Markets Weekly Update (August 9): US weekly jobless claims drop calms market fears

Markets Weekly Update (August 9): US weekly jobless claims drop calms market fears

Macro Matters

宏觀事項

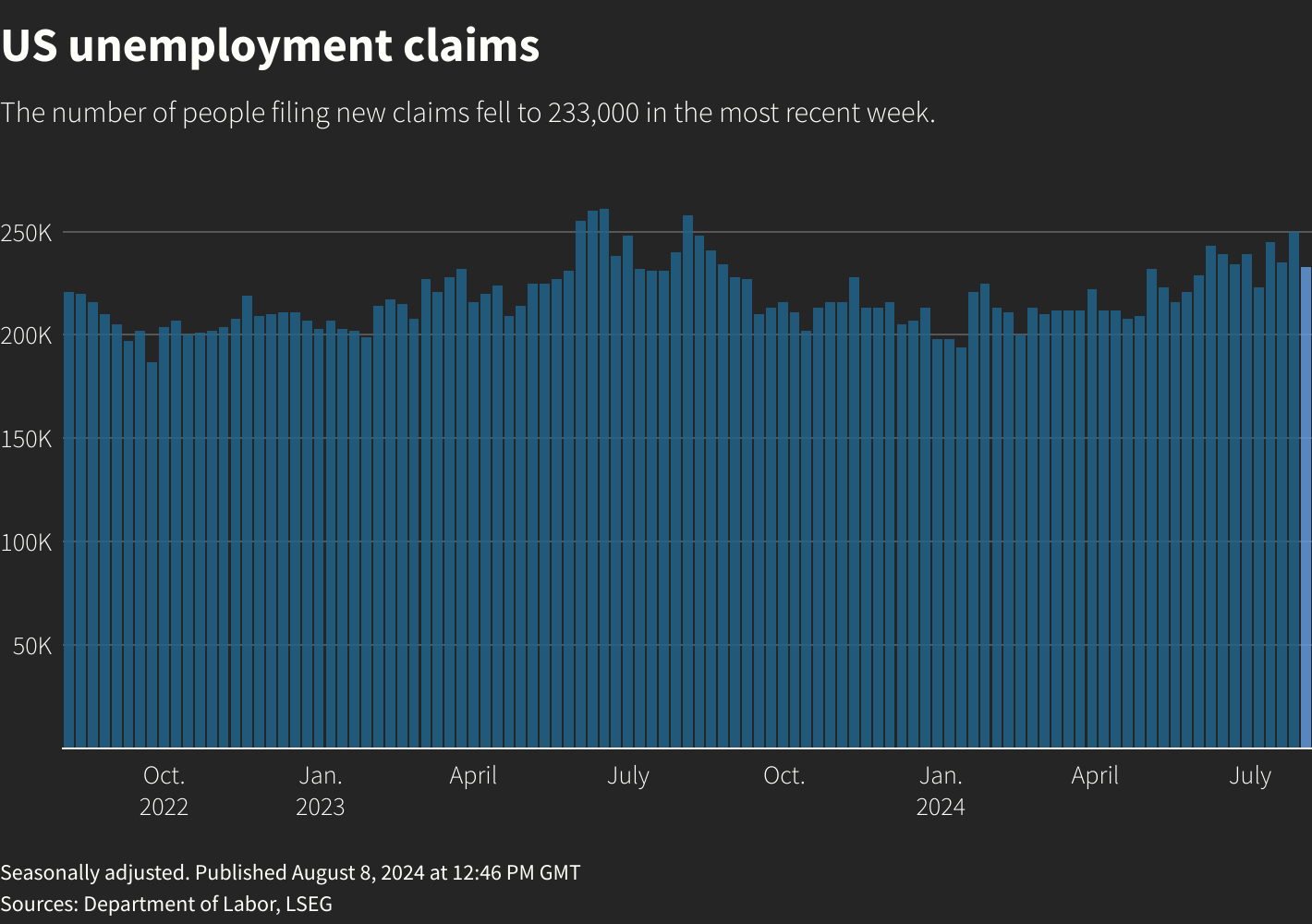

US weekly jobless claims drop calms market fears

美國每週失業救濟金申請下降,平息了市場的擔憂。

Initial claims for state unemployment benefits fell 17,000 to a seasonally adjusted 233,000 for the week ended Aug. 3, the Labor Department said on Thursday, the largest drop in about 11 months. Economists polled by Reuters had forecast 240,000 claims for the latest week.

