McKesson's Options Frenzy: What You Need to Know

McKesson's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bearish move on McKesson. Our analysis of options history for McKesson (NYSE:MCK) revealed 41 unusual trades.

金融巨頭對麥克森持看淡態度。我們對麥克森(紐交所:MCK)期權歷史的分析顯示,出現了41次非同尋常交易。

Delving into the details, we found 17% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 33 were puts, with a value of $3,204,542, and 8 were calls, valued at $380,924.

具體來看,我們發現17%的交易者看好,而60%的交易者顯示出看淡趨勢。我們發現33次看跌期權交易,價值3204542美元,8次認購期權交易,價值380924美元。

Predicted Price Range

預測價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $270.0 to $690.0 for McKesson over the last 3 months.

考慮到這些合同的成交量和持倉量,似乎鯨魚已經在過去的3個月裏鎖定了麥克森在270.0至690.0美元的價格區間。

Insights into Volume & Open Interest

成交量和持倉量分析

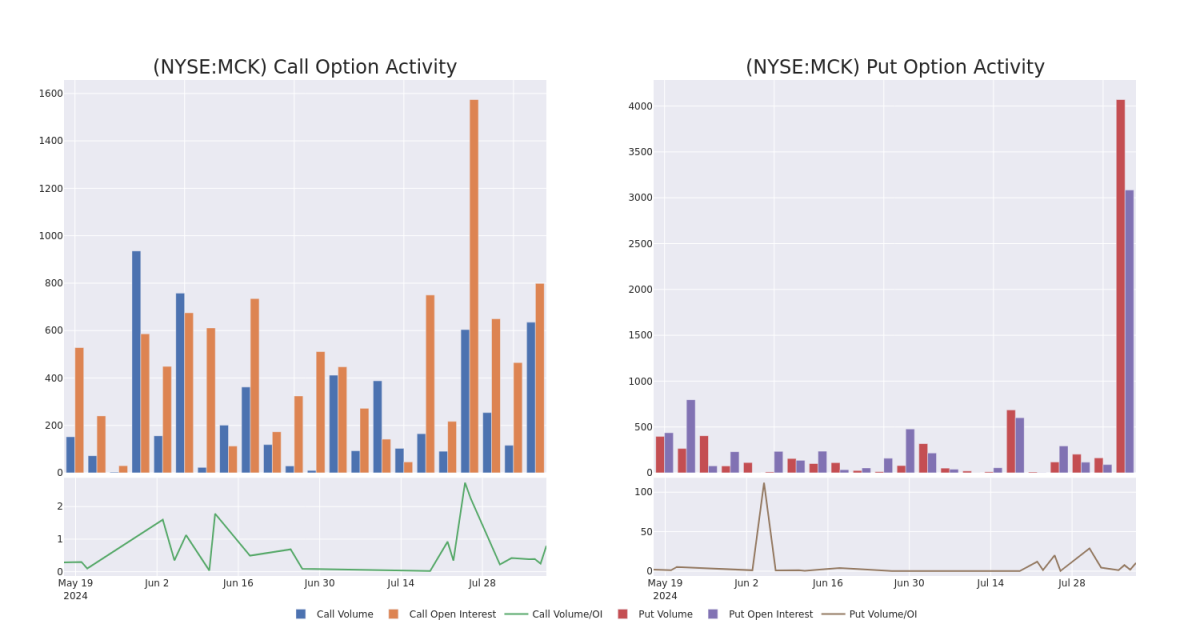

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in McKesson's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to McKesson's substantial trades, within a strike price spectrum from $270.0 to $690.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的一項戰略步驟。這些度量標準揭示了指定行權價格的麥克森期權的流動性和投資者興趣。即將發佈的數據可視化顯示過去30天麥克森的看跌和看漲期權的成交量和持倉量的波動,這些與270.0至690.0美元行權價範圍內的巨額交易有關。

