on Goldman Sachs Gr. Our analysis of options history for Goldman Sachs Gr (NYSE:GS) revealed 24 unusual trades.

金融巨頭們對高盛集團採取了明顯的看淡策略。我們對高盛集團(NYSE:GS)的期權歷史分析顯示了24筆不尋常的交易。

Delving into the details, we found 29% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $854,852, and 9 were calls, valued at $1,430,676.

深入了解後,我們發現29%的交易者看漲,而45%的交易者表現出看淡的趨勢。我們所發現的所有交易中,有15個看跌期權,價值爲854,852美元,9個看漲期權,價值爲1,430,676美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $300.0 and $520.0 for Goldman Sachs Gr, spanning the last three months.

通過評估交易量和未平倉合約,很明顯,主要市場推動者正在關注高盛集團在過去三個月中在300.0美元至520.0美元的區間內的價格波動。

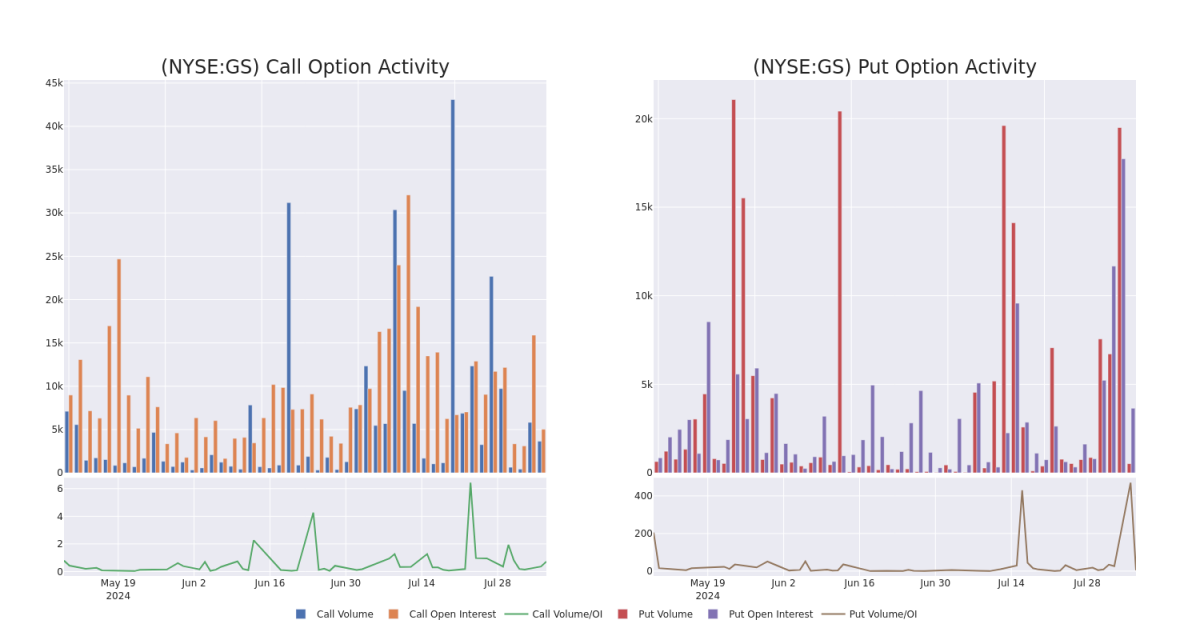

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

In terms of liquidity and interest, the mean open interest for Goldman Sachs Gr options trades today is 412.95 with a total volume of 4,159.00.

就流動性和利益而言,高盛集團期權交易今日的平均未平倉合約爲412.95,總成交量爲4,159.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Goldman Sachs Gr's big money trades within a strike price range of $300.0 to $520.0 over the last 30 days.

