Smart Money Is Betting Big In DDOG Options

Smart Money Is Betting Big In DDOG Options

Deep-pocketed investors have adopted a bearish approach towards Datadog (NASDAQ:DDOG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in DDOG usually suggests something big is about to happen.

深口袋的投資者對Datadog (NASDAQ:DDOG) 採取了看淡的態度,這是市場參與者不應忽視的一點。我們在Benzinga跟蹤公共期權記錄的過程中發現了這一重大變化。這些投資者的身份仍然未知,但DDOG的這樣的大幅動盪通常意味着重大變化即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 17 extraordinary options activities for Datadog. This level of activity is out of the ordinary.

我們是從觀察中了解到這一信息的,當時Benzinga的期權掃描儀突出顯示了Datadog的17個非凡期權活動。這種活動水平是不尋常的。

The general mood among these heavyweight investors is divided, with 29% leaning bullish and 64% bearish. Among these notable options, 8 are puts, totaling $1,127,658, and 9 are calls, amounting to $705,223.

這些重量級投資者的整體情緒是分裂的,29%偏看好,64%看淡。在這些引人注目的期權中,有8個put期權,總金額爲1,127,658美元,有9個call期權,總額爲705,223美元。

Expected Price Movements

預期價格波動

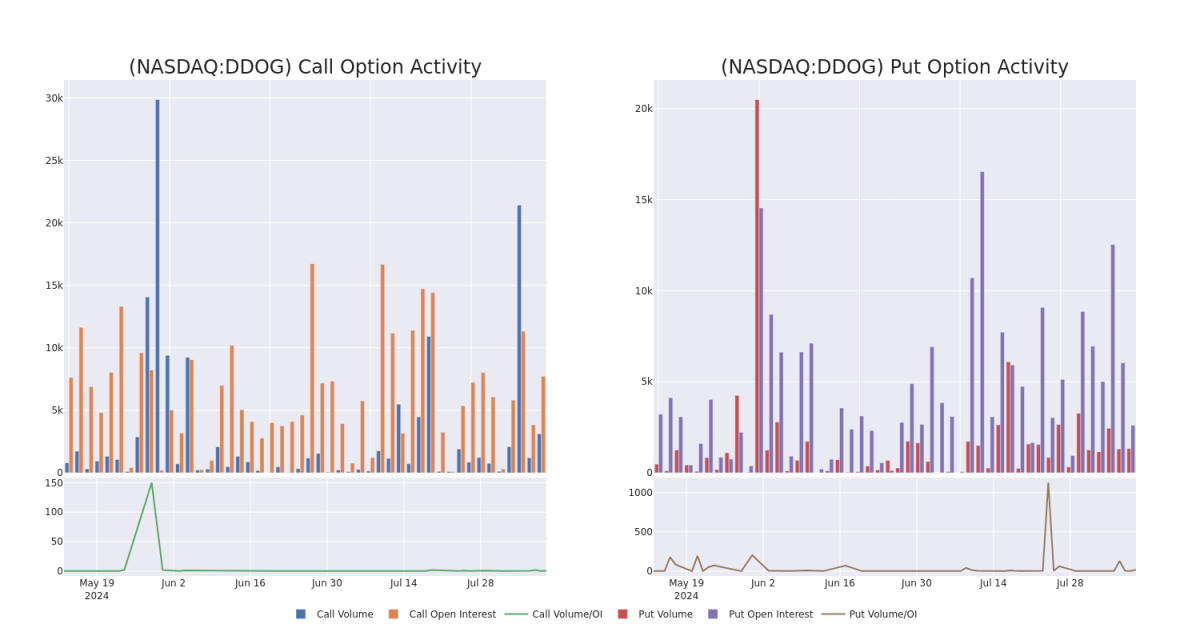

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $95.0 to $135.0 for Datadog during the past quarter.

分析這些合同的成交量和未平倉量,似乎大型投資者在過去一個季度一直在關注Datadog的價格區間從95.0美元到135.0美元。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Datadog's options for a given strike price.

這些數據可以幫助您跟蹤Datadog的期權在給定行權價的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Datadog's whale activity within a strike price range from $95.0 to $135.0 in the last 30 days.