McKesson Option Activity Analysis: Last 30 Days

麥克森期權活動分析:過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCK | PUT | SWEEP | NEUTRAL | 08/09/24 | $79.9 | $75.0 | $77.12 | $630.00 | $382.0K | 117 | 117 |

| MCK | PUT | TRADE | BEARISH | 08/09/24 | $76.5 | $69.0 | $75.0 | $635.00 | $375.0K | 100 | 100 |

| MCK | PUT | SWEEP | BEARISH | 08/16/24 | $14.9 | $14.8 | $14.9 | $570.00 | $224.9K | 1.0K | 104 |

| MCK | PUT | SWEEP | BEARISH | 11/15/24 | $36.7 | $33.9 | $35.6 | $570.00 | $195.8K | 595 | 229 |

| MCK | PUT | SWEEP | NEUTRAL | 11/15/24 | $36.6 | $36.0 | $36.6 | $570.00 | $153.7K | 595 | 284 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MCK | 看跌 | SWEEP | 中立 | 08/09/24 | $79.9 | $75.0 | $77.12 | $630.00 | $382.0K | 117 | 117 |

| MCK | 看跌 | 交易 | 看淡 | 08/09/24 | $76.5 | $69.0 | $75.0 | $635.00 | $375.0K | 100 | 100 |

| MCK | 看跌 | SWEEP | 看淡 | 08/16/24 | $14.9 | $14.8 | $14.9 | $570.00 | $224.9K | 1.0K | 104 |

| MCK | 看跌 | SWEEP | 看淡 | 11/15/24 | 36.7 | $33.9 | $35.6 | $570.00 | $195.8K | 595 | 229 |

| MCK | 看跌 | SWEEP | 中立 | 11/15/24 | $ 36.6 | $36.0 | $ 36.6 | $570.00 | $153.7K | 595 | 284 |

About McKesson

關於麥克森

McKesson Corp is one of three leading pharmaceutical wholesalers in the us engaged in sourcing and distributing branded, generic, and specialty pharmaceutical products to pharmacies (retail chains, independent, and mail order), hospitals networks, and healthcare providers. Along with Cencora and Cardinal Health, the three account for over 90% of the us pharmaceutical wholesale industry. Outside the us market, McKesson engages in pharmaceutical wholesale and distribution in Canada. Additionally, the company supplies medical-surgical products and equipment to healthcare facilities and provides a variety of technology solutions for pharmacies.

麥克森公司是美國三大主要藥品經銷商之一,從事採購和分銷品牌、仿製和特殊藥品產品給藥店(連鎖店、獨立店和郵購)、醫院網絡和醫療保健提供者。三家公司加起來佔美國藥品批發業超過90%的市場份額。在美國市場之外,麥克森公司在加拿大從事藥品批發和分銷,此外,該公司還向醫療設施供應醫療器械產品和設備,併爲藥店提供各種技術解決方案。

Following our analysis of the options activities associated with McKesson, we pivot to a closer look at the company's own performance.

在我們分析了麥克森相關期權活動後,我們轉而更仔細地觀察這家公司的表現。

McKesson's Current Market Status

麥克森的當前市場狀況

- Currently trading with a volume of 3,264,678, the MCK's price is down by -7.39%, now at $571.85.

- RSI readings suggest the stock is currently may be approaching oversold.

- Anticipated earnings release is in 83 days.

- 麥克森的交易量爲3264678股,目前價格下跌了-7.39%,報價571.85美元。

- RSI讀數表明該股票目前可能接近超賣狀態。

- 預計在83天內發佈收益報告。

What Analysts Are Saying About McKesson

關於麥克森的分析師評價

In the last month, 4 experts released ratings on this stock with an average target price of $646.75.

在過去一個月,4位專家對這支股票進行了評級,平均目標價爲646.75美元。

- An analyst from Barclays has decided to maintain their Overweight rating on McKesson, which currently sits at a price target of $616.

- Maintaining their stance, an analyst from Baird continues to hold a Outperform rating for McKesson, targeting a price of $671.

- Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on McKesson with a target price of $670.

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on McKesson with a target price of $630.

- 巴克萊銀行的分析師決定維持對麥克森的股票超配評級,當前目標價爲616美元。

- 巴德證券分析師繼續持有麥克森的跑贏大盤評級,目標價爲671美元。

- 花旗集團的分析師一如既往地對麥克森的股票給予買入評級,目標價爲670美元。

- Evercore ISI Group的分析師堅持對麥克森的股票給予跑贏大盤評級,目標價爲630美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。