Analysts Just Published A Bright New Outlook For Espressif Systems (Shanghai) Co., Ltd.'s (SHSE:688018)

Analysts Just Published A Bright New Outlook For Espressif Systems (Shanghai) Co., Ltd.'s (SHSE:688018)

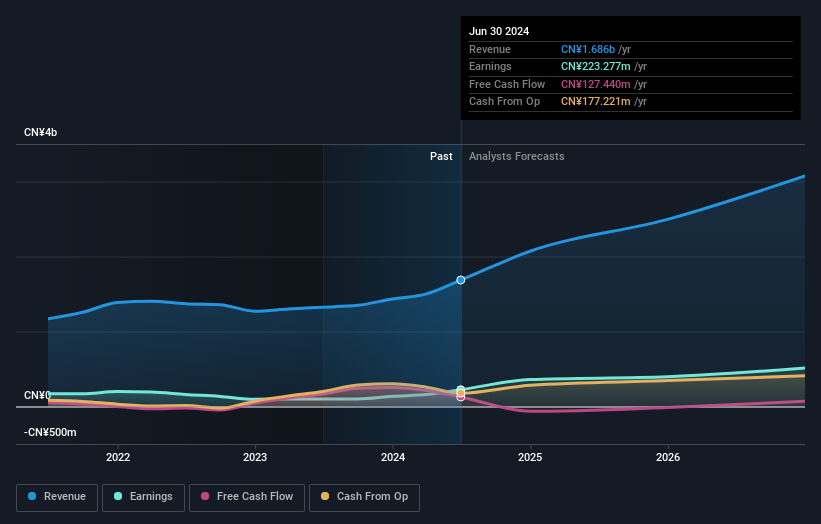

Shareholders in Espressif Systems (Shanghai) Co., Ltd. (SHSE:688018) may be thrilled to learn that the analysts have just delivered a major upgrade to their near-term forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance.

樂鑫科技(上海)股東們可能會非常高興地得知,分析師剛剛對他們的短期預測進行了重大升級。 一致預期表明,投資者可以期望統計收入和每股收益大幅增加,分析師將業務表現實現了真正的提升。

After this upgrade, Espressif Systems (Shanghai)'s five analysts are now forecasting revenues of CN¥2.1b in 2024. This would be a major 23% improvement in sales compared to the last 12 months. Statutory earnings per share are presumed to bounce 56% to CN¥3.22. Previously, the analysts had been modelling revenues of CN¥1.8b and earnings per share (EPS) of CN¥1.82 in 2024. There has definitely been an improvement in perception recently, with the analysts substantially increasing both their earnings and revenue estimates.

在本次升級之後,樂鑫科技(上海)的五位分析師現在預測其2024年的收入將達到210億元人民幣。與過去12個月相比,這將是一項重大的23%銷售增長。法定每股收益被認爲將反彈56%至3.22元人民幣。此前,分析師們曾預測樂鑫科技(上海)在2024年的收入爲18億元人民幣,每股收益爲1.82元人民幣。顯然,近期市場對這隻股票的看法有所改觀,分析師們大大增加了預期收益和營收的估計。

It will come as no surprise to learn that the analysts have increased their price target for Espressif Systems (Shanghai) 30% to CN¥119 on the back of these upgrades.

毫不奇怪的是,分析師們在這些升級的基礎上將樂鑫科技(上海)的股票價格目標上調了30%至119元人民幣。

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Espressif Systems (Shanghai)'s rate of growth is expected to accelerate meaningfully, with the forecast 51% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 17% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 22% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Espressif Systems (Shanghai) to grow faster than the wider industry.

現在來看一下更大的情況,我們可以通過對比過去的業績和行業增長預測來理解這些預測的意義。從最新的預測數據來看,樂鑫科技(上海)的增長速度有望顯著加速,預計到2024年年底的年化營收增長率51%,明顯快於過去五年17%的年增長率。相比之下,我們的數據表明,在類似行業中其他有分析師覆蓋的公司預計其年收入增長率爲22%。顯然,雖然增長前景比最近的過去要更好,但分析師也預計樂鑫科技(上海)的增長速度將超過行業整體水平。

The Bottom Line

最重要的事情是分析師增加了它對下一年每股虧損的估計。令人欣慰的是,營收預測未發生重大變化,業務仍有望比整個行業增長更快。共識價格目標穩定在28.50美元,最新估計不足以對價格目標產生影響。

The biggest takeaway for us from these new estimates is that analysts upgraded their earnings per share estimates, with improved earnings power expected for this year. Fortunately, analysts also upgraded their revenue estimates, and our data indicates sales are expected to perform better than the wider market. With a serious upgrade to expectations and a rising price target, it might be time to take another look at Espressif Systems (Shanghai).

我們從這些新的預測中得出的最重要的結論是,分析師升級了他們的每股收益預期,預計今年將實現更好的盈利能力。幸運的是,分析師們也升級了他們的營收預期,我們的數據表明,銷售預計將優於整個市場。隨着預期的大幅提升和股票價格目標的上漲,現在可能是時候重新審視樂鑫科技(上海)了。

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have estimates - from multiple Espressif Systems (Shanghai) analysts - going out to 2026, and you can see them free on our platform here.

然而,業務的長期前景比明年的收益更爲相關。我們從多位樂鑫科技(上海)的分析師那裏獲得了2026年的預測,並可以在我們的平台上免費查看。

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks with high insider ownership.

當然,看到公司高管將大量資金投入股票與分析師是否升級他們的估計同樣有用。因此,您可能還希望搜索此高內部持股的股票免費名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Espressif Systems (Shanghai)'s rate of growth is expected to accelerate meaningfully, with the forecast 51% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 17% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 22% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Espressif Systems (Shanghai) to grow faster than the wider industry.

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. It's clear from the latest estimates that Espressif Systems (Shanghai)'s rate of growth is expected to accelerate meaningfully, with the forecast 51% annualised revenue growth to the end of 2024 noticeably faster than its historical growth of 17% p.a. over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 22% per year. It seems obvious that, while the growth outlook is brighter than the recent past, the analysts also expect Espressif Systems (Shanghai) to grow faster than the wider industry.