美國勞工部週四表示,截至8月3日的一週內,州級失業救濟金初始申請人數季節性調整後下降了17,000人,爲約11個月內的最大降幅。路透社調查的經濟學家預測最新一週的申請人數爲240,000人。

U.S. stocks gained following the release, while benchmark Treasury yields rose back above 4%. The U.S. dollar (.DXY), opens new tab also strengthened against a basket of currencies.

美國股市在這一數據公佈後上漲,而基準國債收益率也重新上升至4%以上。美元 (.DXY) 也顯得更加堅挺,兌一籃子貨幣走強。

"The talk of an imminent recession seems wide of the mark," said Marc Chandler, chief market strategist at Bannockburn Global Forex.

「關於即將到來的經濟衰退的談話似乎言過其實,」班納克本全球外匯首席市場策略師馬克·錢德勒表示。

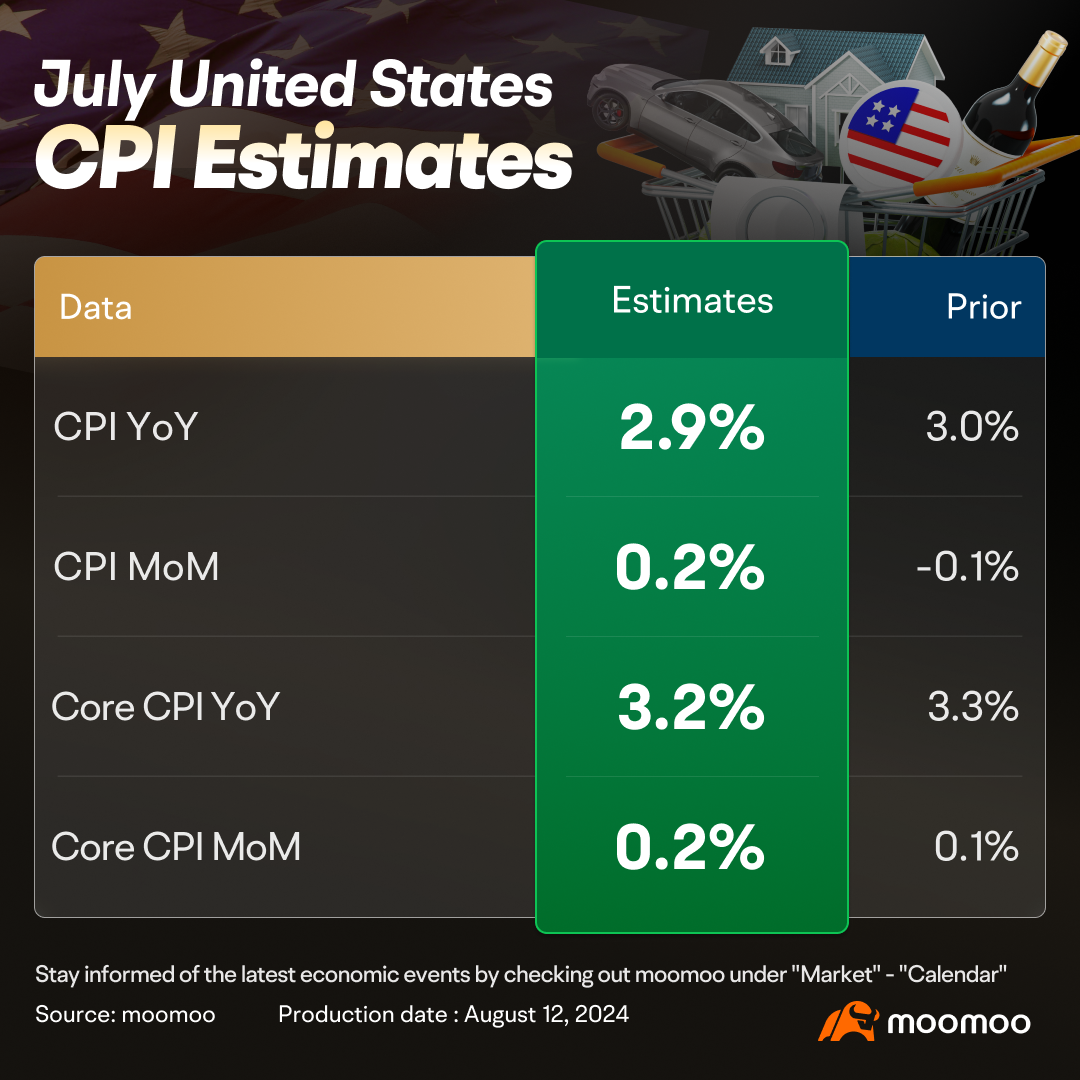

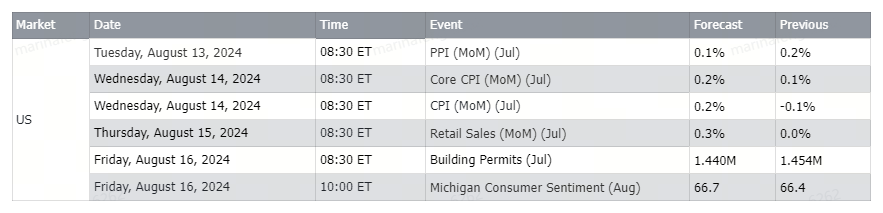

What To Expect From The Next CPI Inflation Report

下一份消費者價格指數(CPI)的預期

The July CPI report is likely to further the case that inflation is quieting down even if it has not yet returned all the way back to the Fed's target. Economists look for headline CPI to have advanced 0.2% in July, which would make the year-over-year rate at more than a three-year low of 2.9%. The core CPI also looks set to advance 0.2% in July. The step-down in shelter inflation from the first six months of the year might be sustained. If realized, the 12-month change in the core CPI would fall to a fresh cycle low of 3.2%.

7月CPI報告很可能會進一步證明通貨膨脹正在趨於平靜,即使它尚未完全回到聯儲局的目標水平。經濟學家預計,7月總CPI將增長0.2%,這將使同比增長率降至2.9%,是三年多的低點。核心CPI也有望在7月增長0.2%。從一年前來看,住房通脹可能會持續下降。如果實現,核心CPI的12個月變化將降至一個新的週期低點,爲3.2%。

Labor costs are no longer a meaningful threat to the Fed's 2% inflation target, as growth in the labor force has coincided with fading demand for workers.