下面,我們可以觀察所有Datadog鯨魚活動在95.0美元至135.0美元罷工價格區間內call和put市場成交量和未平倉量的演變,時間範圍爲最近30天。

Datadog Option Activity Analysis: Last 30 Days

Datadog期權活動分析:近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DDOG | PUT | TRADE | NEUTRAL | 09/20/24 | $1.22 | $0.86 | $1.05 | $95.00 | $525.0K | 1.1K | 0 |

| DDOG | PUT | SWEEP | BEARISH | 12/20/24 | $4.65 | $4.5 | $4.65 | $95.00 | $206.4K | 97 | 844 |

| DDOG | PUT | TRADE | BEARISH | 12/20/24 | $4.65 | $4.5 | $4.65 | $95.00 | $186.0K | 97 | 400 |

| DDOG | CALL | SWEEP | BULLISH | 01/17/25 | $6.0 | $5.55 | $6.0 | $135.00 | $165.6K | 4.0K | 510 |

| DDOG | CALL | SWEEP | BEARISH | 12/20/24 | $11.2 | $11.15 | $11.15 | $115.00 | $159.4K | 451 | 225 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DDOG | 看跌 | 交易 | 中立 | 09/20/24 | $1.22 | 每股0.86美元 | $1.05 | $ 95.00 | $525.0K | 1.1千 | 0 |

| DDOG | 看跌 | SWEEP | 看淡 | 12/20/24 | $4.65 | $4.5 | $4.65 | $ 95.00 | $206,400 | 97 | 844 |

| DDOG | 看跌 | 交易 | 看淡 | 12/20/24 | $4.65 | $4.5 | $4.65 | $ 95.00 | $186.0K | 97 | 400 |

| DDOG | 看漲 | SWEEP | 看好 | 01/17/25 | $6.0 | $5.55 | $6.0 | $135.00 | $165.6K | 4.0K | 510 |

| DDOG | 看漲 | SWEEP | 看淡 | 12/20/24 | $11.2 | $11.15 | $11.15 | $115.00 | $159.4K | 451 | 225 |

About Datadog

關於Datadog

Datadog is a cloud-native company that focuses on analyzing machine data. The firm's product portfolio, delivered via software as a service, allows a client to monitor and analyze its entire IT infrastructure. Datadog's platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to utilize it for a variety of applications throughout their businesses.

Datadog是一家以云爲基礎的公司,專注於分析機器數據。該公司的產品組合通過軟件服務提供,允許客戶監控和分析他們的整個IT基礎設施。Datadog平台可以實時地攝取和分析大量的機器生成數據,使客戶能夠將其用於業務的各種應用。

Datadog's Current Market Status

Datadog的當前市場狀態

- With a volume of 2,399,931, the price of DDOG is down -1.6% at $112.24.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 88 days.

- 成交量爲2,399,931,DDOG的價格下跌1.6%,爲112.24美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一筆利潤將在88天內發佈。

Professional Analyst Ratings for Datadog

Datadog的專業分析師評級

In the last month, 5 experts released ratings on this stock with an average target price of $145.0.

在過去的一個月中,有五位專家對這隻股票發佈了評級,平均目標價爲145.0美元。

- An analyst from Wedbush downgraded its action to Outperform with a price target of $155.

- Maintaining their stance, an analyst from Needham continues to hold a Buy rating for Datadog, targeting a price of $140.

- An analyst from Mizuho upgraded its action to Outperform with a price target of $155.

- An analyst from Evercore ISI Group downgraded its action to Outperform with a price target of $150.

- Maintaining their stance, an analyst from UBS continues to hold a Neutral rating for Datadog, targeting a price of $125.

- Wedbush的分析師將其行動評級下調爲表現優異,並降低價格目標至155美元。

- Needham的一位分析師繼續維持對Datadog的買入評級,目標價爲140美元。

- Mizuho 的一位分析師將其行動升級爲跑贏大盤,並將其價格目標定爲155美元。

- Evercore ISI Group的分析師將其行動評級下調爲表現優異,並降低價格目標至150美元。

- UBS的一位分析師繼續維持中立評級,目標價爲125美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Datadog with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過不斷的教育、戰略性的交易調整、利用各種因子並保持對市場動態的關注來化解這些風險。使用Benzinga Pro即時警報學習Datadog的最新期權交易。