Smart Money Is Betting Big In SNOW Options

Smart Money Is Betting Big In SNOW Options

Deep-pocketed investors have adopted a bearish approach towards Snowflake (NYSE:SNOW), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in SNOW usually suggests something big is about to happen.

資金充裕的投資者對Snowflake(NYSE:SNOW)採取了看淡的態度,市場參與者不應忽視這一點。我們在Benzinga跟蹤公開期權記錄時發現了這一重大舉動。這些投資者的身份仍然是未知的,但是在SNOW發生如此大的變動通常意味着即將發生一些重要的事情。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Snowflake. This level of activity is out of the ordinary.

當Benzinga的期權掃描儀突出顯示了11個Snowflake的非凡期權活動時,我們從觀察今天收集到了這些信息。這種活動水平是非同尋常的。

The general mood among these heavyweight investors is divided, with 27% leaning bullish and 63% bearish. Among these notable options, 7 are puts, totaling $368,151, and 4 are calls, amounting to $209,165.

這些重量級投資者的總體情緒分爲兩種,27%看漲,63%看淡。在這些顯著的期權活動中,有7個看跌,總額爲$368,151,4個看漲,總額爲$209,165。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $155.0 for Snowflake, spanning the last three months.

在評估成交量和持倉量之後,可以明顯看出,主要市場推動者正在關注Snowflake的100.0美元至155.0美元的價格區間,跨越過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

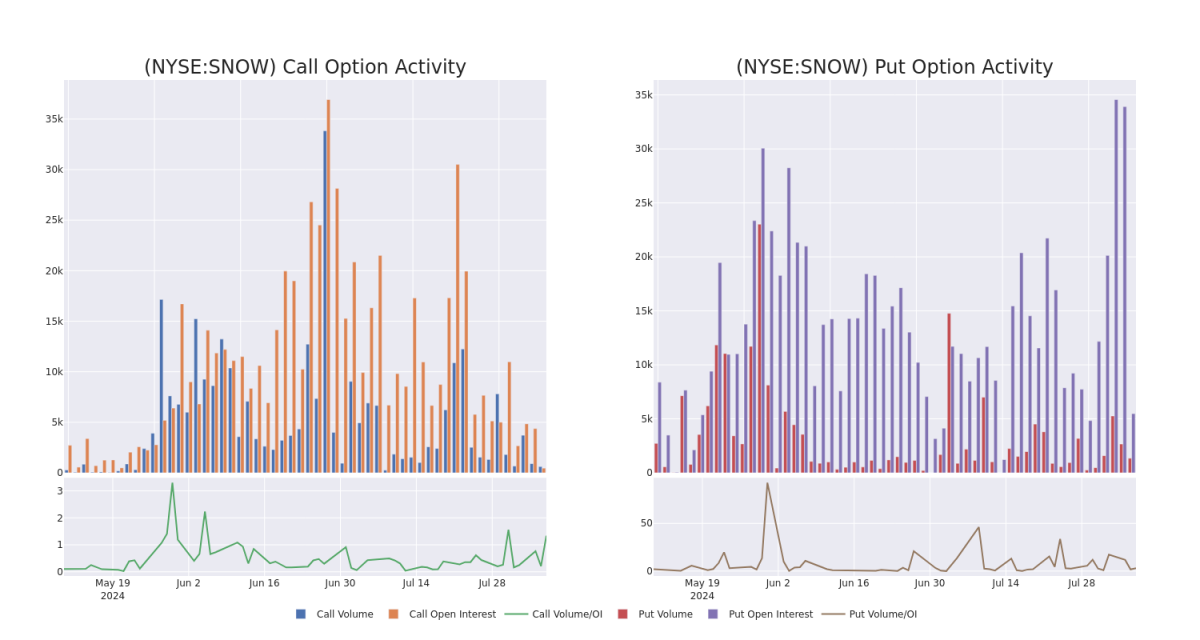

In today's trading context, the average open interest for options of Snowflake stands at 594.2, with a total volume reaching 1,967.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Snowflake, situated within the strike price corridor from $100.0 to $155.0, throughout the last 30 days.

