ServiceNow's Options Frenzy: What You Need to Know

ServiceNow's Options Frenzy: What You Need to Know

Financial giants have made a conspicuous bullish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 8 unusual trades.

金融巨頭對ServiceNow做出明顯看好的舉動。我們對ServiceNow(紐交所:NOW)期權歷史記錄的分析發現了8次飛凡交易。

Delving into the details, we found 25% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $346,325, and 3 were calls, valued at $90,632.

深入了解後,我們發現25%的交易者看多,而25%表現出看淡的趨勢。在我們發現的所有交易中,有5個是看跌的,價值爲$346,325,而3個是看漲的,價值爲$90,632。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $550.0 and $850.0 for ServiceNow, spanning the last three months.

通過評估成交量和持倉量,明顯可以看出主要市場活動者正在關注ServiceNow在$550.0和$850.0之間的價格區間,跨過了過去三個月。

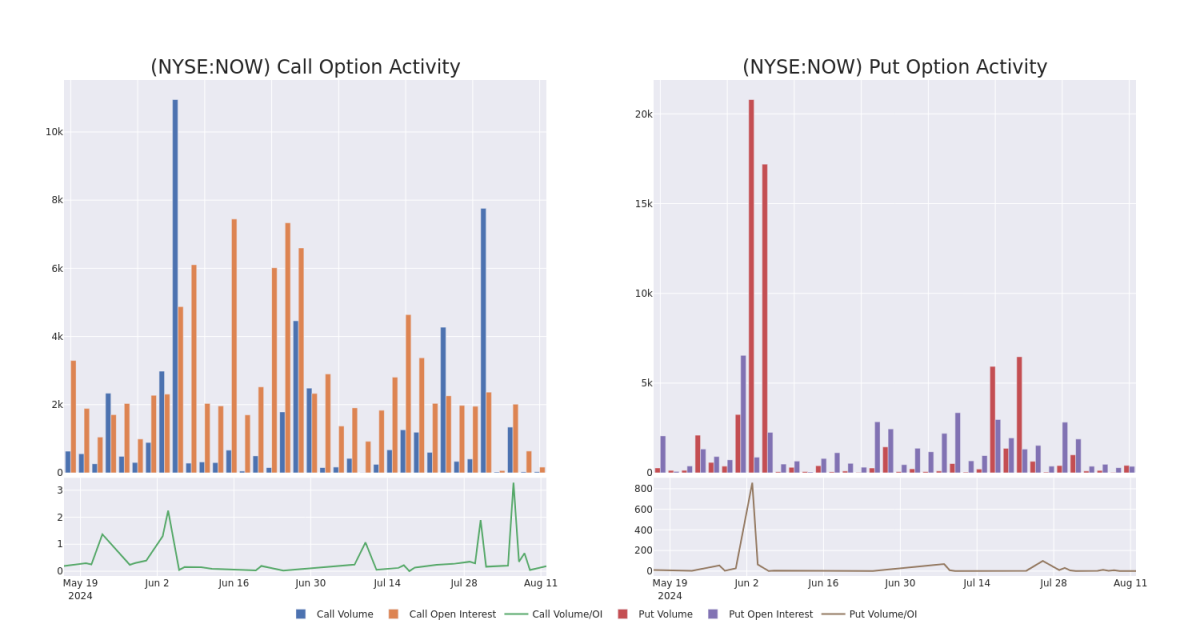

Volume & Open Interest Trends

成交量和未平倉量趨勢

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for ServiceNow's options for a given strike price.

這些數據可以幫助您追蹤ServiceNow某個行權價的期權流動性和趨勢。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ServiceNow's whale activity within a strike price range from $550.0 to $850.0 in the last 30 days.

