Bloomin' Brands Analysts Slash Their Forecasts After Downbeat Earnings

Bloomin' Brands Analysts Slash Their Forecasts After Downbeat Earnings

Bloomin' Brands, Inc. (NASDAQ:BLMN) reported downbeat results for the second quarter on Tuesday.

Bloomin品牌公司(納斯達克:BLMN)週二公佈了第二季度的不佳業績報告。

The company reported second-quarter adjusted EPS of 51 cents, missing the analyst consensus of 58 cents. Quarterly sales of $1.12 billion marginally missed the street view of $1.13 billion, decreasing 2.9% Y/Y.

該公司報告第二季度調整後的每股收益爲51美分,低於分析師預期的58美分。季度銷售額爲11.2億美元,略低於街道預期的11.3億美元,同比下降2.9%。

David Deno, CEO said, "While our comparable sales growth outpaced the industry in Q2, we did not meet our expectations. We are very focused on developing a path to sustainable growth at Outback and are making progress in improving the guest experience, providing meaningful value, and enhancing customer and digital capabilities."

首席執行官David Deno表示:"儘管我們在Q2中的可比銷售增長超過了行業的平均水平,但我們並沒有達到我們的預期。在Outback,我們專注於制定一條可持續增長的道路,並在提高客戶體驗、提供有意義的價值以及增強客戶和數字能力方面取得了進展。"

Bloomin' Brands lowered the FY24 adjusted EPS outlook to $2.10-$2.30 (from $2.51-$2.66) vs. the estimate of $2.41 and projects U.S. Comparable Restaurant sales declining 1% to flat (prior view: flat to +2%). The company expects third-quarter U.S. comparable restaurant sales to be down 2% to flat, with adjusted EPS of $0.17-$0.25 (from $0.55-$0.60 prior) versus the estimate of $0.39.

Bloomin品牌下調了2024財年的調整後每股收益預期,從2.51-2.66美元降至2.10-2.30美元(預期爲2.41美元),並預計美國餐廳可比銷售額將下降1%至平穩(之前的預期爲平穩至+2%)。該公司預計第三季度美國餐廳可比銷售額將下降2%至平穩,調整後每股收益爲0.17-0.25美元(之前爲0.55-0.60美元),預期爲0.39美元。

Bloomin' Brands shares rose 1.4% to trade at $17.21 on Wednesday.

Bloomin品牌股票週三上漲1.4%,報價17.21美元。

These analysts made changes to their price targets on Bloomin' Brands following earnings announcement.

這些分析師在收益公告後調整了Bloomin品牌的價格目標。

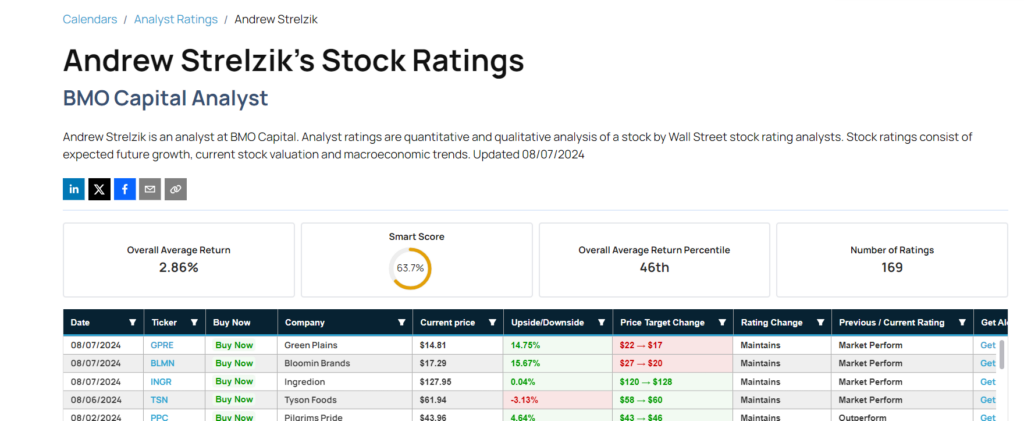

BMO Capital analyst Andrew Strelzik maintained Bloomin Brands with a Market Perform and lowered the price target from $27 to $20.

BMO Capital的分析師安德魯·斯特雷爾齊克維持了Bloomin品牌的市場表現,並將價格目標從27美元降至20美元。

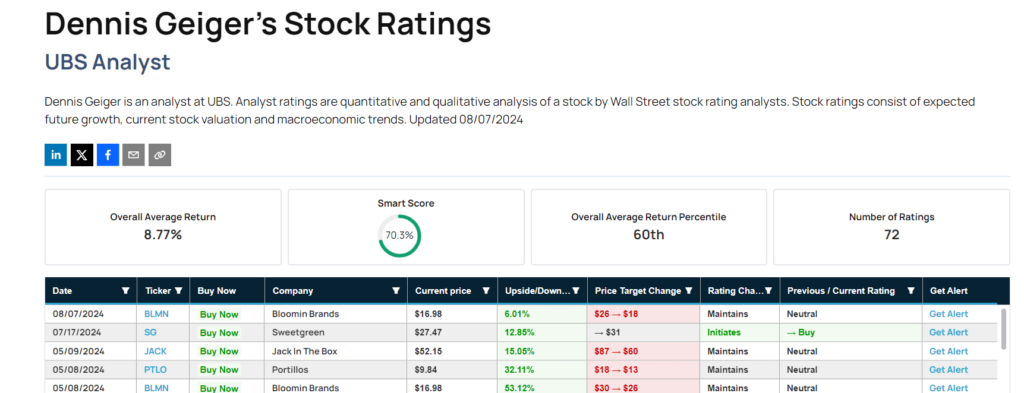

UBS analyst Dennis Geiger maintained Bloomin Brands with a Neutral and cut the price target from $26 to $18.

UBS分析師丹尼斯·蓋格維持了Bloomin品牌的中立評級,並將價格目標從26美元降至18美元。

Read More:

閱讀更多:

- How To Earn $500 A Month From Eli Lilly Stock Ahead Of Q2 Earnings

- 如何在Q2收益發布前從Eli Lilly股票中賺取每月$500。

Bloomin' Brands lowered the FY24 adjusted EPS outlook to $2.10-$2.30 (from $2.51-$2.66) vs. the estimate of $2.41 and projects U.S. Comparable Restaurant sales declining 1% to flat (prior view: flat to +2%). The company expects third-quarter U.S. comparable restaurant sales to be down 2% to flat, with adjusted EPS of $0.17-$0.25 (from $0.55-$0.60 prior) versus the estimate of $0.39.

Bloomin' Brands lowered the FY24 adjusted EPS outlook to $2.10-$2.30 (from $2.51-$2.66) vs. the estimate of $2.41 and projects U.S. Comparable Restaurant sales declining 1% to flat (prior view: flat to +2%). The company expects third-quarter U.S. comparable restaurant sales to be down 2% to flat, with adjusted EPS of $0.17-$0.25 (from $0.55-$0.60 prior) versus the estimate of $0.39.