在下面的圖表中,我們可以跟蹤高盛集團大手交易中看漲和看跌期權的成交量和未平倉合約的發展情況,在300.0美元至520.0美元的行權價格區間內,覆蓋了過去30天。

Goldman Sachs Gr 30-Day Option Volume & Interest Snapshot

高盛集團30天期權成交量和利息快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GS | CALL | SWEEP | NEUTRAL | 09/20/24 | $44.8 | $44.75 | $44.75 | $430.00 | $492.2K | 723 | 112 |

| GS | CALL | SWEEP | BULLISH | 01/17/25 | $37.0 | $36.6 | $37.0 | $470.00 | $407.0K | 423 | 110 |

| GS | CALL | SWEEP | BEARISH | 08/16/24 | $9.95 | $9.8 | $9.8 | $470.00 | $190.6K | 628 | 241 |

| GS | PUT | SWEEP | NEUTRAL | 08/16/24 | $15.55 | $15.25 | $15.44 | $480.00 | $133.0K | 597 | 87 |

| GS | PUT | SWEEP | BULLISH | 10/18/24 | $28.6 | $27.8 | $28.0 | $475.00 | $103.4K | 85 | 92 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 高盛公司所有板塊成交量 | 看漲 | SWEEP | 中立 | 09/20/24 | $44.8 | $44.75 | $44.75 | $430.00 | $492.2K | 723 | 112 |

| 高盛公司所有板塊成交量 | 看漲 | SWEEP | 看好 | 01/17/25 | $37.0 | $ 36.6 | $37.0 | $470.00 | $407.0K | 423 | 110 |

| 高盛公司所有板塊成交量 | 看漲 | SWEEP | 看淡 | 08/16/24 | $9.95 | $9.8 | $9.8 | $470.00 | $190.6K | 628 | 241 |

| 高盛公司所有板塊成交量 | 看跌 | SWEEP | 中立 | 08/16/24 | $15.55 | $15.25 | $15.44 | 該公司的股票上週五收於$74.31。 | $133.0K | 597 | 87 |

| 高盛公司所有板塊成交量 | 看跌 | SWEEP | 看好 | 10/18/24 | $28.6 | $27.8 | $28.0 | $475.00 | $103.4K | 85 | 92 |

About Goldman Sachs Gr

高盛集團簡介

Goldman Sachs is a leading global investment banking and asset management firm. Approximately 20% of its revenue comes from investment banking, 45% from trading, 20% from asset management and 15% from wealth management and retail financial services. Around 60% of the company's net revenue is generated in the Americas, 15% in Asia, and 25% in Europe, the Middle East, and Africa.

高盛是一家領先的全球投資銀行和資產管理公司。約20%的營業收入來自投資銀行業務,45%來自交易業務,20%來自資產管理業務,15%來自财富管理和零售金融服務。公司約60%的淨營收來自美洲,15%來自亞洲,25%來自歐洲、中東和非洲。

Following our analysis of the options activities associated with Goldman Sachs Gr, we pivot to a closer look at the company's own performance.

在我們分析和關注高盛期權活動之後,我們轉向更近距離地關注公司的表現。

Present Market Standing of Goldman Sachs Gr

高盛集團的現有市場地位

- With a volume of 753,146, the price of GS is up 1.47% at $465.75.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 70 days.

- 股票交易量爲753,146,GS股價上漲1.47%,報465.75美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一輪的業績預計將在70天內發佈。

What Analysts Are Saying About Goldman Sachs Gr

分析師對高盛集團的看法

In the last month, 5 experts released ratings on this stock with an average target price of $527.4.

在過去一個月中,有5位專家對該股票發表了評級,平均目標價爲527.4美元。

- Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on Goldman Sachs Gr with a target price of $565.

- An analyst from RBC Capital persists with their Sector Perform rating on Goldman Sachs Gr, maintaining a target price of $500.

- Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for Goldman Sachs Gr, targeting a price of $513.

- An analyst from RBC Capital downgraded its action to Sector Perform with a price target of $500.

- An analyst from Oppenheimer has decided to maintain their Outperform rating on Goldman Sachs Gr, which currently sits at a price target of $559.

- 巴克萊銀行的分析師對高盛公司的看好評級一直保持一致,目標價爲 $565。

- 花旗集團的分析師堅持將高盛公司評爲中立,維持目標價爲$500。

- 維持他們的觀點,摩根士丹利的一位分析師繼續對高盛集團持有超配評級,目標價爲513美元。

- 一位RBC Capital的分析師將其行動下調爲板塊表現,價格目標爲500美元。

- Oppenheimer的分析師決定維持他們對高盛集團的跑贏大盤評級,目前的價格目標爲559美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Goldman Sachs Gr options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷教育自己、調整他們的策略、監控多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro即時獲得最新的高盛集團期權交易提醒,保持知情。