下面,我們可以觀察到在過去30天中,所有ServiceNow的鯨魚活動的認購和認沽的成交量和未平倉合約的變化情況,限於行權價格區間$550.0至$850.0。

ServiceNow 30-Day Option Volume & Interest Snapshot

ServiceNow 30天期權成交量和持倉量快照

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | PUT | SWEEP | NEUTRAL | 09/20/24 | $34.8 | $32.8 | $34.81 | $810.00 | $110.7K | 218 | 170 |

| NOW | PUT | SWEEP | BEARISH | 09/20/24 | $33.9 | $32.8 | $33.35 | $810.00 | $100.3K | 218 | 124 |

| NOW | PUT | SWEEP | NEUTRAL | 09/20/24 | $34.9 | $33.6 | $34.35 | $810.00 | $68.6K | 218 | 82 |

| NOW | PUT | TRADE | BULLISH | 11/15/24 | $40.2 | $39.6 | $39.6 | $770.00 | $39.6K | 143 | 10 |

| NOW | CALL | SWEEP | BULLISH | 10/18/24 | $37.3 | $27.4 | $32.4 | $850.00 | $36.1K | 76 | 10 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| servicenow | 看跌 | SWEEP | 中立 | 09/20/24 | 34.8美元 | $32.8 | $34.81 | 810.00美元 | 110.7K美元 | 218 | 170 |

| servicenow | 看跌 | SWEEP | 看淡 | 09/20/24 | $33.9 | $32.8 | $33.35 | 810.00美元 | $100.3K | 218 | 124 |

| servicenow | 看跌 | SWEEP | 中立 | 09/20/24 | $34.9 | $33.6 | $34.35 | 810.00美元 | $68.6K | 218 | 82 |

| servicenow | 看跌 | 交易 | 看好 | 11/15/24 | $ 40.2 | $39.6 | $39.6 | $770.00 | $39.6K | 143 | 10 |

| servicenow | 看漲 | SWEEP | 看好 | 10/18/24 | $37.3 | $27.4 | $32.4 | $850.00 | $36.1K | 76 | 10 |

About ServiceNow

關於servicenow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

ServiceNow Inc提供軟件解決方案,通過SaaS交付模式構建和自動化各種業務流程。該公司主要關注企業客戶的IT功能。ServiceNow始於IT服務管理,在IT功能內部擴展,並最近將其工作流自動化邏輯擴展到IT以外的功能領域,尤其是客戶服務、HR服務交付和安全運營。ServiceNow還提供作爲服務的應用程序開發平台。

After a thorough review of the options trading surrounding ServiceNow, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在徹底審查圍繞ServiceNow的期權交易之後,我們轉而更詳細地檢查該公司。這包括對其當前市場地位和業績的評估。

Current Position of ServiceNow

ServiceNow目前的職位

- With a trading volume of 233,889, the price of NOW is down by -0.76%, reaching $804.91.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 72 days from now.

- 目前NOW交易量爲233,889,價格下跌0.76%,達到$804.91。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一份業績將在72天后發佈。

What The Experts Say On ServiceNow

專家關於ServiceNow的看法

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $887.0.

在過去30天中,共有5位專業分析師對此股票發表了看法,給出了平均目標價$887.0。

- Consistent in their evaluation, an analyst from TD Cowen keeps a Buy rating on ServiceNow with a target price of $900.

- An analyst from Stifel persists with their Buy rating on ServiceNow, maintaining a target price of $900.

- Consistent in their evaluation, an analyst from Baird keeps a Outperform rating on ServiceNow with a target price of $900.

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $900.

- An analyst from Canaccord Genuity persists with their Buy rating on ServiceNow, maintaining a target price of $835.

- TD Cowen的一位分析師一直給出ServiceNow買入評級,並設定目標價$900,保持其評價的連續性。

- Stifel的一位分析師一直堅持對ServiceNow的買入評級,保持目標價$900的不變。

- Baird的一位分析師一直給出ServiceNow跑贏大盤評級,並設定目標價$900,保持其評價的連續性。

- 反映出擔憂,紐帶漢姆(Needham)的一位分析師將其評級降低爲買入,新的目標價爲900美元。

- Canaccord Genuity的一位分析師一直堅持對ServiceNow的買入評級,保持目標價$835的不變。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.