Decoding Intuit's Options Activity: What's the Big Picture?

Decoding Intuit's Options Activity: What's the Big Picture?

Investors with a lot of money to spend have taken a bearish stance on Intuit (NASDAQ:INTU).

資金充沛的投資者已對Intuit(納斯達克:INTU)持看淡態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄上看到交易時發現了這一點。

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with INTU, it often means somebody knows something is about to happen.

無論是機構還是富有的個人,我們都不知道。但是當這樣的大事發生在INTU身上時,往往意味着某些人知道即將發生的事情。

Today, Benzinga's options scanner spotted 10 options trades for Intuit.

今天,Benzinga的期權掃描器發現了Intuit的10筆期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 0% bullish and 100%, bearish.

這些大資金交易者的總體情緒在0%看漲和100%看淡之間分裂。

Out of all of the options we uncovered, 9 are puts, for a total amount of $502,660, and there was 1 call, for a total amount of $48,200.

在我們發現的所有期權中,有9個是認沽期權,總金額爲502660美元,有1個是看漲期權,總金額爲48200美元。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $600.0 to $630.0 for Intuit over the recent three months.

根據交易活動,看起來重要的投資者正在瞄準Intuit在最近三個月內的價格區間,從600.0美元到630.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

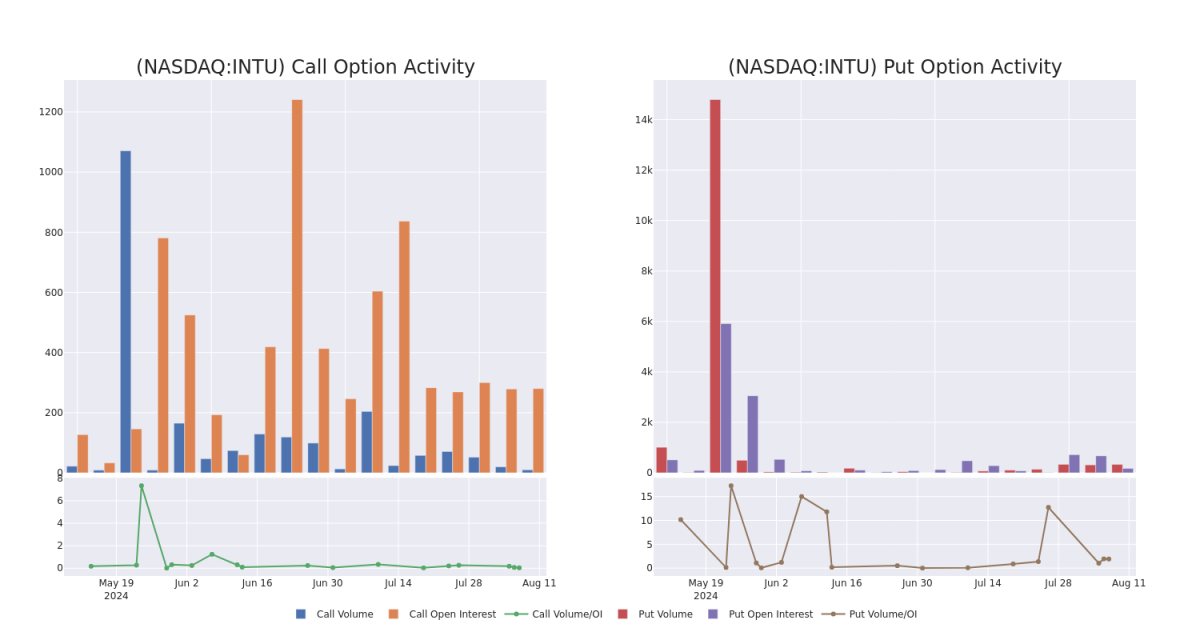

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Intuit's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Intuit's significant trades, within a strike price range of $600.0 to $630.0, over the past month.

研究成交量和未平倉合約的趨勢可以爲股票研究提供重要見解。這些信息對於評估Intuit特定行權價的認購和認沽期權的流動性和興趣水平至關重要。下面,我們提供在600.0美元到630.0美元行權價範圍內的Intuit重要交易中認購和認沽期權成交量和未平倉合約的趨勢快照,過去一個月的數據。

Intuit Option Volume And Open Interest Over Last 30 Days

Intuit在過去30天的期權成交量和未平倉合約

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| INTU | PUT | TRADE | BEARISH | 01/17/25 | $52.8 | $51.7 | $52.8 | $630.00 | $168.9K | 174 | 97 |

| INTU | PUT | TRADE | BEARISH | 01/17/25 | $52.2 | $51.6 | $52.2 | $630.00 | $73.0K | 174 | 54 |

| INTU | PUT | TRADE | BEARISH | 01/17/25 | $52.5 | $51.9 | $52.5 | $630.00 | $57.7K | 174 | 65 |

| INTU | CALL | SWEEP | BEARISH | 09/20/24 | $49.0 | $48.2 | $48.2 | $600.00 | $48.2K | 280 | 10 |

| INTU | PUT | TRADE | BEARISH | 01/17/25 | $51.0 | $49.7 | $51.0 | $630.00 | $35.7K | 174 | 21 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 財捷 | 看跌 | 交易 | 看淡 | 01/17/25 | $52.8 | $51.7 | $52.8 | $630.00 | 168.9K | 174 | 97 |

| 財捷 | 看跌 | 交易 | 看淡 | 01/17/25 | $52.2 | $51.6 | $52.2 | $630.00 | $73.0K | 174 | 54 |

| 財捷 | 看跌 | 交易 | 看淡 | 01/17/25 | $52.5 | $51.9 | $52.5 | $630.00 | $57.7K | 174 | 65 |

| 財捷 | 看漲 | SWEEP | 看淡 | 09/20/24 | $49.0 | $48.2 | $48.2 | $600.00 | $48.2K | 280 | 10 |

| 財捷 | 看跌 | 交易 | 看淡 | 01/17/25 | $51.0 | $49.7 | $51.0 | $630.00 | 35.7K | 174 | 21 |

About Intuit

關於Intuit

Intuit is a provider of small-business accounting software (QuickBooks), personal tax solutions (TurboTax), and professional tax offerings (Lacerte). Founded in the mid-1980s, Intuit controls the majority of US market share for small-business accounting and do-it-yourself tax-filing software.

Intuit是小型企業會計軟件(QuickBooks)、個人稅務解決方案(TurboTax)和專業稅務服務(Lacerte)的提供商。成立於1980年代中期,Intuit控制着美國小型企業會計和自助報稅軟件的大部分市場份額。

After a thorough review of the options trading surrounding Intuit, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在深入審查Intuit周邊的期權交易後,我們開始更詳細地研究該公司。這包括對其當前市場地位和業績的評估。

Present Market Standing of Intuit

Intuit的現有市場地位

- With a trading volume of 254,791, the price of INTU is up by 1.71%, reaching $622.77.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 15 days from now.

- INTU的交易量爲254791,價格上漲了1.71%,達到了622.77美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一次收益報告將在15天后發佈。

Professional Analyst Ratings for Intuit

Intuit的專業分析師評級

In the last month, 1 experts released ratings on this stock with an average target price of $760.0.

在過去一個月中,有1位專家對該股票發表了評級,平均目標價爲760.0美元。

- An analyst from Piper Sandler persists with their Overweight rating on Intuit, maintaining a target price of $760.

- Piper Sandler的分析師堅持對Intuit的超配評級,並維持對該公司760美元的目標價。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。