Decoding Applied Mat's Options Activity: What's the Big Picture?

Decoding Applied Mat's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on Applied Mat. Our analysis of options history for Applied Mat (NASDAQ:AMAT) revealed 27 unusual trades.

應用材料(NASDAQ:AMAT)的期權歷史分析顯示,金融巨頭對其採取了明顯的看淡態度,我們發現有27筆異常交易。

Delving into the details, we found 40% of traders were bullish, while 59% showed bearish tendencies. Out of all the trades we spotted, 8 were puts, with a value of $358,741, and 19 were calls, valued at $1,141,179.

深入了解後,我們發現40%的交易者看漲,而59%的交易者看跌。我們發現所有交易中有8筆看跌,價值358,741美元,而有19筆看漲,價值1,141,179美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $150.0 and $250.0 for Applied Mat, spanning the last three months.

在評估成交量和未平倉合約後,我們可以看出應用材料的主要市場資金正在專注於150.0美元至250.0美元的價格區間,這個區間橫跨了過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Applied Mat's options for a given strike price.

這些數據可以幫助你跟蹤應用材料在給定行權價的期權的流動性和利息。

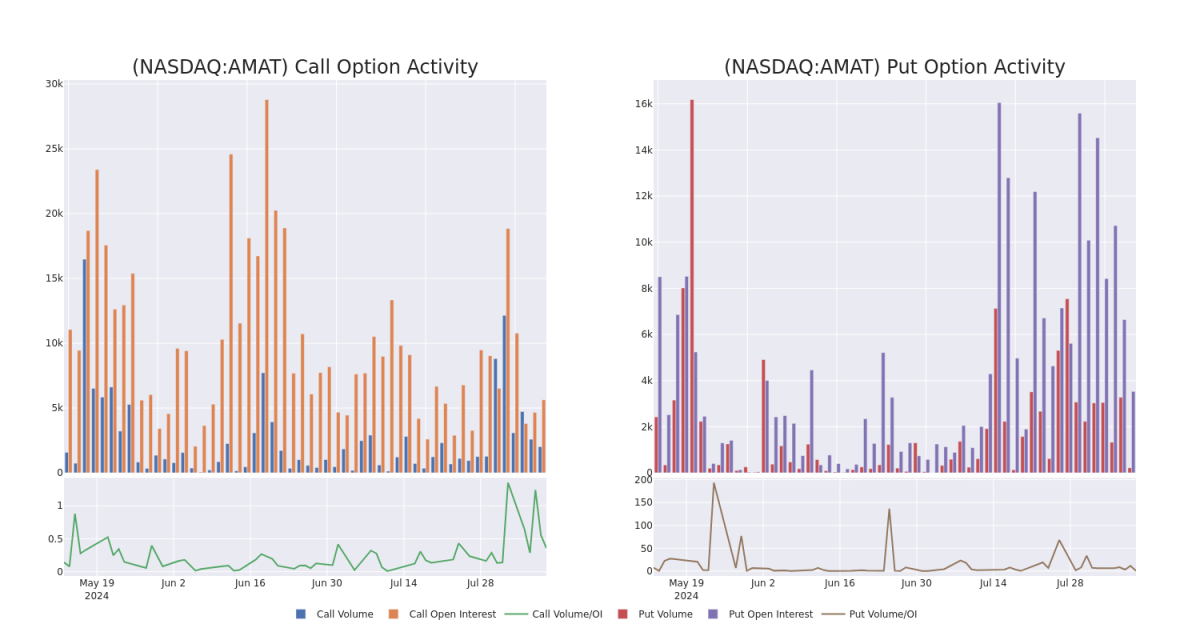

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Applied Mat's whale activity within a strike price range from $150.0 to $250.0 in the last 30 days.

