Check Out What Whales Are Doing With CEG

Check Out What Whales Are Doing With CEG

Whales with a lot of money to spend have taken a noticeably bullish stance on Constellation Energy.

資金充沛的鯨魚在Constellation Energy方面採取了明顯看好的立場。

Looking at options history for Constellation Energy (NASDAQ:CEG) we detected 8 trades.

查看Constellation Energy(納斯達克:CEG)期權歷史記錄,我們檢測到8次交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 37% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有50%的投資者持有看好期望,而37%的人持有看淡期望。

From the overall spotted trades, 3 are puts, for a total amount of $401,769 and 5, calls, for a total amount of $806,910.

根據全部已知交易情況,看跌期權共3單,總金額爲401,769美元,看漲期權共5單,總金額爲806,910美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $175.0 and $240.0 for Constellation Energy, spanning the last three months.

經過成交量和持倉量的分析,明顯發現主要的市場操縱者將目光聚焦於Constellation Energy的價格區間在175.0美元到240.0美元之間,該價格區間歷時三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

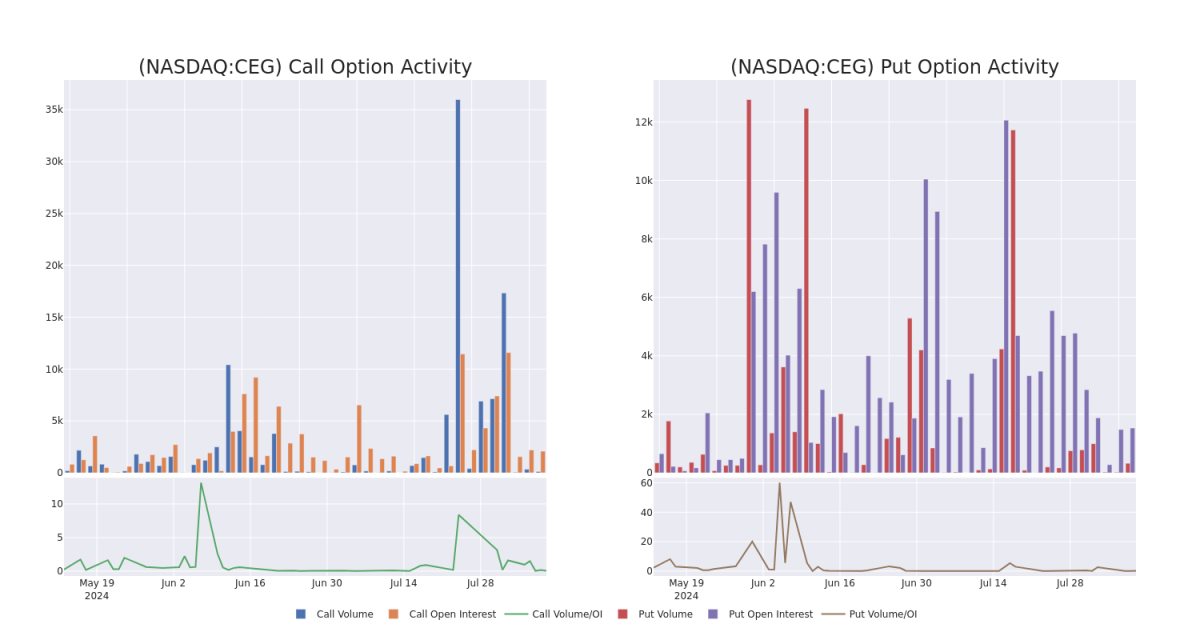

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Constellation Energy's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Constellation Energy's significant trades, within a strike price range of $175.0 to $240.0, over the past month.

