Looking At Palo Alto Networks's Recent Unusual Options Activity

Looking At Palo Alto Networks's Recent Unusual Options Activity

Financial giants have made a conspicuous bullish move on Palo Alto Networks. Our analysis of options history for Palo Alto Networks (NASDAQ:PANW) revealed 10 unusual trades.

金融巨頭對帕洛阿爾託網絡採取了明顯的看漲舉動。我們對帕洛阿爾託網絡(納斯達克股票代碼:PANW)期權歷史的分析顯示了10筆不尋常的交易。

Delving into the details, we found 50% of traders were bullish, while 40% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $257,945, and 5 were calls, valued at $261,659.

深入研究細節,我們發現50%的交易者看漲,而40%的交易者表現出看跌趨勢。在我們發現的所有交易中,有5筆是看跌期權,價值爲257,945美元,5筆是看漲期權,價值261,659美元。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $200.0 to $650.0 for Palo Alto Networks over the recent three months.

根據交易活動,看來主要投資者的目標是在最近三個月中將帕洛阿爾託網絡的價格區間從200.0美元擴大到650.0美元。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

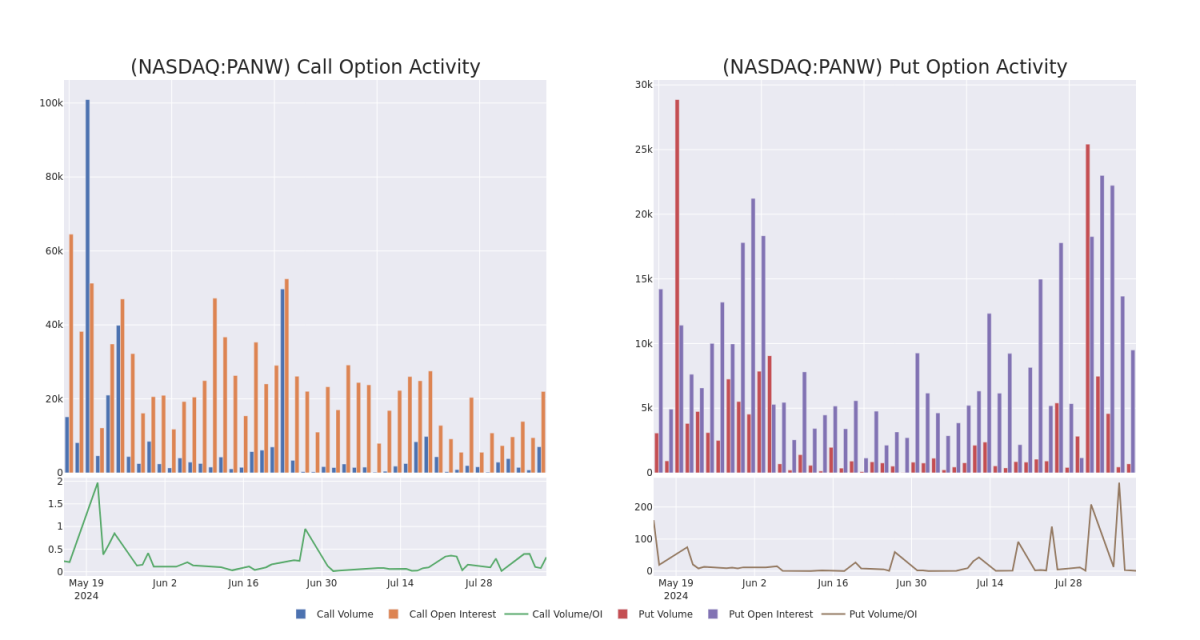

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palo Alto Networks's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palo Alto Networks's significant trades, within a strike price range of $200.0 to $650.0, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量Palo Alto Networks期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月Palo Alto Networks重大交易的交易量和未平倉合約的趨勢,行使價區間爲200.0美元至650.0美元。

