Texas Instruments Options Trading: A Deep Dive Into Market Sentiment

Texas Instruments Options Trading: A Deep Dive Into Market Sentiment

Whales with a lot of money to spend have taken a noticeably bullish stance on Texas Instruments.

擁有大量資金的鯨魚對德州儀器採取了明顯看好的態度。

Looking at options history for Texas Instruments (NASDAQ:TXN) we detected 13 trades.

查看德州儀器(納斯達克:TXN)期權歷史,我們發現有13筆交易。

If we consider the specifics of each trade, it is accurate to state that 61% of the investors opened trades with bullish expectations and 30% with bearish.

如果我們考慮每個交易的具體情況,可以準確地說,61%的投資者對看好行情的交易開倉,30%的投資者對看淡行情的交易開倉。

From the overall spotted trades, 8 are puts, for a total amount of $516,500 and 5, calls, for a total amount of $3,547,870.

從所有交易中,共有8筆看跌期權,總價值爲516,500美元,以及5筆看漲期權,總價值爲3,547,870美元。

What's The Price Target?

目標價是多少?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $155.0 to $230.0 for Texas Instruments over the recent three months.

根據交易活動,大部分投資者的目標價位爲德州儀器最近三個月的155-230美元區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

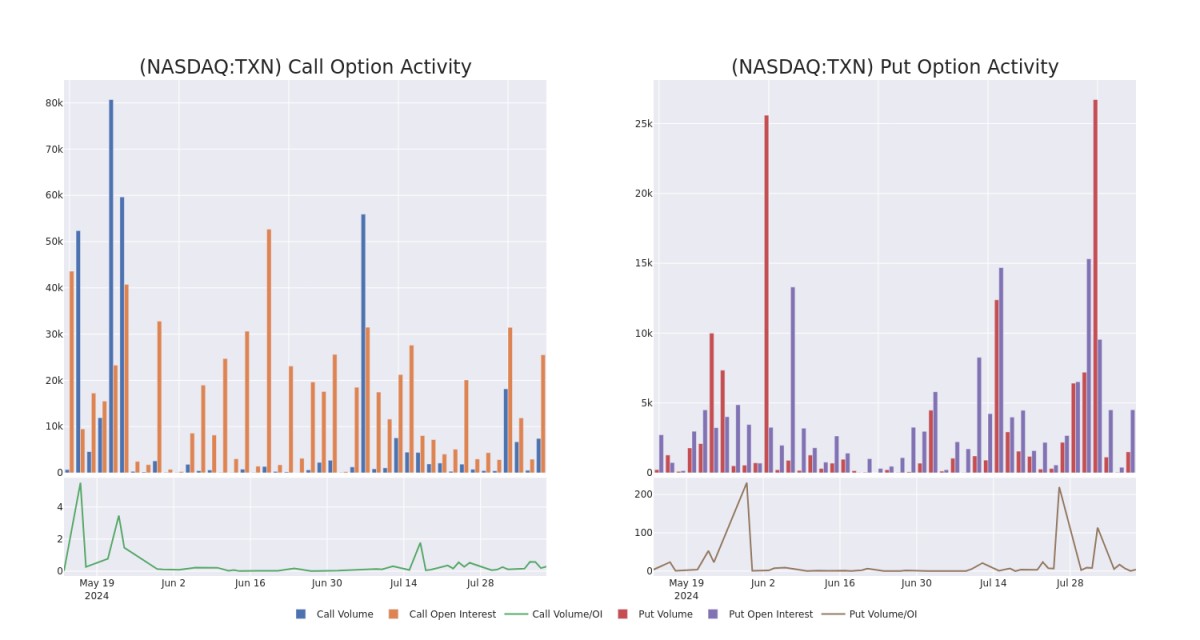

In today's trading context, the average open interest for options of Texas Instruments stands at 3336.67, with a total volume reaching 8,929.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Texas Instruments, situated within the strike price corridor from $155.0 to $230.0, throughout the last 30 days.