分析成交量和持倉量可以提供關鍵性的股票研究信息。該信息對於衡量Constellation Energy特定行權價格的期權的流動性和利益水平至關重要。以下內容爲Constellation Energy的顯著交易的看漲和看跌期權在175.0美元至240.0美元行權價格區間內的成交量和持倉量趨勢。

Constellation Energy Option Volume And Open Interest Over Last 30 Days

Constellation Energy在過去30天中的期權成交量和持倉量。

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | CALL | TRADE | BEARISH | 01/17/25 | $16.6 | $16.1 | $16.2 | $210.00 | $648.0K | 515 | 0 |

| CEG | PUT | SWEEP | BEARISH | 11/15/24 | $13.4 | $13.3 | $13.4 | $175.00 | $261.3K | 1.5K | 301 |

| CEG | PUT | SWEEP | BULLISH | 11/15/24 | $13.5 | $13.4 | $13.4 | $175.00 | $107.2K | 1.5K | 25 |

| CEG | CALL | TRADE | NEUTRAL | 01/16/26 | $37.5 | $36.0 | $36.7 | $210.00 | $55.0K | 45 | 15 |

| CEG | CALL | SWEEP | BEARISH | 01/17/25 | $10.9 | $10.5 | $10.5 | $230.00 | $46.2K | 268 | 44 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CEG | 看漲 | 交易 | 看淡 | 01/17/25 | $16.6 | $16.1 | $16.2 | 目標股價爲$210.00。 | 648,000美元 | 515 | 0 |

| CEG | 看跌 | SWEEP | 看淡 | 11/15/24 | $13.4 | $13.3 | $13.4 | $175.00 | 261,300美元 | 1.5K | 301 |

| CEG | 看跌 | SWEEP | 看好 | 11/15/24 | $13.5 | $13.4 | $13.4 | $175.00 | $107.2K | 1.5K | 25 |

| CEG | 看漲 | 交易 | 中立 | 01/16/26 | $37.5 | $36.0 | 36.7 | 目標股價爲$210.00。 | $55.0K | 45 | 15 |

| CEG | 看漲 | SWEEP | 看淡 | 01/17/25 | $10.9 | $10.5 | $10.5 | $230.00 | $46.2千 | 268 | 44 |

About Constellation Energy

Constellation Energy

Constellation Energy Corp offers energy solutions. It provides clean energy and sustainable solutions to homes, businesses, the public sector, community aggregations, and a range of wholesale customers (such as municipalities, cooperatives, and other strategics). The company offers comprehensive energy solutions and a variety of pricing options for electric, natural gas, and renewable energy products for companies of any size.

Constellation Energy Corp提供能源解決方案。它爲家庭、企業、公共部門、社區集合體和各種批發客戶(如市政當局、合作社和其他戰略客戶)提供清潔能源和可持續解決方案。公司爲各種規模的企業提供綜合能源解決方案和各種定價選項,包括電力、天然氣和可再生能源產品。

Having examined the options trading patterns of Constellation Energy, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在檢查了Constellation Energy的期權交易模式後,我們的注意力現在直接轉向該公司。這個轉變使我們深入了解其現在的市場位置和表現。

Constellation Energy's Current Market Status

Constellation Energy的當前市場情況。成交量爲700,159,CEG的價格上漲了0.28%,定位於187.54美元。

- Trading volume stands at 700,159, with CEG's price up by 0.28%, positioned at $187.54.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 87 days.

- UBS的一位分析師堅持對Constellation Energy的買入評級,維持目標價爲230美元。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計將在87天內宣佈收益。

Expert Opinions on Constellation Energy

Constellation Energy的專家意見。

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $217.66666666666666.

在過去30天中,共有3位專業分析師對該股票給出了他們的看法,設定了平均價格目標爲217.66666666666666美元。

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Constellation Energy, targeting a price of $212.

- An analyst from UBS persists with their Buy rating on Constellation Energy, maintaining a target price of $230.

- In a cautious move, an analyst from Barclays downgraded its rating to Overweight, setting a price target of $211.

- 艾佛裏公司的一位分析師繼續持有對Constellation Energy的跑贏大盤評級,目標價爲212美元。

- UBS的一位分析師堅持對Constellation Energy的買入評級,維持目標價爲230美元。

- 巴克萊銀行的一位分析師在謹慎的行動中將其評級下調爲增持,並制定了211美元的價格目標。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。