隨着勞動力的增長與對工人需求的減弱相吻合,勞動力成本不再對聯儲局2%的通貨膨脹目標構成重大威脅。

Smart Money Flow

智能資金流

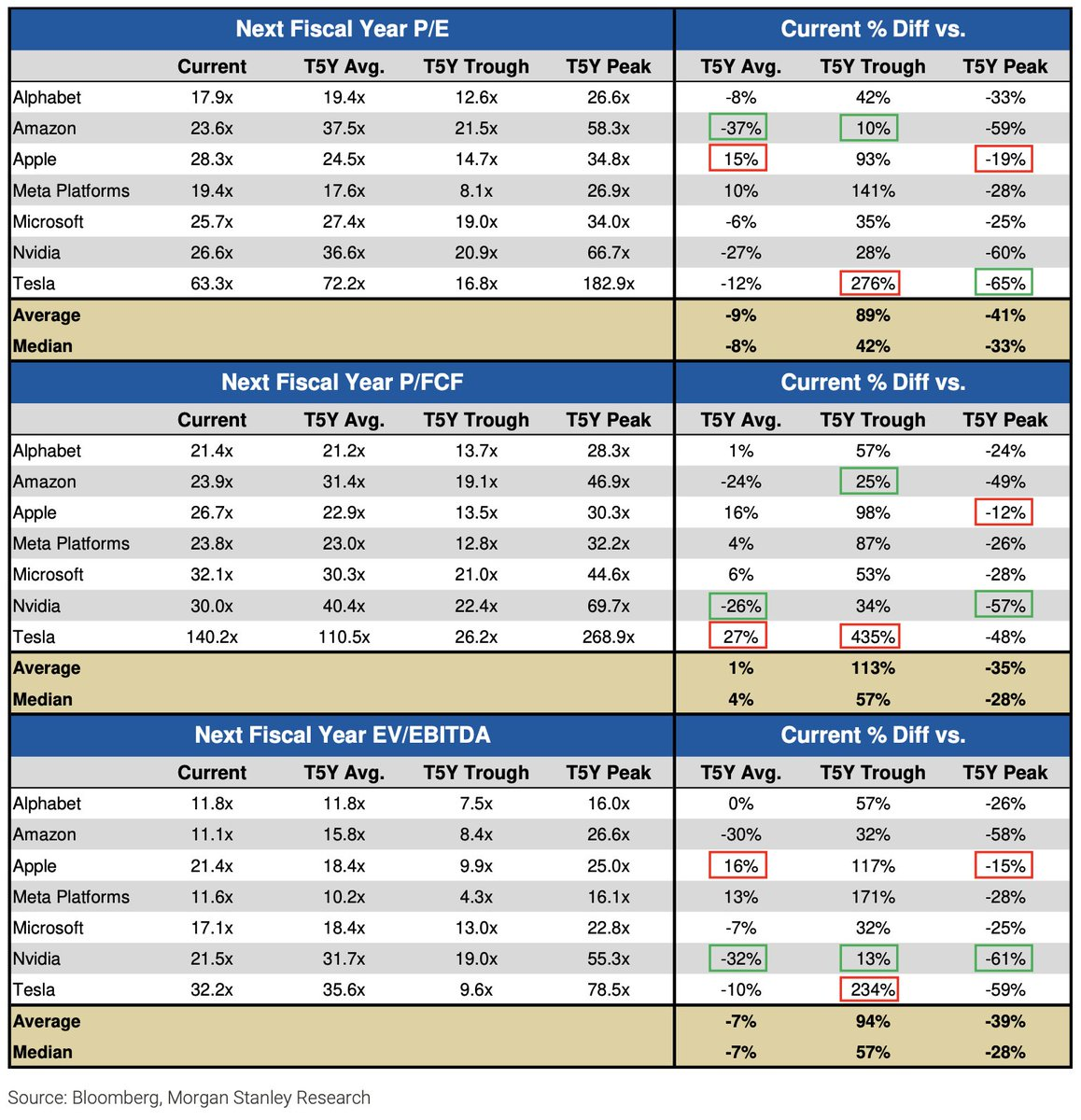

The median Mag 7 stock is trading about 8% below T5Y average P/E, about 40% above the T5Y trough, and about 30% below peak multiples.

Mag 7 中位股票交易價格比T5Y平均市盈率低約8%,比T5Y底部高約40%,比高峰時期的市盈率低約30%。

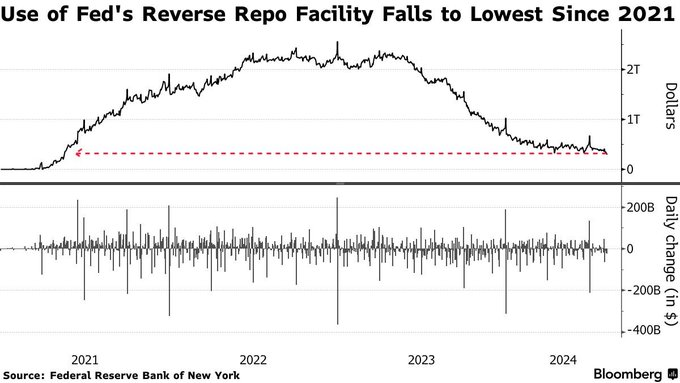

Some on Wall Street warn the draining facility is evidence that excess liquidity has been removed from the financial system and bank reserve balances are less abundant than policymakers believe.