Palo Alto Networks Option Volume And Open Interest Over Last 30 Days

帕洛阿爾託網絡過去 30 天的期權交易量和未平倉合約

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PANW | CALL | SWEEP | BEARISH | 08/23/24 | $16.2 | $13.75 | $13.7 | $335.00 | $109.6K | 351 | 80 |

| PANW | PUT | TRADE | BULLISH | 01/16/26 | $328.0 | $319.05 | $319.15 | $650.00 | $95.7K | 0 | 5 |

| PANW | PUT | TRADE | BULLISH | 01/16/26 | $324.95 | $316.0 | $316.0 | $650.00 | $63.2K | 0 | 2 |

| PANW | CALL | SWEEP | BULLISH | 08/16/24 | $0.6 | $0.6 | $0.6 | $350.00 | $60.0K | 2.5K | 1.0K |

| PANW | PUT | TRADE | NEUTRAL | 01/16/26 | $37.35 | $20.75 | $29.0 | $280.00 | $43.5K | 159 | 0 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 平底鍋 | 打電話 | 掃 | 粗魯的 | 08/23/24 | 16.2 美元 | 13.75 美元 | 13.7 美元 | 335.00 美元 | 109.6 萬美元 | 351 | 80 |

| 平底鍋 | 放 | 貿易 | 看漲 | 01/16/26 | 328.0 美元 | 319.05 美元 | 319.15 美元 | 650.00 美元 | 95.7 萬美元 | 0 | 5 |

| 平底鍋 | 放 | 貿易 | 看漲 | 01/16/26 | 324.95 美元 | 316.0 美元 | 316.0 美元 | 650.00 美元 | 63.2 萬美元 | 0 | 2 |

| 平底鍋 | 打電話 | 掃 | 看漲 | 08/16/24 | 0.6 美元 | 0.6 美元 | 0.6 美元 | 350.00 美元 | 60.0 萬美元 | 2.5K | 1.0K |

| 平底鍋 | 放 | 貿易 | 中立 | 01/16/26 | 37.35 美元 | 20.75 美元 | 29.0 美元 | 280.00 美元 | 43.5 萬美元 | 159 | 0 |

About Palo Alto Networks

關於帕洛阿爾託網絡

Palo Alto Networks is a platform-based cybersecurity vendor with product offerings covering network security, cloud security, and security operations. The California-based firm has more than 85,000 customers across the world, including more than three fourths of the Global 2000.

Palo Alto Networks是一家基於平台的網絡安全供應商,其產品涵蓋網絡安全、雲安全和安全運營。這家總部位於加利福尼亞的公司在全球擁有超過8.5萬名客戶,其中包括全球2000強企業的四分之三以上。

Following our analysis of the options activities associated with Palo Alto Networks, we pivot to a closer look at the company's own performance.

在我們分析了與Palo Alto Networks相關的期權活動之後,我們開始仔細研究公司自身的業績。

Current Position of Palo Alto Networks

帕洛阿爾託網絡的現狀

- With a trading volume of 224,617, the price of PANW is down by -1.61%, reaching $326.13.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 7 days from now.

- PANW的交易量爲224,617美元,下跌了-1.61%,至326.13美元。

- 當前的RSI值表明,該股目前在超買和超賣之間處於中立狀態。

- 下一份收益報告定於7天后發佈。

What The Experts Say On Palo Alto Networks

專家對帕洛阿爾託網絡的看法

Over the past month, 4 industry analysts have shared their insights on this stock, proposing an average target price of $353.75.

在過去的一個月中,4位行業分析師分享了他們對該股的見解,提出平均目標價爲353.75美元。

- An analyst from Redburn Atlantic downgraded its action to Neutral with a price target of $325.

- An analyst from Stifel has decided to maintain their Buy rating on Palo Alto Networks, which currently sits at a price target of $360.

- Maintaining their stance, an analyst from Keybanc continues to hold a Overweight rating for Palo Alto Networks, targeting a price of $380.

- Maintaining their stance, an analyst from Barclays continues to hold a Overweight rating for Palo Alto Networks, targeting a price of $350.

- 雷德本大西洋的一位分析師將其股票評級下調至中性,目標股價爲325美元。

- Stifel的一位分析師已決定維持對帕洛阿爾託網絡的買入評級,該評級目前的目標股價爲360美元。

- Keybanc的一位分析師保持立場,繼續對帕洛阿爾託網絡進行增持評級,目標價格爲380美元。

- 巴克萊銀行的一位分析師保持立場,繼續維持帕洛阿爾託網絡的增持評級,目標股價爲350美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palo Alto Networks with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解Palo Alto Networks的最新期權交易情況,獲取實時提醒。