在今天的交易中,德州儀器期權的平均持倉量爲3336.67,成交量總計爲8,929.00。下列圖表顯示在過去30天內,在價位區間爲155.0至230.0美元的高價值德州儀器期權中,看漲和看跌期權的成交量和持倉量的變化。

Texas Instruments Option Volume And Open Interest Over Last 30 Days

德州儀器期權成交量和未平倉量過去30天

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | TRADE | BULLISH | 01/17/25 | $5.85 | $5.65 | $5.8 | $220.00 | $2.9M | 7.9K | 5.0K |

| TXN | CALL | TRADE | NEUTRAL | 09/20/24 | $2.46 | $2.16 | $2.3 | $210.00 | $529.0K | 15.6K | 2.3K |

| TXN | PUT | SWEEP | BULLISH | 09/20/24 | $6.95 | $6.85 | $6.85 | $190.00 | $206.8K | 2.9K | 395 |

| TXN | PUT | SWEEP | BULLISH | 01/17/25 | $16.2 | $16.0 | $16.0 | $195.00 | $88.0K | 394 | 55 |

| TXN | CALL | SWEEP | BULLISH | 08/16/24 | $4.65 | $4.6 | $4.65 | $190.00 | $46.5K | 1.9K | 111 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | 看漲 | 交易 | 看好 | 01/17/25 | $5.85 | $5.65 | $5.8 | $220.00 | 2.9百萬美元 | 7.9K | 5.0K |

| TXN | 看漲 | 交易 | 中立 | 09/20/24 | $2.46 | $2.16 | $2.3 | 目標股價爲$210.00。 | 529.0千美元 | 15.6K | 2.3K |

| TXN | 看跌 | SWEEP | 看好 | 09/20/24 | $6.95 | $6.85 | $6.85 | $190.00 | 206.8千美元 | 2.9K | 395 |

| TXN | 看跌 | SWEEP | 看好 | 01/17/25 | $16.2 | $16.0 | $16.0 | $195.00 | $88.0千美元 | 394 | 55 |

| TXN | 看漲 | SWEEP | 看好 | 08/16/24 | $4.65 | $4.6 | $4.65 | $190.00 | $46.5K | 1.9K | 111 |

About Texas Instruments

關於德州儀器

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

總部位於達拉斯的德州儀器有超過95%的營業收入來自半導體,剩下的來自其著名的計算器。德州儀器是世界上最大的模擬芯片製造商,用於處理實時信號(如聲音和電源)。德州儀器還在處理器和微控制器方面擁有領先的市場份額,用於各種電子應用。

Having examined the options trading patterns of Texas Instruments, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查德州儀器的期權交易模式後,我們的關注現在直接轉向公司。這個轉變使我們能夠深入研究其當前的市場地位和表現。

Where Is Texas Instruments Standing Right Now?

德州儀器現在處於什麼位置?

- Currently trading with a volume of 812,236, the TXN's price is down by -0.8%, now at $191.75.

- RSI readings suggest the stock is currently is currently neutral between overbought and oversold.

- Anticipated earnings release is in 74 days.

- TXN現在的成交量爲812,236,價格下跌了-0.8%,目前爲191.75美元。

- RSI讀數表明該股票目前處於中立狀態,處於超買和超賣之間。

- 預計收益發布還有74天。

Expert Opinions on Texas Instruments

專家對德州儀器的觀點

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $215.0.

過去一個月中,有5位行業分析師分享了他們對這隻股票的看法,提出了一個平均目標價爲215美元的建議。

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Texas Instruments, targeting a price of $250.

- An analyst from Jefferies has decided to maintain their Hold rating on Texas Instruments, which currently sits at a price target of $185.

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Neutral, setting a price target of $210.

- Consistent in their evaluation, an analyst from JP Morgan keeps a Overweight rating on Texas Instruments with a target price of $230.

- Consistent in their evaluation, an analyst from Baird keeps a Neutral rating on Texas Instruments with a target price of $200.

- Rosenblatt的一位分析師繼續持有德州儀器的買入評級,目標價爲250.0美元

- Jefferies的一位分析師決定維持他們對德州儀器的持有評級,目前的價位目標爲185美元。

- 小心謹慎,Cantor Fitzgerald的一位分析師將其評級下調至中立,設定價格目標爲210美元。

- JP Morgan的一位分析師保持對德州儀器的增持評級,目標價爲230美元。

- Baird的一位分析師保持對德州儀器的中立評級,目標價爲200美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Texas Instruments options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在的回報。敏銳的交易者通過不斷教育自己、調整策略、監控多種因子並緊密關注市場變動來管理這些風險。了解來自Benzinga Pro的實時提醒,掌握最新的德州儀器期權交易信息。

From the overall spotted trades, 8 are puts, for a total amount of $516,500 and 5, calls, for a total amount of $3,547,870.

From the overall spotted trades, 8 are puts, for a total amount of $516,500 and 5, calls, for a total amount of $3,547,870.