下面,我們可以觀察應用材料所有鯨魚活動中$150.0至$250.0執行價格區間內看漲/看跌期權的成交量及未平倉合約的進化情況,這個區間是最近30天的。

Applied Mat 30-Day Option Volume & Interest Snapshot

Applied Mat 30天期權成交量和未平倉利潤快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | CALL | TRADE | BEARISH | 10/18/24 | $17.05 | $16.95 | $16.95 | $190.00 | $161.0K | 169 | 95 |

| AMAT | CALL | SWEEP | BEARISH | 01/17/25 | $12.25 | $12.15 | $12.15 | $220.00 | $114.2K | 1.6K | 138 |

| AMAT | CALL | SWEEP | BEARISH | 08/16/24 | $7.65 | $7.45 | $7.53 | $190.00 | $113.0K | 1.0K | 464 |

| AMAT | CALL | TRADE | BEARISH | 08/30/24 | $10.95 | $10.7 | $10.72 | $190.00 | $107.2K | 65 | 118 |

| AMAT | PUT | TRADE | BULLISH | 01/16/26 | $70.3 | $68.5 | $69.2 | $250.00 | $96.8K | 488 | 14 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMAT | 看漲 | 交易 | 看淡 | 10/18/24 | $17.05 | $16.95 | $16.95 | $190.00 | $161.0K | 169 | 95 |

| AMAT | 看漲 | SWEEP | 看淡 | 01/17/25 | $12.25 | $12.15 | $12.15 | $220.00 | $114.2K | 1.6K | 138 |

| AMAT | 看漲 | SWEEP | 看淡 | 08/16/24 | $7.65 | $7.45 | $7.53 | $190.00 | $113.0K | 1.0K | 464 |

| AMAT | 看漲 | 交易 | 看淡 | 08/30/2024 | $10.95 | $10.7 | $10.72 | $190.00 | $107.2K | 65 | 118 |

| AMAT | 看跌 | 交易 | 看好 | 01/16/26 | $70.3 | $68.5 | $69.2 | $250.00 | 96.8K | 488 | 14 |

About Applied Mat

關於應用材料

Applied Materials is the largest semiconductor wafer fabrication equipment, or WFE, manufacturer in the world. Applied Materials has a broad portfolio spanning nearly every corner of the WFE ecosystem. Specifically, Applied Materials holds a market share leadership position in deposition, which entails the layering of new materials on semiconductor wafers. It is more exposed to general-purpose logic chips made at integrated device manufacturers and foundries. It counts the largest chipmakers in the world as customers, including TSMC, Intel, and Samsung.

應用材料是全球最大的半導體硅片製造設備或WFE製造商。應用材料擁有廣泛的產品組合,幾乎涵蓋了WFE生態系統中的每個角落。具體而言,應用材料在沉積領域佔據市場份額領先地位,該領域包括在半導體晶片上堆疊新材料。它更多地暴露於集成器件製造商和代工廠製造的通用邏輯芯片。它將全球最大的芯片製造商(包括台積電,英特爾和三星)視爲客戶。

Having examined the options trading patterns of Applied Mat, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查應用材料期權交易模式之後,我們的注意力現在直接轉向公司。這個轉變使我們能夠深入探究它目前的市場地位和表現。

Current Position of Applied Mat

應用材料當前位置

- Trading volume stands at 2,735,430, with AMAT's price up by 0.88%, positioned at $192.22.

- RSI indicators show the stock to be may be approaching oversold.

- Earnings announcement expected in 6 days.

- 交易量爲2,735,430,AMAT的股價上漲0.88%,位於192.22美元。

- RSI指標顯示該股票可能正接近超賣。

- 將在6天內公佈收益預測。

What The Experts Say On Applied Mat

關於應用材料的專家意見

In the last month, 3 experts released ratings on this stock with an average target price of $268.3333333333333.

在過去一個月中,有3位專家對這個股票發佈了評級,平均目標價爲$268.3333333333333。

- Maintaining their stance, an analyst from Cantor Fitzgerald continues to hold a Overweight rating for Applied Mat, targeting a price of $290.

- An analyst from Stifel persists with their Buy rating on Applied Mat, maintaining a target price of $275.

- An analyst from Citigroup has decided to maintain their Buy rating on Applied Mat, which currently sits at a price target of $240.

- Cantor Fitzgerald的一位分析師繼續持有Applied Mat的超配評級,目標價格爲290美元。

- Stifel的一位分析師堅持對Applied Mat的買入評級,維持目標價爲275美元。

- 花旗集團的一位分析師決定維持對應用材料的買入評級,目前的價格目標爲240美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Applied Mat options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。 精明的交易者通過不斷自我教育,調整策略,監控多個因子並密切關注市場動向來管理這些風險。通過Benzinga Pro實時警報保持了解最新的應用材料期權交易動態。