華爾街一些人警告稱,這一抽水設施證明了超額流動性已經被從金融系統中清除,銀行準備金餘額比政策制定者估計的要少。

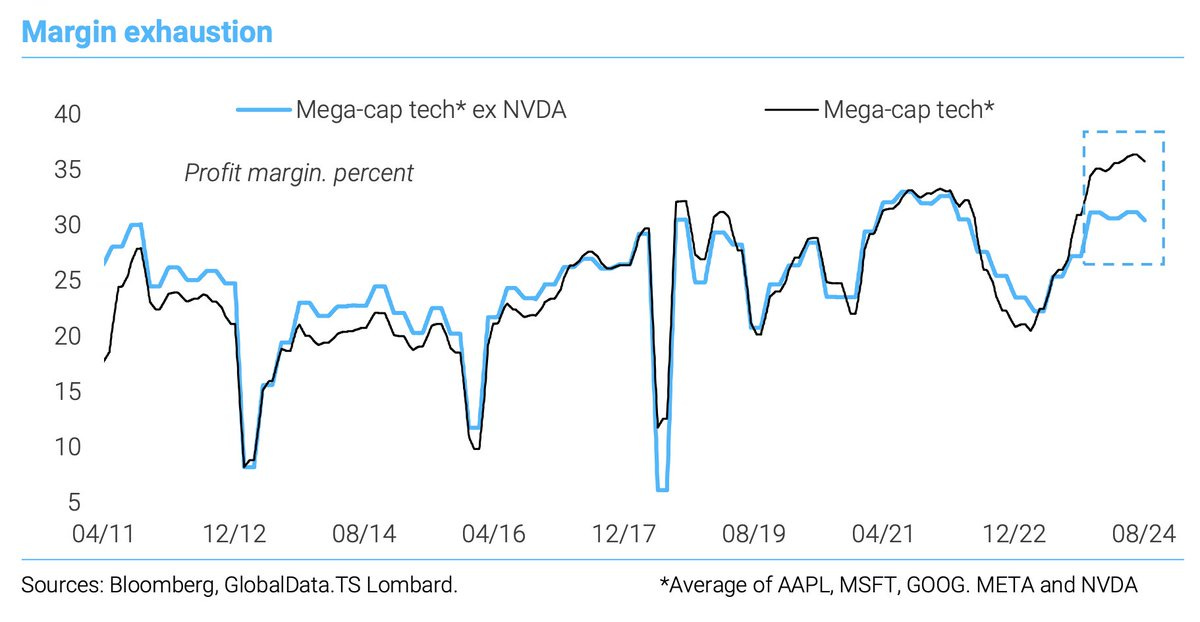

Signs of exhaustion in margin expansion are prompting investors to seek more clarity about the earnings impact from heavy capex on AI.

GPU (gpu芯片-雲計算) 帶來的重資產核心支出對人工智能的收益影響迫使投資者尋求更多的業績影響明確的信息。

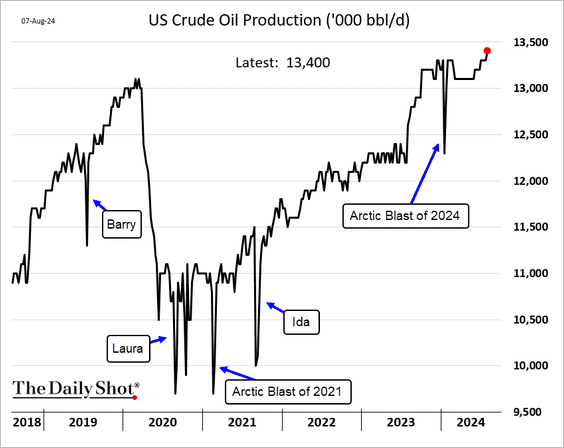

US crude oil production hit a record high.

美國原油產量創紀錄新高。

Top Corporate News

頭條公司新聞

Berkshire Hathaway Q2 Operating Profit Climbs Over 15%, Cash Hoard Swells To $277B As It Slashes Apple Stake by Nearly 50%

伯克希爾·哈撒韋(Q2)營業利潤增長15%以上,現金儲備擴大至2770億美元,將蘋果減倉幅度減少近50%。

Warren Buffett-led Berkshire Hathaway, Inc. (NYSE:BRK) reported second-quarter net earnings on Saturday that fell year-over-year as a decline in investment gains more than offset an increase in operating earnings. The company's offloading of its stake in tech giant Apple, Inc. (NASDAQ:APPL) continued. Second-quarter net earnings fell 15.50% year-over-year from $35.91 billion to $30.35 billion. Operating earnings, which refer to income generated by its portfolio companies, climbed 15.48% to $11.60 billion. On the other hand, gains from its investment portfolio fell 27.52% to $18.75 billion. Berkshire's cash and cash-equivalents ballooned to $276.94 billion at the end of the second quarter, up from roughly $189 billion at the end of the first quarter.