在今天的交易背景下,Snowflake的期權平均持倉量爲594.2,總成交量達到1,967.00。附帶的圖表描繪了過去30天中,Snowflake高價值交易的看漲期權和看跌期權成交量和持倉量的進展情況,位於100.0美元至155.0美元的行權價格走廊內。

Snowflake Option Volume And Open Interest Over Last 30 Days

雪花期權成交量和未平倉合約過去30天的情況

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | PUT | TRADE | BEARISH | 03/21/25 | $11.05 | $9.9 | $10.7 | $100.00 | $117.7K | 1.7K | 110 |

| SNOW | CALL | SWEEP | BEARISH | 10/18/24 | $2.87 | $2.66 | $2.87 | $155.00 | $70.0K | 274 | 414 |

| SNOW | PUT | SWEEP | BULLISH | 08/09/24 | $2.65 | $2.63 | $2.63 | $119.00 | $53.3K | 352 | 216 |

| SNOW | PUT | TRADE | BEARISH | 08/09/24 | $2.09 | $1.07 | $2.09 | $114.00 | $52.2K | 349 | 250 |

| SNOW | CALL | TRADE | BULLISH | 08/30/24 | $10.0 | $9.7 | $10.0 | $120.00 | $50.0K | 35 | 65 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNOW | 看跌 | 交易 | 看淡 | 03/21/25 | $11.05 | $9.9 | $10.7 | $100.00。 | $117.7K | 1.7K | 110 |

| SNOW | 看漲 | SWEEP | 看淡 | 10/18/24 | $2.87 | $2.66 | $2.87 | $155.00 | $70.0K | 274 | 414 |

| SNOW | 看跌 | SWEEP | 看好 | 08/09/24 | $2.65 | $2.63 | $2.63 | $119.00 | 53.3千美元 | 352 | 216 |

| SNOW | 看跌 | 交易 | 看淡 | 08/09/24 | $2.09 | $1.07 | $2.09 | $114.00 | 52,200 美元 | 349 | 250 |

| SNOW | 看漲 | 交易 | 看好 | 08/30/2024 | $10.0 | 9.7 | $10.0 | $120.00 | $50.0K | 35 | 65 |

About Snowflake

關於Snowflake

Founded in 2012, Snowflake is a data lake, warehousing, and sharing company that came public in 2020. To date, the company has over 3,000 customers, including nearly 30% of the Fortune 500 as its customers. Snowflake's data lake stores unstructured and semistructured data that can then be used in analytics to create insights stored in its data warehouse. Snowflake's data sharing capability allows enterprises to easily buy and ingest data almost instantaneously compared with a traditionally months-long process. Overall, the company is known for the fact that all of its data solutions that can be hosted on various public clouds.

Snowflake成立於2012年,是一家數據湖,數據倉庫和共享公司,於2020年上市。到目前爲止,該公司擁有超過3000個客戶,其中近30%是財富500強客戶。Snowflake的數據湖存儲非結構化和半結構化數據,然後可用於分析,創建存儲在其數據倉庫中的見解。Snowflake的數據共享功能使企業可以輕鬆購買和攝取數據,而傳統方式需要數月時間。總的來說,該公司以其數據解決方案可以託管在各種公共雲中而聞名。

Following our analysis of the options activities associated with Snowflake, we pivot to a closer look at the company's own performance.

在對Snowflake相關的期權活動進行分析之後,我們將轉向更近距離地觀察該公司的表現。

Present Market Standing of Snowflake

Snowflake的當前市場地位

- With a trading volume of 674,564, the price of SNOW is up by 4.06%, reaching $119.48.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 14 days from now.

- 在交易674,564股的情況下,SNOW的交易量上漲了4.06%,達到119.48美元。

- 當前RSI值表明該股票可能即將超賣。

- 下次業績將在14天后發佈。

Expert Opinions on Snowflake

關於Snowflake的專家意見

In the last month, 1 experts released ratings on this stock with an average target price of $165.0.

在過去一個月中,共有1個專家對該股票發佈了評級,平均目標價爲165.0美元。

- An analyst from Piper Sandler has decided to maintain their Overweight rating on Snowflake, which currently sits at a price target of $165.

- 派傑投資的一位分析師決定維持其對Snowflake的超額評級,該評級目標價爲165美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Snowflake with Benzinga Pro for real-time alerts.

交易期權有更大的風險,但也有可能獲得更高的利潤。精明的交易者通過不斷學習、策略性交易調整,利用各種因子,並時刻關注市場變化來減少風險。使用Benzinga Pro獲取Snowflake最新期權交易的實時提醒。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $155.0 for Snowflake, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $100.0 and $155.0 for Snowflake, spanning the last three months.