Behind the Scenes of Honeywell Intl's Latest Options Trends

Behind the Scenes of Honeywell Intl's Latest Options Trends

Financial giants have made a conspicuous bullish move on Honeywell Intl. Our analysis of options history for Honeywell Intl (NASDAQ:HON) revealed 10 unusual trades.

金融巨頭密集買入霍尼韋爾國際股票,看好其未來發展。我們對霍尼韋爾國際(NASDAQ:HON)期權歷史進行分析,發現出現了10個飛凡交易。

Delving into the details, we found 50% of traders were bullish, while 30% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $90,201, and 8 were calls, valued at $424,416.

細節中發現,50%的交易者看漲,30%的交易者看跌。在所有我們發現的交易中,有2個看跌期權,價值90201美元,有8個看漲期權,總價值爲424416美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $180.0 to $210.0 for Honeywell Intl over the recent three months.

根據交易活動,顯然有很多重要的投資者瞄準了霍尼韋爾國際的股價區間,即在最近三個月內股價從180.0美元到210.0美元。

Volume & Open Interest Trends

成交量和未平倉量趨勢

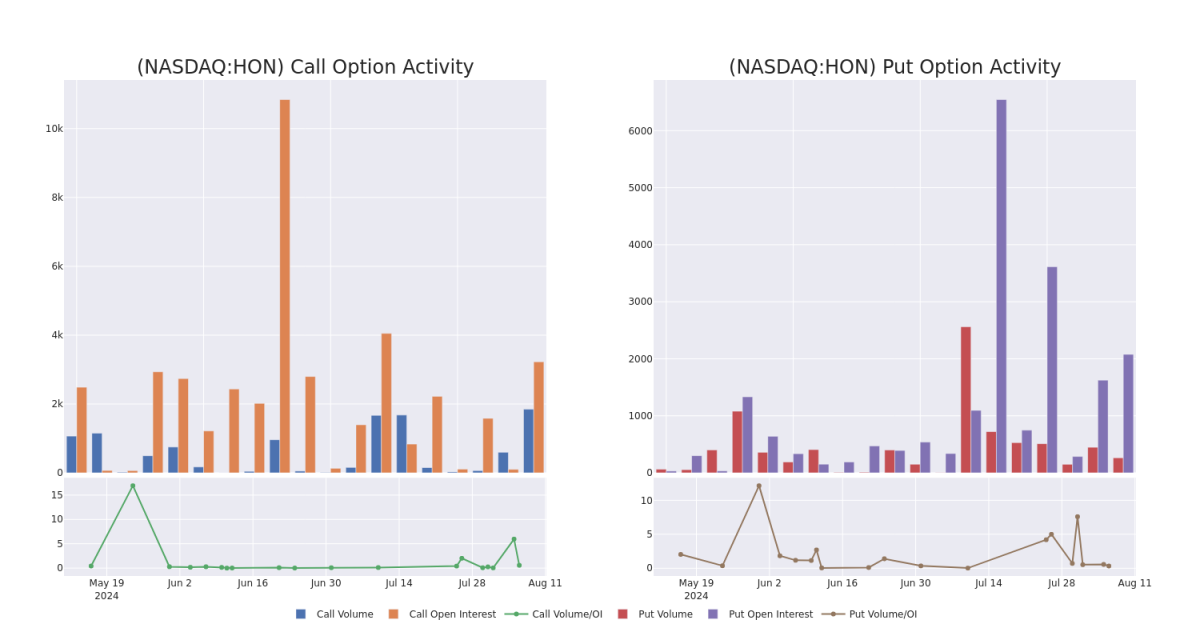

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Honeywell Intl's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Honeywell Intl's substantial trades, within a strike price spectrum from $180.0 to $210.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的必要步驟,這些指標可以揭示指定執行價格下霍尼韋爾國際期權的流動性和投資者興趣。這份即將公佈的數據可視化了最近30天霍尼韋爾國際成交量和持倉量的波動情況,並且涵蓋了$180.0到$210.0期權執行價格範圍內的看漲期權和看跌期權。