禾倫巴菲特領導的伯克希爾哈撒韋公司(NYSE:BRK)公佈了第二季度的淨利潤,同比下降,投資收益下降超過營業收入的增長。該公司減持科技巨頭蘋果公司股份的行動仍在繼續。二季度淨利潤同比下降15.50%,從359.1億美元降至303.5億美元。營業利潤增長15.48%,爲116億美元。另一方面,投資組合收益下降27.52%,至187.5億美元。伯克希爾的現金及現金等價物在第二季度末膨脹至2769.4億美元,較一季度末的約1890億美元有所增加。

Nvidia's New Blackwell GPU May Be Delayed

Nvidia的新型Blackwell GPU可能會延遲推出。

Tech news site The Information, citing a couple of industry sources, said volume shipments of the Blackwell B200 chip would be delayed some three months. Blackwell volumes were expected to begin in October 2024. Nvidia reports on a January fiscal year, so a delay would push revenue contributions from the B200 into the April 2025 quarter.

科技新聞網站The Information 援引業內一些消息人士的話報道,Blackwell B200芯片的成交量將延遲三個月。Blackwell成交量預計將於2024年10月開始。Nvidia報告的是一月爲財年,因此延遲將使B200的收入貢獻推遲到2025年4月季度。

Lilly Reports Q2 2024 Financial Results, Raises Full-Year Revenue Guidance by $3 Billion

Lilly報告2024年第二季度財務業績,將全年營業收入預測調高了30億美元。

In Q2 2024, worldwide revenue was $11.30 billion, an increase of 36% compared with Q2 2023, driven by Mounjaro, Zepbound and Verzenio. Q2 2024 EPS increased 68% to $3.28 on a reported basis. 2024 full-year revenue guidance raised by $3 billion; reported EPS guidance raised $2.05 to the range of $15.10 to $15.60, and non-GAAP EPS guidance raised $2.60 to the range of $16.10 to $16.60.

截至2024年Q2,全球收入爲113億美元,較2023年同期增長36%,由Mounjaro、Zepbound和Verzenio推動。2024年Q2 EPS報告基礎上增加了68%。全年2024年收入指引上調了30億美元,報告的EPS指引上調了2.05美元,範圍爲15.1至15.6美元。而非GAAP的EPS指導範圍則上調了2.6美元,爲16.1至16.6美元。

Super Micro Computer Q4 Earnings: Revenue In Line, Strong Guidance, 10-For-1 Stock Split

超微電腦第四季度收益:營業收入符合預期,強勁指引,10對1股票分割。

Super Micro reported FY24Q4 revenue of $5.31 billion, in line with estimates. The company reported quarterly earnings of $6.25 per share, below analyst estimates of $8.10 per share. Super Micro said fiscal 2024 revenue was up 110% year-over-year, driven by record demand for new AI infrastructures. Gross margin was 11.2% in the fourth quarter. Super Micro's board also authorized a 10-for-1 forward split of its common stock. The company expects shares to begin trading on a split-adjusted basis on Oct. 1st. Super Micro expects first-quarter revenue to be in the range of $6 billion to $7 billion versus estimates of $5.3 billion. The company anticipates first-quarter adjusted earnings of $6.69 to $8.27 per share.

超微公司報告的2024財年第四季度收入爲53.1億美元,與預期一致。公司每股季度收益爲6.25美元,低於分析師預期的8.10美元。超微表示,2024財年收入同比增長110%,受到新型 AI 基礎設施需求的推動。第四季度毛利率爲11.2%。超微公司董事會還授權進行10股合1的股票前向拆分。公司預計股票將從10月1日開始以拆分後價格進行交易。超微公司預計第一季度收入將在60億至70億美元的範圍內,預計的目標是53億美元。該公司預計第一季度調整後收益爲每股6.69至8.27美元。

Upcoming Economic Data

免責聲明:本演示僅供信息和教育目的;不是任何特定投資或投資策略的建議或認可。在此提供的投資信息具有一般性質,僅供說明目的,並可能不適合所有投資者。它是在沒有考慮個人投資者的財務知識水平、財務狀況、投資目標、投資時間範圍或風險承受能力的情況下提供的。在做出任何投資決策之前,您應考慮此信息是否適合您的相關個人情況。過去的投資業績並不表明或保證未來的成功。收益將有所不同,所有投資都存在風險,包括本金損失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo是由Moomoo Technologies Inc.提供的金融信息和交易應用程序。在美國,Moomoo的投資產品和服務由Moomoo Financial Inc.提供,成爲FINRA/SIPC成員。

"The talk of an imminent recession seems wide of the mark," said Marc Chandler, chief market strategist at Bannockburn Global Forex.

"The talk of an imminent recession seems wide of the mark," said Marc Chandler, chief market strategist at Bannockburn Global Forex.