Honeywell Intl 30-Day Option Volume & Interest Snapshot

霍尼韋爾國際30天期權成交量和持倉量快照

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HON | CALL | SWEEP | NEUTRAL | 09/20/24 | $5.7 | $5.6 | $5.6 | $200.00 | $168.9K | 1.6K | 319 |

| HON | CALL | SWEEP | BEARISH | 12/20/24 | $7.4 | $7.1 | $7.4 | $210.00 | $63.6K | 460 | 144 |

| HON | PUT | SWEEP | BULLISH | 08/09/24 | $2.5 | $2.45 | $2.45 | $200.00 | $57.2K | 743 | 219 |

| HON | CALL | SWEEP | NEUTRAL | 09/20/24 | $5.8 | $5.6 | $5.6 | $200.00 | $48.7K | 1.6K | 501 |

| HON | CALL | TRADE | BULLISH | 08/16/24 | $3.2 | $2.95 | $3.1 | $200.00 | $38.7K | 954 | 145 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HON | 看漲 | SWEEP | 中立 | 09/20/24 | $5.7 | $5.6 | $5.6 | 。 | 168.9K | 1.6K | 319 |

| HON | 看漲 | SWEEP | 看淡 | 12/20/24 | $7.4 | $7.1 | $7.4 | 目標股價爲$210.00。 | $63.6K | 460 | 144 |

| HON | 看跌 | SWEEP | 看好 | 08/09/24 | $2.5 | $2.45 | $2.45 | 。 | $57.2K | 743 | 219 |

| HON | 看漲 | SWEEP | 中立 | 09/20/24 | $5.8 | $5.6 | $5.6 | 。 | $48.7K | 1.6K | 501 |

| HON | 看漲 | 交易 | 看好 | 08/16/24 | $3.2 | $2.95應翻譯爲$2.95 | $3.1 | 。 | $38.7K | 954 | 145 |

About Honeywell Intl

關於霍尼韋爾國際

Honeywell traces its roots to 1885 with Albert Butz's firm, Butz Thermo-Electric Regulator, which produced a predecessor to the modern thermostat. Other inventions by Honeywell include biodegradable detergent and autopilot. Today, Honeywell is a global multi-industry behemoth with one of the largest installed bases of equipment. It operates through four business segments: aerospace technologies (37% of 2023 company revenue), industrial automation (29%), energy and sustainability solutions (17%), and building automation (17%). Recently, Honeywell has made several portfolio changes to focus on fewer end markets and align with a set of secular growth trends. The firm is working diligently to expand its installed base, deriving 30% of its revenue from recurring aftermarket services.

霍尼韋爾公司起源於1885年的Albert Butz創立的公司Butz Thermo-Electric Regulator,該公司生產出前身是現代恒溫器的產品。霍尼韋爾的其他發明包括可生物降解的洗滌劑和自動駕駛儀。如今,霍尼韋爾是一家全球性的多行業巨頭,擁有最大規模的設備安裝基礎之一。它通過四個業務板塊運營:航空技術(2023年公司收入的37%),工業自動化(29%),能源和可持續解決方案(17%)以及建築自動化(17%)。最近,霍尼韋爾進行了幾次投資組合變化,以聚焦更少的終端市場,並與一系列長期增長趨勢保持一致。該公司正在努力擴大安裝基礎,從再生後市場服務中獲得30%的收入。

After a thorough review of the options trading surrounding Honeywell Intl, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在全面審查霍尼韋爾國際期權交易後,我們開始更詳細地檢查該公司的市場狀況和業績。

Where Is Honeywell Intl Standing Right Now?

霍尼韋爾國際現在處於什麼水平?

- With a volume of 1,931,931, the price of HON is up 0.65% at $201.0.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 79 days.

- 隨着成交量達到1931931股,HON的股價上漲0.65%,達到201.0美元。

- RSI指標暗示基礎股票可能接近超賣。

- 下一個業績預計將在79天內發佈。

Professional Analyst Ratings for Honeywell Intl

霍尼韋爾國際的專業分析師評級

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $216.33333333333334.

最近30天中,總共有3位專業分析師對這支股票發表了評論,並設定了平均目標價格爲216.33333333333334美元。

- Consistent in their evaluation, an analyst from RBC Capital keeps a Sector Perform rating on Honeywell Intl with a target price of $214.

- An analyst from Wells Fargo persists with their Equal-Weight rating on Honeywell Intl, maintaining a target price of $215.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Honeywell Intl, targeting a price of $220.

- RBC Capital的一位分析師堅持對霍尼韋爾國際保持業內表現評級,並設定了214美元的目標價格。

- Wells Fargo的一位分析師堅持保持霍尼韋爾國際的中性評級,目標價格爲215美元。

- Wells Fargo的一位分析師堅持保持霍尼韋爾國際的中性評級,目標價格爲220美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Honeywell Intl with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因素指標和保持對市場動態的關注來降低這些風險。通過Benzinga Pro獲取霍尼韋爾國際最新的期權交易,以獲得實時警報。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Honeywell Intl's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Honeywell Intl's substantial trades, within a strike price spectrum from $180.0 to $210.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Honeywell Intl's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Honeywell Intl's substantial trades, within a strike price spectrum from $180.0 to $210.0 over the preceding 30 days.